CARMEL, Ind. — MISO last week expounded on why its late August maximum generation emergency wasn’t met with prices dictated by its emergency offer floors.

The RTO shared more of the data it collected on the event during its Oct. 3-5 Markets Week. Over those meetings, stakeholders warned the low prices could discourage market participants from voluntary actions to manage dire circumstances.

MISO dipped into its emergency procedures Aug. 24 to activate emergency pricing. Its early morning analysis showed that footprint-wide capacity would fall about 2.8 GW short of demand by the day’s peak. (See MISO: Could Have Employed Wait-and-see Approach for August Emergency.)

Although MISO enacted its second emergency offer floor at $1,411.74/MWh in this case, it ultimately didn’t use the threshold in locational marginal prices, MISO staff said. Aside from a brief spike to about $1,300/MWh around 5:20 p.m. ET, extended locational marginal prices mostly stayed below $200/MWh.

When MISO applies an emergency offer floor, it doesn’t automatically mean MISO will set locational marginal prices on emergency pricing. MISO’s pricing engine can run optimizations that dodge emergency pricing when emergency resources are readied but ultimately unnecessary to ease system strain.

Some stakeholders said members need more visibility into MISO’s price formation to know in real time when emergency pricing is being used. They said emergency resources are expensive to bring online and were forced to take relatively low locational marginal pricing Aug. 24.

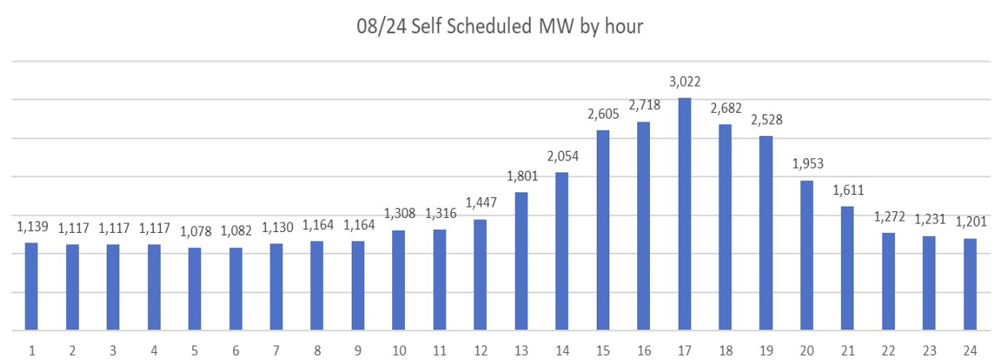

On Aug. 24, MISO said it “consistently” imported power from Manitoba Hydro and PJM with a maximum value of nearly 8.5 GW. It also said market participants voluntarily self-scheduled up to 3 GW of load modifying resources in the afternoon peak hours, even though MISO didn’t order them.

Travis Stewart, representing the Coalition of Midwest Power Producers, said the nonemergency pricing over Aug. 24 will make market participants think twice about making themselves available in future emergency conditions.

“I think you’re hitting at the heart of the conversation we’re going to be having: what effect these voluntary actions have and what they should be compensated,” MISO’s Tim Aliff said during an Oct. 5 Market Subcommittee meeting.

MISO Independent Market Monitor David Patton said he doesn’t agree with creating an expectation that voluntary load reductions made ahead of an event should receive emergency pricing. He said MISO should put out its best information available, leaving LMRs to “make their own decision on what prices will be.”

“Even when we forecast conditions to be tight, there’s a possibility that prices might not go that high,” Patton said.

Patton said he’d like to see MISO commit turbines with 30-minute startup times closer to when they’re needed, not several hours ahead of time. MISO committed about 25 GW of combustion turbines in its day-ahead market for Aug. 24. In addition, it sent dispatch instructions in real time to another 1.5 GW of small combustion turbines to manage risk.

But Patton did say he respected MISO’s decision to cancel generation commitments when it became clear they were unnecessary.

“We haven’t seen MISO cancelling commitments at this rate ever. It saved customers about $1.6 million” in revenue sufficiency guarantee payments, Patton said.

MidAmerican Energy Co.’s Dennis Kimm said committing gas units “just in time” in the summer makes sense because gas operators are prepared. However, he said that philosophy shouldn’t apply to stressful operations in the winter. He said gas units should be committed ahead of time in the colder months to make sure they can secure fuel supplies.

“We knew this day was not going to be pretty,” MISO’s John Harmon said at an Oct. 3 Reliability Subcommittee. He said a pre-dawn load check registered higher than forecasted and MISO at the time was expecting an additional 3 GW of generation losses and derates over the day.

By midmorning, however, MISO’s in-house meteorologist noticed an isentropic lift weather pattern that had clouds covering major load centers and dampening demand.

A day earlier, MISO’s 125 GW of actual peak demand fell short of its 128-GW forecast.

Harmon said MISO dealt with heat-related system stressors for the majority of August.

“This part of August was the fifth heat wave, heat dome, heat spell of the summer,” Harmon said, adding that MISO operators until then had prepared for and tracked heat for much of the summer.

MISO merges 10 separate weather forecasts to predict conditions. Harmon said MISO wasn’t the only grid operator to encounter load forecasting challenges that day.

“Things changed in a fascinating way that generated a lot of questions,” Harmon said. He said accurately predicting cloud cover over load centers in the footprint like Detroit, Minneapolis and New Orleans remains difficult.

“We did what we could to cancel some of those starts due to the drastic change in our reserve margin,” Harmon said.

Harmon said conditions improved throughout the day and the emergency declaration lured in more imports, so MISO didn’t need to dispatch emergency capacity. Harmon said obligations were met by non-emergency resources in MISO’s pricing engine despite the emergency offer floor.

DTE Energy’s Mike Samson said MISO may be declaring emergencies too early and might want to wait until later in the operating day when it becomes clear actions are necessary.

Harmon said the other side of that argument is, “if you knew it, why didn’t you tell us?” But he said MISO could have more conversations on how best to approach early warnings.

Aliff said MISO has become more proactive over the years as emergency conditions emerge.

“I’ve been at MISO 22 years, and I remember the days at MISO where we made declarations minutes before an event,” he said.

Aliff said all told, MISO followed the procedures outlined in its tariff, which directs MISO to declare an emergency if it foresees a “significant operating reserve shortage” in its real-time reliability assessment commitment.

Harmon said MISO is investigating how wind forecasts, expected imports and voluntary load reductions can evolve going into an event. He said MISO is looking for ways to improve and takes stakeholders’ views seriously after these events.

MISO has taken to commemorating extreme weather emergencies with “flair” pins on lanyards for MISO staff. Harmon predicted the late August event might earn him a new pin in the shape of a thermometer bulb.

Relatedly, MISO continues working on what it deems its “uncertainty management” project to better quantify system unknowns. As part of that, MISO is building a new risk prediction model that will allow MISO to use a dynamic reserve requirement based on a daily risk profile.