The Bonneville Power Administration said it would keep its power and transmission rates flat for the next two years, even as it pursues a $2 billion grid modernization effort.

The Bonneville Power Administration said Friday it would keep its power and transmission rates flat for the next two years, even as it pursues a $2 billion grid modernization effort.

“BPA will hold the average Tier 1 power rate and all transmission rates, including ancillary and control area service rates, flat for the next two-year period beginning Oct. 1, 2023,” it said in a news release. “This determination was part of the final record of decision for the BP-24 power and transmission rate case released today.”

The BP-24 rate case reflected a settlement between BPA and most of the rate case parties in a proceeding that began in November.

“The great collaboration with our customers and other rate case parties helped us to offer rates that are stable, predictable and low while preserving BPA’s strong financial health,” Administrator John Hairston said in Friday’s statement.

Tribal governments and environmental groups continued to object to the settlement agreement, saying it insufficiently funds efforts to increase salmon and steelhead runs and protect the tribes’ fishing rights in the Columbia River watershed.

“BPA’s BP-24 Rate Proposal takes steps to defund fish and wildlife protection, mitigation and enhancement, affording neither equitable treatment nor consistency,” to bolster fish populations, the Confederated Tribes and Bands of the Yakama Nation and the Confederated Tribes of the Umatilla Indian Reservation argued in their initial brief.

“The BPA Administrator should reject the BP-24 Rate Proposal and significantly increase fish and wildlife funding in the BP-24 rate calculation to ensure sufficient progress towards measurable increases in adult salmon and steelhead returns in the coming years,” the brief said.

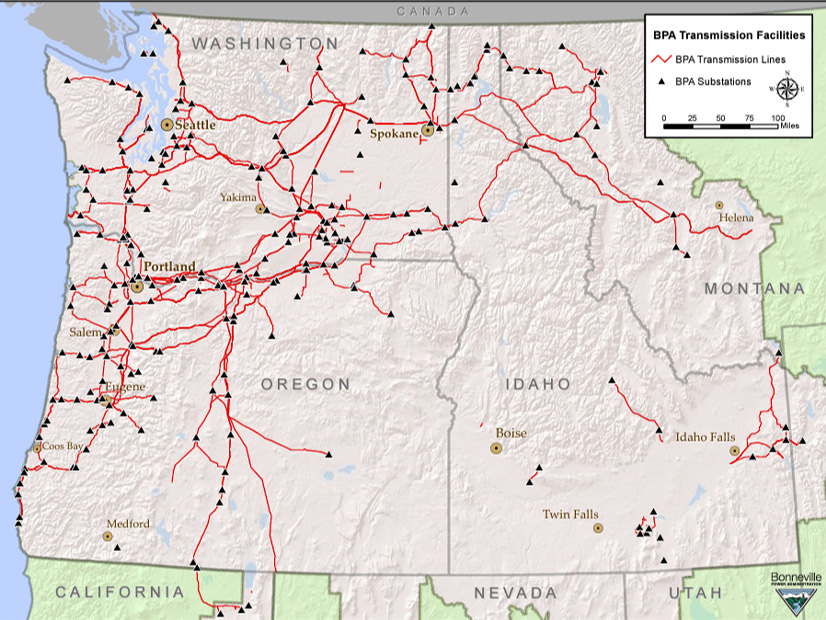

But Hairston said in the news release that “BPA is well positioned to meet our customers’ needs across our service territory, including reinforcement of our existing grid and new infrastructure to meet anticipated load growth and the further proliferation of renewable resources coming into the region.”

On July 13, BPA said it was “moving forward with more than $2 billion in multiple transmission substation and line projects necessary to reinforce the grid. These projects are intended to increase capacity and accommodate regional growth, as well as an abundance of new, clean energy resources.”

Six of the projects will “reinforce existing major BPA transmission lines that run from east to west, allowing the flow of energy from the east side of the region to load centers such as the Puget Sound area and Portland,” it said. Projects in Central Oregon, “where utilities are experiencing significant growth and are attracting large commercial customers,” include a new transmission line and substations, with an estimated cost of $839 million.

BPA said grid modernization helps it participate in CAISO’s Western Energy Imbalance Market, which it joined last year. It is also participating in the development of CAISO’s proposed extended day-ahead market for the real-time WEIM and in SPP’s development of its planned Markets+ offering in the West, which includes a day-ahead market.

To pay for the infrastructure projects, BPA received a $10 billion boost in its borrowing authority with the U.S. Treasury under the Infrastructure Investment and Jobs Act of 2021, which raised BPA’s borrowing line from $7.7 billion to $17.7 billion.

BPA is self-funded; it must repay the Treasury with revenues from its power and transmission rate revenues.

“BPA sets its rates to ensure the probability of repaying its annual U.S. Treasury debt is at least 95%, which is the last payment it makes after all other obligations are paid,” it said in Friday’s news release. “BPA has made its Treasury payment on time and in full for the past 39 years. With the increased funds [$258 million] set aside for risk and its other sources of liquidity, the probability of making the Treasury payment over the BP-24 rate case period is more than 99%.”

The rate case takes effect Oct. 1 and runs through Sept. 30, 2025.

“BPA will file the case with the Federal Energy Regulatory Commission, requesting interim approval for the rates while awaiting final FERC approval,” it said.