Batteries connected to CAISO’s grid exceeded a record 5,000 MW this spring, absorbing a significant portion of the abundant solar energy California generates during the day and supporting grid stability on hot summer evenings, the ISO’s Department of Market Monitoring (DMM) said in a Special Report on Battery Storage posted Monday.

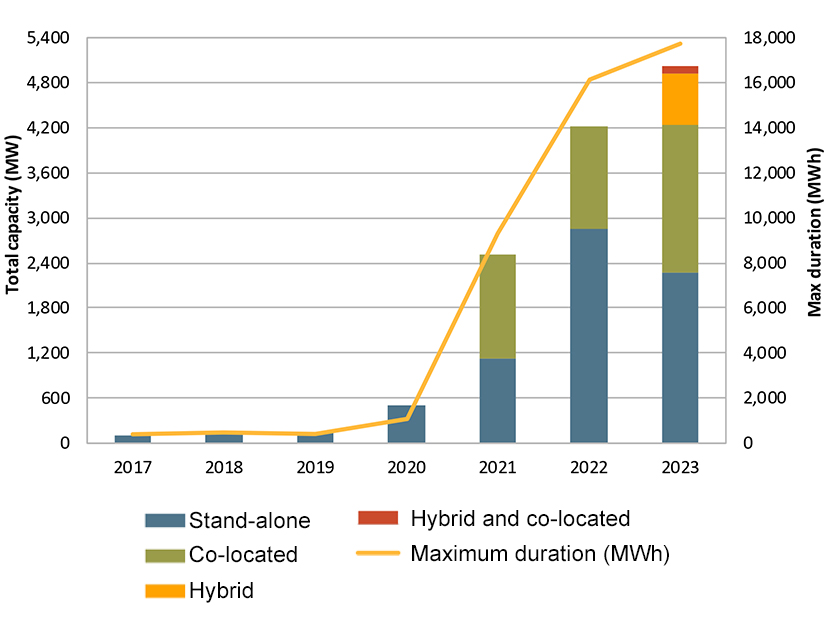

Following the blackouts of August 2020, battery storage in CAISO grew rapidly from 500 MW in 2020 to 5,000 MW in May, the report said. (In a separate news release, CAISO said total battery capacity had reached 5,600 on July 1.)

“Battery storage is the fastest-growing type of resource in the CAISO market,” the report said. “As of May 1 … batteries make up 7.6% of CAISO’s nameplate capacity.”

Reaching 5,000 MW means California is about one-tenth of the way toward having the 50 GW of battery storage it needs to reach its 100% clean energy goal by 2045, the DMM noted.

Battery charging accounted for 5% of load during peak solar hours in the middle of the day last year, the Market Monitor said.

“During these hours, batteries help reduce the need to curtail or export surplus solar energy at very low prices,” it said.

The batteries “provided valuable net peak capacity and energy” during a September 2022 heat wave that set demand records across the West and brought CAISO to the brink of ordering rolling blackouts, DMM said. (See California Runs on Fumes but Avoids Blackouts.)

Batteries provided 2.4% of output in CAISO from 5 to 9 p.m. from Aug. 31 to Sept. 9 last year during the extended heat wave, the report said.

On Sept. 6, the day when CAISO nearly ordered rolling blackouts, some batteries discharged earlier than expected because of prices that exceeded $1,000/MWh before the evening net peak, after solar drops offline. But generally, “a minimum state-of-charge constraint was used by operators to ensure the availability of batteries in peak net demand hours on most days during the 2022 summer heat wave,” DMM said.

CAISO adopted its minimum state-of-charge requirement as part of its summer 2021 readiness measures to ensure batteries would be available to discharge during hot summer evenings when the grid was most stressed.

In addition, DMM said batteries were frequently issued manual or exceptional dispatches through the 2022 heat wave.

“Most of these exceptional dispatches were to hold charge in anticipation of net peak demand hours,” the report said. “Exceptional dispatches to charge were used largely in response to a software issue that prevented storage resources from bidding to charge at a higher price than $150/MWh, which resulted in those resources not being able to charge even when in merit.”

Battery Fast Facts

The report provided a snapshot of CAISO’s battery fleet as of May:

-

- Many of the batteries in CAISO are paired with solar or wind generation and participate in CAISO either as hybrid resources or under a co-located model in which they share an interconnection point. Of the 5,000 MW of batteries connected, 2,200 MW were stand-alone resources, 2,000 MW were co-located, 700 MW were part of hybrid resources and 100 MW were part of co-located hybrids.

- The size of active batteries ranges from 1 to 260 MW, with most in the lower-to-mid ranges. They typically can discharge for up to four hours.

- A majority of the projects in CAISO’s interconnection queue also have a proposed battery component.

- CAISO’s interstate Western Energy Imbalance Market has also been adding storage. As of May 1, 20 non-CAISO battery storage resources were participating in the WEIM, with roughly 1,000 MW of discharge capacity. “In comparison, WEIM battery capacity totaled 286 MW in December 2022,” the report said.

- Batteries now provide over half of CAISO’s regulation up and down requirements.

- Net revenue for batteries rose from about $73/kW-year in 2021 to $103/kW-year in 2022, driven largely by higher peak energy prices.

- Bid cost recovery (BCR) payments for batteries increased significantly in 2022, accounting for 10% of BCR paid to all resources, while batteries made up just 5% of total capacity. The payments represented 7.6% of all battery revenues last year, although the DMM expects a portion to be rescinded because of a market rule change made last November.