FERC on Wednesday approved CAISO’s proposed changes to the Western Energy Imbalance Market’s resource sufficiency evaluation (RSE), including a provision to allow energy transfers to members who fail to meet resource obligations ahead of a trading interval (ER23-1534).

The package of changes was part of a second round of RSE-related tariff revisions, which were approved by the CAISO Board of Governors and WEIM Governing Body in December. (See CAISO, WEIM Boards Back Reliability Enhancements.)

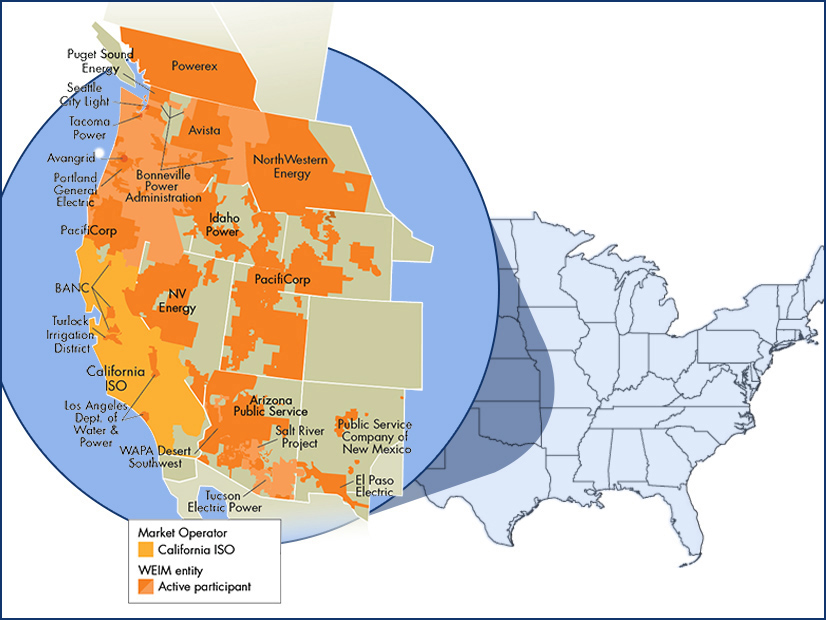

The RSE test is designed to ensure that each WEIM participant enters a trading hour with enough capacity and ramping capability to cover its own needs and to prevent participants from “leaning” on the market to meet internal demand. A balancing authority area (BAA) that fails the test before an operating hour is prohibited from receiving WEIM transfers during that interval.

But meeting that requirement has become a challenge for some participants as the West faces a worsening shortage of generating resources and declining liquidity in the regional bilateral electricity market that typically helps provide short-term resource sufficiency — which stakeholders attribute to the expansion of the WEIM itself.

The RSE consists of four tests that measure feasibility, balancing, capacity and flexibility. The rule changes approved Wednesday relate to the capacity test, which determines whether a WEIM participant has provided sufficient incremental bid-in capacity to meet the imbalance among load, intertie and generation base schedules.

The first rule change will allow CAISO to establish a process by which participants that fail the RSE can obtain “energy assistance” transfers from within the WEIM. Any BAA that receives such assistance will be subject to a surcharge on top of the cleared price for energy assistance transfers.

“The EIM assistance energy transfer surcharge is an after-the-fact charge designed to provide an alternative incentive for WEIM balancing authority areas to meet their resource sufficiency obligations during tight supply conditions while making additional supply available to other balancing authorities in the WEIM,” FERC noted in its order.

CAISO plans to align the surcharge with the level of its soft ($1,000/MWh) or hard ($2,000/MWh) energy bid caps, depending on system conditions. It says energy assistance transfers will be voluntary for both the provider and recipient.

In approving the tariff revision, FERC concluded that CAISO’s plan “provides increased flexibility to WEIM participants and can help WEIM balancing authority areas to meet their resource sufficiency obligations during tight supply conditions.

“We also find the proposal allows CAISO to optimally dispatch supply and provide access to resources that were not otherwise available,” it said.

The rule change had particularly strong backing from WEIM member NV Energy. The Nevada-based utility faces increasingly critical shortages of resources during summer and has been seeking a legislative remedy to address the issue. (See Bill Would Require NV Energy to Examine Market Reliance.)

In a December letter to the CAISO and WEIM boards, Lindsey Schlekeway, NV Energy’s market policy manager, noted that her company had asked the ISO to develop a mechanism to make excess supply available to a “distressed EIM entity at an appropriate scarcity price” and said “it is of critical importance not to delay the implementation of this reliability enhancement past the summer of 2023 for grid reliability.”

Asymmetry Addressed

CAISO’s second and third RSE rule revisions focus specifically on the ISO itself.

The second change will allow the grid operator to exclude from its own RSE calculation any real-time “lower priority” energy exports out of its BAA. Those exports are currently included in the calculation even though the ISO can freely curtail them to meet its own load obligations. At the same time, real-time WEIM transfers into the ISO are not factored into the RSE, representing an asymmetry in treatment of transfers, CAISO argued. Inclusion of curtailable exports has caused CAISO to fail RSE tests that it would have otherwise passed, the ISO said.

FERC said CAISO’s proposal “helps mitigate this asymmetry and will improve the ability of the resource sufficiency test to more accurately reflect actual system conditions during periods of potential resource insufficiency.”

The third rule change pertains to scheduling priority rules and E-Tag requirements for lower priority exports, with CAISO clarifying how it will interpret its scheduling priority tariff provisions to ensure that it can manually curtail lower priority exports in real-time to meet its own supply obligations.

“We find that these clarifications are consistent with CAISO’s existing authority to apply the scheduling priorities and help provide better transparency for market participants,” FERC wrote. “Further, we find that these clarifications could help operators identify lower priority exports and priority exports for scheduling and manual curtailment purposes.”