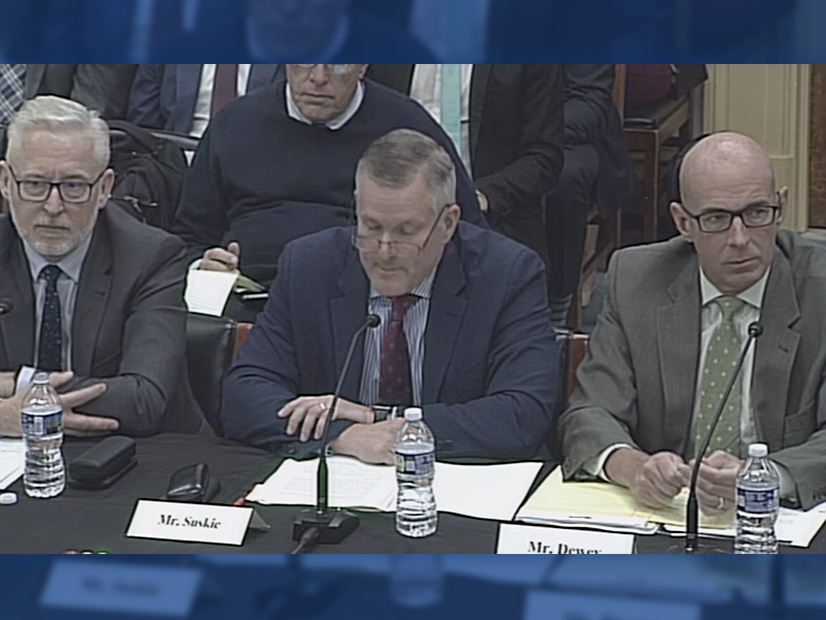

Senior executives from all seven ISO/RTOs discussed how the changing resource mix is impacting reliability.

Senior executives from all seven ISO/RTOs on Thursday discussed how the changing resource mix is impacting reliability during a hearing of the House Energy and Commerce Subcommittee on Energy, Climate and Grid Security.

“The nation is facing an electric reliability crisis and the nation’s grid operators are not equipped to address that alone,” subcommittee Chair Jeff Duncan (R-S.C.) said. “Federal tax subsidies and state policies designed to prop up renewables and EPA regulations targeting coal and natural gas power plants continue to lead to premature retirement of the nation’s most dependable generation sources. As a direct result, grid operators have issued unprecedented warnings and pleas to conserve energy and prepare for blackouts.”

Democrats also seek to maintain reliability and keep electricity affordable, said subcommittee Ranking Member Diane DeGette (D-Colo.). Reliability will only become more important as climate change leads to more extreme weather, she said.

“As the impact of the climate crisis grows, reliability may literally be the difference between life and death,” DeGette said. “Losing power during extreme heat or extreme cold events is life-threatening. And so, we must ensure that we have the assets and infrastructure to ensure reliability even as the climate changes.”

Need for Planning

A common theme across most of the ISO/RTO testimony was that while the transition toward more renewables and generally a cleaner grid presents new reliability challenges, they can be overcome with enough planning.

“This is a monumental task, and it requires four critical pillars to provide a robust foundation for the transition,” said ISO-NE CEO Gordon van Welie. “New England will need to add significant amounts of clean energy, ensure we have sufficient flexible resources to balance the renewable energy, ensure that we have sufficient backup energy for those periods when renewables cannot perform and … further build out the region’s transmission infrastructure.”

New England was not alone in that perspective, with MISO Senior Vice President Todd Ramey testifying that the grid operator has seen no-carbon resources like wind go from 0% of its generation in 2005 to 25% today. He said the trend has been accelerating lately and MISO expects 85% of its generation will be from wind, solar or battery storage by 2040.

“The growth in weather-dependent resources has occurred in parallel with the retirement of significant amounts of dispatchable generators, primarily coal, gas and nuclear resources,” Ramey said. “These investment and retirement decisions in combination with the different operating characteristics of the new resources versus the retiring resources [have] reduced the reserve margins in the MISO footprint to the minimum required levels.”

Other markets are looking to the future and worry they might get down to the bare minimum levels of resource adequacy.

ISO-NE appears to have sufficient RA through this decade, van Welie said, with a look ahead to 2027 showing the system could handle projected demand thanks in part to growth in solar power, which helps even in the winter. The situation becomes more precarious in 2032, but van Welie said that could be handled with proactive planning.

PJM sees the same issues with growing renewables and retiring traditional power plants. Conventional plants not only contribute to resource adequacy, but also provide other grid services, said RTO Senior Vice President Stu Bresler.

“Policies and consumer choices are shifting the grid away from dispatchable emitting generation resources toward resources with little to no carbon emissions, much of which is intermittent generation like wind and solar,” Bresler said. “As generation resources retire, competitive markets have in the past and will continue to work to incentivize replacement generation.”

The market helped replace tens of thousands of megawatts of retiring coal plants with natural gas-fired units in recent decades and Bresler said that experience could be repeated with the shift to renewables; for now, the RTO has a healthy reserve margin of about 20%. That could be complicated by rising demand growth from data centers and longer-term issues such as electrification, coupled with a rapid retirement of additional dispatchable power plants due to federal and state policies.

Renewables are coming online, but at a slower pace than retirements, and they often lack the kind of critical services traditional power plants produce, Bresler said.

Ramey said MISO has about 50 GW of resources with approved interconnection requests that are, on average, running about two years behind schedule.

Developers of those projects have told MISO that many have run into supply chain issues and delays in the permitting process, he added.

‘Greater Coordination’

While most grid operators pointed to the reliability challenges around the timing of the changing resource mix, Neil Millar, CAISO vice president of transmission planning and infrastructure development, noted one of the issues those clean energy policies are seeking to address.

“Our reliability challenges have been primarily impacted by the wider range of extreme weather events that are largely attributable to climate change,” Millar said.

The rest of the Western Interconnection has been dealing with that same issue, but CAISO and other balancing authorities in the region have been able to support each other and make it through challenging conditions with relatively minor disruptions to service.

“Beyond greater coordination in resource commitment and dispatch to support transmission operations, significant opportunities also exist to coordinate resource adequacy programs, resource planning decisions and deployment of transmission infrastructure across the western region,” Millar said. “Working collaboratively with our partners in the West will allow us to unlock these opportunities for the benefit of customers.”

The grid’s transition has also left it more dependent than ever on the natural gas system. Rep. Frank Pallone (D-N.J.), ranking member of the full committee, asked whether the executives testifying supported the idea of a mandatory reliability regime for natural gas.

“I think it’s imperative that we have better oversight of the reliability of the gas system,” van Welie said. “Because I think we should stop thinking about these systems as independent of each other. They’re totally interdependent, and what impacts the one system will impact the other. So, I sort of find it ironic that we’ve got all of this oversight of the electric system as a result of the 2003 blackout, but the biggest single source of energy to the electric system doesn’t have comparable oversight.”