Stakeholders pressed MISO to include some form of cost containment measures for it and SPP’s Joint Targeted Interconnection Queue portfolio, weeks after the RTOs revealed that the cost estimate for the projects nearly doubled to about $2 billion.

The requests came at a June 27 special meeting to firm up the tariff additions MISO will need to incorporate in the JTIQ study and cost recovery details so it can become a repeatable process.

Stakeholders asked MISO to include some oversight or protections against cost overruns on the transmission projects in its tariff edits. MISO staff said while they’ve discussed the possibility, at this point they will likely only consider cost protections for future JTIQ portfolios. However, their position became more fluid as the meeting wore on.

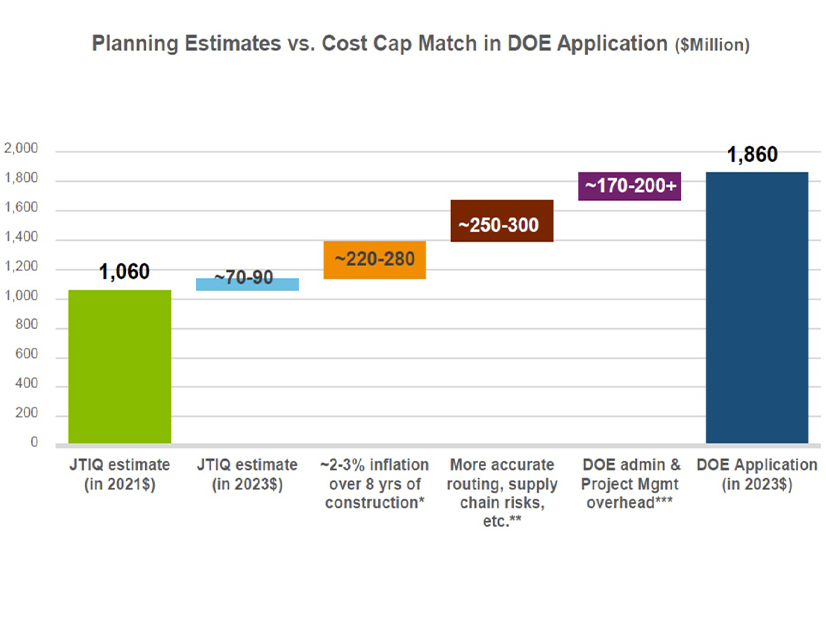

MISO and SPP this month announced the costs estimate for the first, five-project JTIQ portfolio of 345 kV lines rose from a little more than $1 billion to nearly $1.9 billion. The larger figure was sent to the Department of Energy under a funding application for the agency’s Grid Resilience and Innovation Partnerships program. (See JTIQ Portfolio Cost Estimate Nearly Doubles to $1.9B.)

MISO staff said for the DOE application, transmission owners included recent inflation and supply chain trends and tried to predict sharper routing and regulatory issues for their projects, raising costs. MISO and SPP have also included administration costs not included in the original JTIQ estimate, including FERC filing costs and costs related to the DOE funding application and federal environmental reviews.

Invenergy’s Sophia Dossin said a cap on project costs is important, considering JTIQ cost estimates have almost doubled in two years.

“Even just having a percentage somewhere, even a very high cap that we’re sure we’re never going to hit at least gives generators some sort of certainty,” Dossin said.

Clean Grid Alliance’s Rhonda Peters said some type of oversight on costs is “critical.” She warned that some generation developers might not go through with projects based on the risks of escalating line costs.

“If that dollar-per-megawatt charge is high right off the bat, this is not going to work. If those costs are in the mid-range and then double, then projects that invested significant capital will not be able to go forward,” she said, asking for “some sort of accountability mechanism.”

Some stakeholders said the grid operators and transmission owners might be underestimating the effect that stubbornly high inflation will have on the cost of projects.

MISO staff said the JTIQ portfolio can enable an estimated 28 GW of new installed capacity and should give large groups of interconnection customers lowered transmission upgrade costs and more cost certainty than under its previous affected system studies process.

MISO so far has not shared an estimated range of dollar-per-megawatt charges that individual generation projects might face.

“All the buzz around cost caps, is that going to be considered in the tariff language development? … What’s the upper limit where generation developers will not subscribe to these lines?” Southern Renewable Energy Association’s Andy Kowalczyk said.

“I wouldn’t say anything is off the table. We’re listening very carefully to your concerns, and we’re going to discuss them internally,” MISO counsel Chris Supino said. “If there’s a way to include these without disturbing what we’re working towards in the tariff, we’re going to consider them.”

Kowalczyk said contemplating “an upper limit where people are going to bail on lines” is important because load will temporarily pick up the tab on the first JTIQ portfolio if the first batch of lines don’t have enough subscribers to be fully funded.

The JTIQ study is designed to focus on backbone projects rather than point-of-interconnection network upgrades. Whereas MISO’s and SPP’s previous process used actual generation sites in interconnection queues in affected system studies, the JTIQ leans on the likely interconnection spots of future generation representing multiple queue study clusters from both RTOs.

Until now, MISO and SPP have used affected system studies to identify additional, across-the-seam network upgrades the other might need as a result of new generation connecting close to the seam. And while MISO and SPP until now have identified only network upgrades for a particular SPP or MISO study cycle, the JTIQ study is designed to identify larger and longer-term system needs across seams and across groups of generation projects under study.

At this point, MISO considers its proposal to split JTIQ costs 90% to interconnecting generators with the remaining 10% assigned to load final. It will include that cost allocation in tariff edits.

“There is some disagreement, but we believe this course is settled: JTIQ projects meet the definition of generator interconnection projects,” Supino said.

Supino said MISO and SPP are discussing whether the projects should be a subcategory of interconnection upgrades, but he said it’s undisputed that the JTIQ projects are replacing MISO and SPP’s affected system study process and should be allocated 90% to interconnecting generation and 10% to load. As such, he said JTIQ projects won’t be open to competitive bidding.

Supino said MISO will include a pledge in its transmittal letter to FERC to evaluate cost allocation changes in future JTIQ portfolios. MISO didn’t elaborate on which additional benefits it might consider allocating in the future.