NYISO needs to improve shortage pricing and create smaller capacity zones, the ISO’s market monitoring unit (MMU) said in its 2022 State of the Market report.

MMU Potomac Economics, which presented its findings at Thursday’s Installed Capacity/Market Issues Working Group (ICAP/MIWG) meeting, reported that the ISO remained competitive in 2022 but said changes are needed to ensure market efficiency as renewable penetration increases.

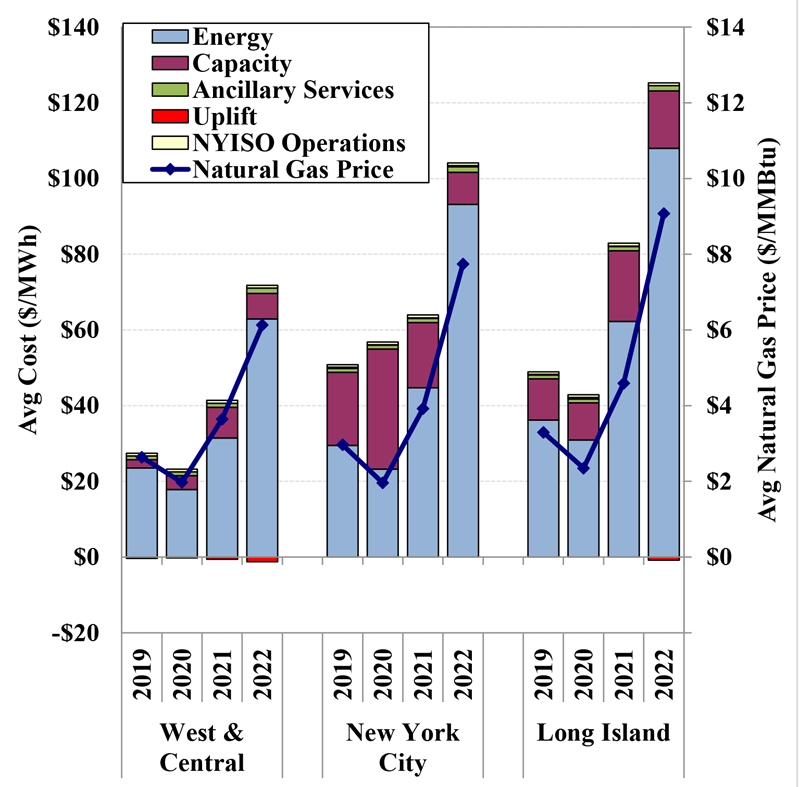

Average all-in price by New York region | Potomac Economics

Average all-in price by New York region | Potomac EconomicsThe report includes five high-priority recommendations, three of which — modeling local reserve requirements in New York City load pockets, dynamically adjusting operating reserve requirements, and improving capacity modeling and accreditation (Recommendations #2017-1, 2015-16 and 2021-4) — are already being pursued.

Also on the high-priority list are a recommendation from 2017 to modify operating reserve demand curves to improve shortage pricing (#2017-2) and one new recommendation: to create more “granular” locations in the capacity market (#2022-4).

The MMU found that NYISO’s shortage pricing has fallen well below that of neighbors PJM and ISO-NE. “When there is an imbalance between the market incentives provided in two adjacent regions, it can lead market participants to schedule interchange from the area with weaker incentives to the area with stronger incentives even when the area with weaker incentives is in a less reliable state,” the MMU said.

Four Capacity Zones Not Enough

The MMU said the ISO’s current four capacity zones (New York City, Long Island, Lower Hudson Valley and Rest-of-State) are too large to provide efficient locational price signals to incent new flexible generation and encourage the retirement of less valuable resources.

The state’s four zones do not account for transmission limits within the zones, meaning resources at some locations are over- or under-compensated relative to their reliability value, the MMU said.

It recommended the ISO create and “dynamically update” an increased number of capacity zones reflecting the known transmission constraints, saying the change also would address “concerns that the current deliverability framework is an inefficient barrier to investment in new resources.”

It said the ISO should not use its existing capacity zone creation process, which it called “flawed and ineffective.”

Potomac said the ISO’s method for determining local capacity requirements (LCRs) results in inefficient prices across zones and excessive price volatility.

Instead, it said the ISO should consider basing locational pricing on marginal reliability values instead of the current zonal demand curves. “This could result in sizeable reliability and economic benefits over the long term and simplify the administration of the capacity market,” it said.

In the 2023/24 capability year, the MMU said, large resources and “Special Case” demand response resources in New York City will receive as much as $52 million in excess capacity revenue.

Some fossil fuel and nuclear generators also were overpaid because the ISO included in their installed capacity 1,200 MW that was “functionally unavailable” on the hottest days last summer, Potomac said. “This includes resources with emergency capacity that is virtually never committed in practice, resources with ambient water and air humidity dependencies that are not captured in the [dependable net maximum capability] testing process, and cogeneration units that face limitations associated with their steam host demand.”

The MMU reiterated a recommendation from its 2021 report that the ISO improve its resource adequacy model (#2021-4) and added a new proposal: that it compensate capacity suppliers based on their contribution to transmission security when LCRs are set by transmission security needs (#2022-1).

Deliverability Testing

Potomac also highlighted what it called a misalignment of the ISO’s deliverability framework, which it said “unreasonably inhibits new investment.”

It noted that the recently completed Class Year 2021 study initially allocated $1.5 billion in system deliverability upgrade costs to 4 GW of new projects seeking to sell capacity — costs that equaled between 50% and 293% of the net cost of new entry of a new peaking plant. “Unsurprisingly, three-quarters of the affected projects refused to pay these costs and either withdrew from the Class Year or accepted a reduced quantity of [capacity resource interconnection service] rights,” Potomac said.

Current ISO rules use a deterministic test “that often does not represent a realistic or likely dispatch of the system during conditions when reliability is threatened,” Potomac said. “This problem is exacerbated by performing the test in relatively large capacity zones with many potential intrazonal constraints.”

In the short term, the MMU said, the ISO should identify “a comprehensive set of granular locations” that would effectively shrink the size of the capacity zone in which new interconnecting resources would have to be deliverable. The change also would allow reduced clearing prices in export-constrained areas, it said.

Seasonal Capacity Market

The MMU also recommended the ISO move to a seasonal capacity market, with requirements and demand curves that consider the reliability needs of each season separately (#2022-2). Although the capacity market is divided into six-month summer and winter capability periods, the installed reserve margin and LCRs are determined annually, so ICAP requirements are the same in all months. “As a result, seasonal prices are determined by the amount of ICAP available in each season, which bears little relation to resource adequacy risk,” Potomac said.

Transmission Planning

The MMU also offered a new recommendation on transmission planning, saying current rules allow inefficient projects to crowd out competing market-based investments — including transmission and nontransmission resources — that could achieve the same policy goals at lower cost.

Potomac acknowledged the ISO’s recent addition of capacity expansion modeling tools. But it said additional changes are needed to respond to the increased uncertainty from the growth of policy-sponsored resources.

It recommended the ISO update its planning study methodology to reflect the market incentives of renewable and storage resources; consider changes to the resource mix resulting from the inclusion of economic and public policy projects; and estimate transmission project benefits based on their market value to the ISO (#2022-3).

The MMU’s report was discussed with stakeholders for the first time at the ICAP/MIWG meeting, where the focus was on energy and ancillary services. Potomac will present the report to the Management Committee meeting and discuss capacity market issues at the next ICAP/MIWG meeting, June 6.

Other Recommendations

Potomac’s Pallas LeeVanSchaick, who presented the findings at the May 25 meeting, said the efficiency of the energy and ancillary services markets will become increasingly important as NYISO increasingly shifts from fuel-secure generation to intermittent renewables.

The report cited inefficiencies for reserve providers, which are not being compensated for their congestion relief; duct-firing combed cycle units, which are not being properly dispatched; and phase angle regulators, which are inappropriately being used to satisfy bilateral contract flows.

In addition to the high priority recommendations, LeeVanSchaick also highlighted five other proposals during Thursday’s meeting.

- 2015-9: Eliminate transaction fees for coordinated transaction scheduling at the PJM-NYISO border.

- 2016-1: Consider rules for efficient pricing and settlement when operating reserve providers provide congestion relief.

- 2020-1: Consider enhancements to the scheduling of duct-firing capacity in the real-time market that more appropriately reflect its operational characteristics.

- 2021-2: Model full locational reserve requirements for Long Island.

- 2022-3: Improve transmission planning assumptions and metrics to better identify and fund economically efficient transmission projects.

Market Highlights

Potomac reported that average natural gas prices roughly doubled from last year in eastern New York and rose 70% in the western part of the state due to increased LNG exports and cold weather.

The high gas prices drove energy prices, with average energy prices in Western New York rising to 109% over 2021 and Eastern New York rising as much as 126%. Gas prices, cold weather and transmission congestion pushed all-in energy prices to the highest levels observed in more than a decade, ranging from $58/MWh in the North Zone to nearly $127/MWh in Long Island.

More severe transmission congestion in the Central-East interface because of lengthy outages during construction of the AC Public Policy Transmission Projects contributed to the East-West price separation.

Capacity costs fell, primarily because of changes in the installed reserve margin for the system and LCR requirements for New York zones.

Winter Storm Elliott

Another highlight from Potomac’s annual report was the analysis of Winter Storm Elliott’s impact on the New York grid, which showed NYISO’s market operations relied heavily on the scheduling of internal peaking units to meet high demands and that large quantities of generating capacity was unavailable because of fuel limits or outages.

Resource supply availability and utilization during Winter Storm Elliott | Potomac Economics

Resource supply availability and utilization during Winter Storm Elliott | Potomac EconomicsWinter Storm Elliott hit the Northeast from Dec. 23 to Dec. 27, 2022, and blizzard conditions through the 24th caused New York energy prices to spike to more than $4,000/MWh.

LeeVanSchaick said the storm “was the first significant test for some market processes that have come into place over the past 10 years that deal with shortage conditions.”

“This was the first time we’ve seen long-duration reserve shortages since PJM and ISO-NE put [Pay-for-Performance] rules in place,” he added. PFP rules incentivize generators for being available during tight supply conditions.

On Dec. 23 and 24, NYISO experienced eight hours of reserve shortages, locational-based marginal prices of more than $2,000/MWh, roughly 4 GW of import curtailment and around 2.3 GW of unavailable fossil fuel capacity because of outages or derates.

Because the amount of forced outages and derated capacity was higher than anticipated, Potomac said NYISO needs to better monitor generator performance during extreme weather, given that current resource adequacy models may be underforecasting load during these cold conditions and inefficiently dispatching generators to provide reliability.

The report also noted that about 80% of unoffered capacity during the blizzard was from energy storage and other duration-limited resources. The MMU said NYISO needs to investigate ways to make sure that during cold conditions, these resources can recharge after being called upon and be available for extended periods of time.

Potomac said the ISO’s real-time commitment scheduling was being undermined, citing the number of import curtailments and unforeseen reductions in supply availability, because of either high gas prices or inefficient market signals.

The MMU noted that several fast-start units were either being shut down or not started up when they might have otherwise, which meant 470 MW of these units was unavailable and an additional 1,350 MW of 30-minute fast-start capacity was sitting offline. This resulted in imports from neighbors like PJM to be curtailed because of unnecessarily high prices in New York.

Based on these findings, Potomac made several recommendations to improve NYISO’s capabilities during future winter storms.

The MMU recommended setting prices consistent with the reliability risks during a reserve shortage event, enhancing capacity accreditation models for nonfirm fuel generators or duration-limited resources, and scheduling additional reserves before blizzard conditions to decrease the NYISO’s reliance on imports.