Thermal energy storage (TES) powered by renewables could be a flexible, cost-effective way to decarbonize heavy industry in the United States, if such projects could access wholesale power prices and rate structures based on cost causation, says a new report from the Renewable Thermal Collaborative and Center for Climate and Energy Solutions.

The technology essentially is a two-fer, capable of providing the high-temperature heat needed for a range of so-called “hard-to-abate” industrial processes, as well as vital grid-support services to ensure power system reliability, according to the report, authored by industry consultants The Brattle Group. Like other storage technologies, it also can be used as a hedge against volatile fossil fuel prices, acting as a sponge to absorb excess renewable power during times of high production and low costs, and discharging during periods of peak demand.

“If widely deployed to their maximum potential, renewable-powered thermal batteries could displace the entirety of the emissions associated with industrial heating demand, amounting to 779 million metric tonnes (MMT, also equivalent to 1 Megatonne) of carbon dioxide equivalent (CO2e) emissions per year in the United States, or approximately 12% of total economy-wide GHG emissions.” the report says.

Globally, renewable TES could slash industrial CO2 emissions by 6,000 MMT per year, or 14.5% of all energy-related emissions, the report says.

A first step for scaling the technology is simply getting it on the radars of critical stakeholders, from potential industrial users to utilities and state and federal regulators, the report says. For example, policymakers and regulators should classify renewable TES as a “qualified technology solution that can be considered equally alongside other alternatives in” state and federal studies examining economy‐wide and grid decarbonization pathways, the report says.

Similarly, the report calls on grid operators to recognize the attributes of renewable TES as a technology that can ramp within minutes or even seconds and operate as either a dispatchable or flexible resource.

Speaking during a recent webinar on the report, Phillip Stephenson, vice president of business development for startup Electrified Thermal Solutions, praised the study for “finally laying out what I think is a great secret we want people to know. … We actually just need to change the rules a bit to match costs and benefits to make this work.

“We are not asking for dumping subsidies on us to unleash a lot of decarbonization and [show] how real these benefits are and how widespread the benefits can be in terms of the grid, which means really [for] the energy transition and society,” he said.

‘The Right Thing to Do’

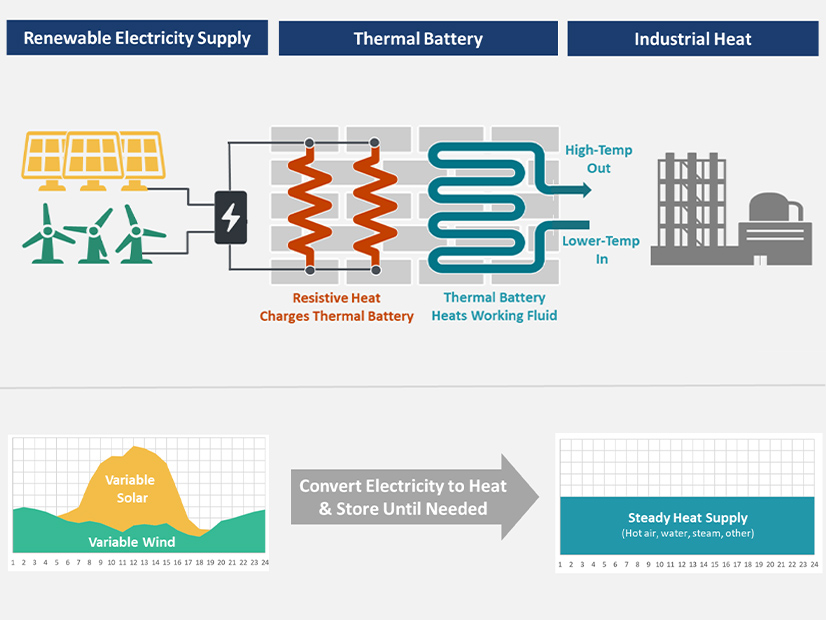

Thermal energy storage is based on the same basic technology as a toaster or electric stove. Electric power is run through a “resistive material” ― for example, some form of carbon or graphite that impedes power flow, creating heat that can be stored.

The technology has long been used in space and water heating applications, especially in district heating or combined heat and power systems, to capture waste heat for heating and cooling. Such systems often store heat in vats or other large containers of water.

But the high temperatures needed for heavy industry — such as glass, paper and chemical production — typically have required the combustion of fossil fuels. Many companies in these sectors anticipate decarbonizing their factories either by switching from fossil fuels to green hydrogen or cutting their fossil fuel emissions with carbon capture and storage. (See Summit Showcases New Technologies to Accelerate Industrial Decarb.)

Instead, startup companies like Electrified Thermal and Antora Energy have developed technologies that can turn renewable power into high-temperature heat that is stored in special bricks or carbon blocks and released as needed. At present, these and other renewable thermal storage companies can provide heat of up to 750 degrees Celsius, or 1,382 degrees Fahrenheit, high enough to cover 75% of all industrial heat demand, the report says.

Antora, a startup with funding from Bill Gates’ Breakthrough Energy Ventures, recently announced a pilot project in California where the company’s system produced heat at 1,800 degrees Celsius, or more than 3,200 degrees Fahrenheit, high enough to cover almost any industrial process.

Greg Wellman, technology manager of decarbonization for Eastman Chemical Company, talked about the commercial benefits of renewable TES for his firm, a Fortune 500 company producing a range of “specialty materials,” such as bird-friendly glass for building facades.

Spun out of Eastman Kodak in the 1990s, the company is looking at thermal storage because it fits well with its existing natural gas-based infrastructure, and the new systems are modular, meaning they can be sized to try out on a single process or to produce industrial heat for a whole factory, he said.

Another reason Eastman is looking closely at the technology is its potential for price parity with natural gas in the near future, Wellman said. “[When] you think about what’s the long-term trajectory of natural gas pricing, what’s the long-term trajectory of electron pricing … there’s going to be a compelling case to make these changes [to renewable TES], not just because it’s the right thing to do but also because it’s a financially right thing to do,” he said.

The Brattle report notes that for companies like Eastman, renewable TES could allow fuel switching, that is, keeping fossil fuel infrastructure, and natural gas, as backup generation to respond to price fluctuations or emergency events.

Stephenson said the technology also could be an attractive option for utilities anticipating new, higher peaks in energy demand as industrial customers seek to electrify their plants and processes. With renewable TES, industries could electrify “without having those peak demand impacts,” he said.

For utilities, the benefits include improved “economics on their entire system by being able to take all that new heat load coming from the customers … but tuck it under their existing peak by using only off-peak energy,” he said.

Good for All Customers

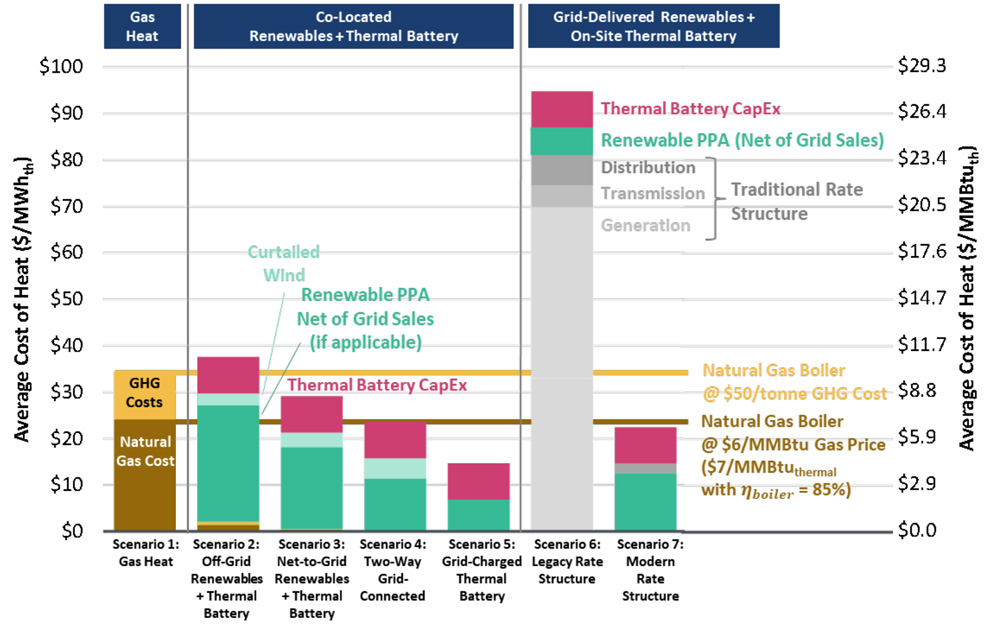

Beyond raising industry awareness of renewable TES, scaling the technology will depend on getting it to price parity with natural gas, which, in turn, may depend on a range of factors, such as the configuration of individual systems, rate structures and access to wholesale power prices.

Price parity could vary across system configurations, the report shows, specifically whether the renewable power is located off- or on-grid, whether the system can export power to provide grid-support services or whether the renewable power is coming from the grid itself.

At present, the report says, the most cost-competitive configurations for renewable TES are for projects that “self‐supply or directly contract with a renewable power supplier in an off‐grid or partially grid‐connected status.”

But project configuration often is determined by the specifics of a customer’s site, said Nick Soncrant, Antora’s head of business development.

“If a customer is space-constrained, colocated, new-build renewables will be pretty tough to implement,” Soncrant said. “If a customer is in a renewable-dense region … where the price of power is competitive with natural gas, we can look to work with utilities either under their existing tariff or partner with them to develop a new wholesale market tariff.”

Such new “modern” rate structures are vital for renewable TES to successfully compete with natural gas, the report says. Traditional rate structures, which include generation, transmission and distribution fees, presume “the customer can’t change when they use power,” said Kathleen Spees, a Brattle Group principal and lead author of the report.

For renewable TES to pencil out, Spees said, will require “very principled ratemaking structures of cost causation. … You only apply costs that are really relevant and caused by this sort of customer, which are low because you can really optimize when you would withdraw any power from the grid with a thermal battery,” she said.

“The good news about these modern rate structures, of course, is that they are good for all customers,” Spees said. “They’re good to incentivize all customers to behave in ways that actually reduce costs to the power grid. There is just much more potential and capability to shape whether and when any consumptions patterns take place.”

The report points to two electric cooperatives, the Vermont Electric Cooperative and the Victory Electric Cooperative in Kansas, that have adopted new rate structures based on cost causation. The Victory co-op, for example, has a rate for industrial customers that, the report says, is “aligned with wholesale power prices, consumption during system coincident peak demand and other (smaller) cost components, including local delivery charges.”

841 and 2222

Whether renewable TES projects will be able to access wholesale prices raises another key question: Is the technology covered under either FERC Order 841 or Order 2222, regulations that require, respectively, that energy storage and distributed energy resources be able to participate in wholesale power markets.

To date, Spees said, “that question has not been specifically asked or answered” and would require one or more affirmative rulings from FERC.

The fact that renewable TES can provide multiple value streams, both storing and discharging power, adds another layer of complexity to the issue, said Jordan Kearns, vice president of project development for Antora Energy.

“We … and other folks in the space have systems that can produce electricity back from these thermal batteries, and it’s kind of hard to argue that’s not a battery that would be covered under 841 or 2222,” Kearns said in an interview with NetZero Insider. “But then how do you treat the heat [that] goes off of it? Are you going to be punished for capturing and … putting that waste heat to good use?”

The report offers several recommendations for grid operators and FERC to ensure renewable TES can participate on a level basis in energy, capacity and ancillary markets, including:

-

- Having the same size requirements for standalone batteries and renewable TES, with a minimum of 100 MW.

- Establishing “distinct participation models” for different renewable TES configurations, such as standalone thermal batteries with controllable demand, colocated renewable electricity and thermal battery systems that can be scheduled to charge or discharge power, and TES systems that receive renewable power from the grid.

- Allowing thermal batteries to access wholesale energy prices based on the same locational marginal price available to generation resources and electric batteries.