CAISO/WEIM

CAISO Board of GovernorsCalifornia Agencies & LegislatureCalifornia Air Resources Board (CARB)California Energy Commission (CEC)California LegislatureCalifornia Public Utilities Commission (CPUC)EDAMOther CAISO CommitteesWestern Energy Imbalance Market (WEIM)WEIM Governing Body

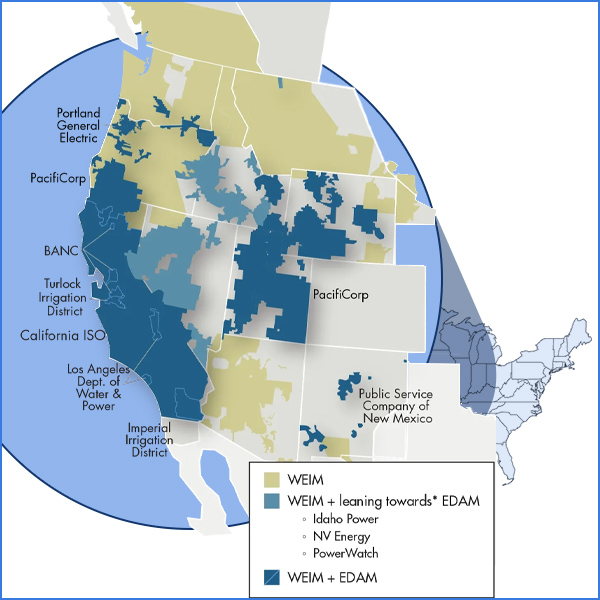

The California Independent System Operator serves about 80% of California's electricity demand, including the service areas of the state's three investor-owned utilities. It also operates the Western Energy Imbalance Market, an interstate real-time market covering territory that accounts for 80% of the load in the Western Interconnection.

Some parties are urging Nevada regulators to wait until initial results are in for CAISO's Extended Day-Ahead Market before deciding whether to allow NV Energy to join.

California’s reliance on a large amount of imported electricity and fossil fuels is a potential weakness in the state’s energy security portfolio, a California Energy Commission staff report finds.

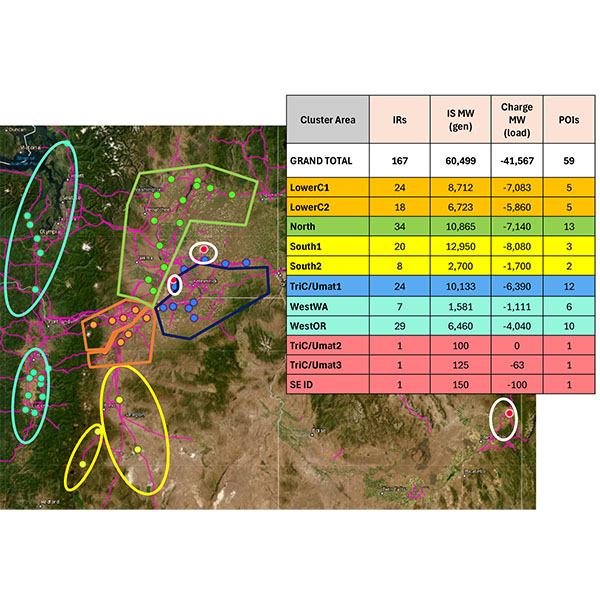

More than 60 GW of generation is a step closer to connecting to BPA's transmission system, following the release of Phase 1 of an interconnection cluster study.

Offshore wind experts urged the California Public Utilities Commission to reconsider a forecasted 6-year delay to the Golden State’s offshore wind project in Humboldt County.

The West must build or upgrade 12,600 miles of transmission at a cost of about $60 billion to meet the region’s forecast 30% increase in peak demand and other needs by 2035, according to the Western Transmission Expansion Coalition's 10-year outlook.

CAISO wants to ensure grid reliability when artificial intelligence data centers “pulsate.”

CAISO leaders staged a virtual “town hall” to stress the importance of a smooth rollout to the ISO’s Extended Day-Ahead Market in May and promise to address market seams issues.

The West-Wide Governance Pathways Initiative’s Launch Committee asked CAISO to initiate a stakeholder process to create a funding mechanism for the newly incorporated organization that is slated to assume governance over the ISO’s energy markets.

As the West appears to move toward two separate day-ahead markets, data center developers like Google and clean energy companies are investing with the intent to mitigate seams and ensure operational consistency, panelists at an Advanced Energy United webinar said.

CAISO released its first mandatory report under the California assembly bill that paves the way for an independent regional organization to assume responsibility over the ISO’s energy markets.

Want more? Advanced Search