Stakeholders Endorse Reserve Requirement Study Values

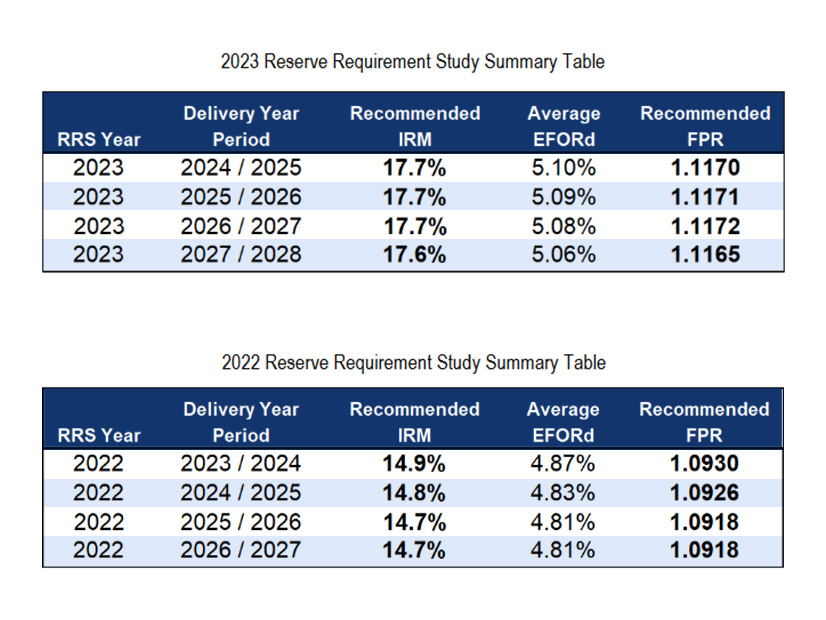

VALLEY FORGE, Pa. — The Planning Committee endorsed the installed reserve margin (IRM) and forecast pool requirement (FPR) values PJM recommended in the 2023 Reserve Requirement Study (RRS), which calls for an increase in procured capacity for the 2027/28 delivery year (DY). (See “First Read of 2023 Reserve Requirement Study,” PJM PC/TEAC Briefs: Sept. 5, 2023.)

The IRM, which sets the targeted capacity level above expected loads, would rise from 14.7% for the 2026/27 DY in the 2022 study to 17.6% for the 2027/28 DY. The FPR, which includes forced outage rates, also would increase from 9.18% to 11.65% for the corresponding DYs. The figures are slated to be considered by the Markets and Reliability Committee (MRC) and Members Committee (MC) next month, followed by the Board of Managers in December.

This year’s RRS included a few differences from past analyses, including a second methodology for setting the IRM and FPR using the hourly loss-of-load modeling developed for effective load-carrying capability (ELCC) studies. PJM also included data from the 2014 polar vortex and the December 2022 winter storm, reversing a historical practice to not include the polar vortex data in the study’s modeling based on the impact of Winter Storm Elliott.

PJM’s Patricio Rocha Garrido said the main drivers for the recommended reserve margin increase are higher uncertainty in peak load forecasts and the higher forced outage rates in the winter owing to extreme weather. Shifting to hourly modeling of peak loads, separate from the ELCC analysis, also contributed to the higher margins.

Minimal coincidence between the PJM peak load period and the “world” peak — which is defined as MISO, NYISO, TVA and VACAR — more than doubled the capacity benefit of ties (CBOT) value to 2.2% from 1% in the 2022 study. To reduce volatility, PJM elected to average the CBOT values from 2017-22 and use that figure, which landed at 1.5%, instead.

The load model, which included data from 2013-19, contributed to a 2.1 percentage point increase in the IRM, while the winter peak week caused a 1.1 percentage point increase. The values were slightly lower for the FPR drivers. The 1.5% CBOT contributed to a 0.5 percentage point decline in the IRM value and 0.58 percentage point decrease in the FPR.

The hourly approach resulted in higher recommended values — an IRM of 18.3% for the 2027/28 DY and a 12.31% FPR — with much of the difference from the PRISM values arising from the load model. PJM ran both models for this year’s RRS analysis, but it plans to shift to using the hourly approach only in the long term.

During an August Resource Adequacy Analysis Subcommittee meeting, James Wilson, a consultant to state consumer advocates, calculated the recommended values would constitute an approximate 3,700-MW increase in the summer reserve margin.

More Extensive Guidelines for Load Forecast Adjustment Endorsed

Stakeholders endorsed a PJM quick fix proposal to increase the granularity of the data included in load forecasting requests, as well as how far out it should seek to adjust future load estimates. The quick fix pathway allows a problem statement and issue charge to be brought concurrent with a proposed solution. (See “PJM Presents Quick Fix on Load Forecast Guidelines,” PJM PC/TEAC Briefs: Sept. 5, 2023.)

Under the proposal, load forecast adjustments would need to include a 15-year forecast and the granularity of the load history electric distribution companies (EDCs) and load serving entities (LSEs) are asked to provide would be increased to hourly. If no load history exists, the adjustment request should include the “expected hourly behavior of load.”

Requests would be required to come with a public document detailing how the forecast adjustment was calculated. Also, the process of assessing adjustments would begin earlier, with the Load Analysis Subcommittee (LAS) initiating its work in September and October under the proposal.

PJM’s Molly Mooney said the proposal is focused on data center loads, which are difficult to capture in the RTO’s existing processes, which rely on federal labor data that doesn’t match up well with the electrically intensive data industry. Data center developments also tend to have a short period between their initial requests to interconnect and their in-service date, making advanced forecasting more critical.

Wilson said the proposed language doesn’t make it clear that PJM is seeking only to add the amount of the forecast above the embedded amount and not double count loads already captured in the existing analysis. He encouraged PJM to hire a consultant with the expertise to do a 15-year forecast of data center loads, rather than leaving it up to EDCs and LSEs to report their own expectations and data.

PJM has made some modifications to the proposed Manual 19 revisions since the proposal’s first read in September, specifying that when the RTO conducts annual information requests about significant shifts in load from electric distribution companies (EDCs), it is seeking information about changes within their service areas. The new language also states that any documentation of EDCs’ or LSEs’ internal financial or planning forecasts supplied to PJM will be confidential.

First Read of Periodic Review of Manuals 19 and 14B

PJM presented a first read of several revisions to Manuals 19 and 14B resulting from the documents’ periodic review.

Revisions to Manual 19 added information reflecting the change to hourly peak load modeling in the load forecast and sought to clarify the procedure when forecasting price-responsive demand.

The changes to Manual 14B are intended to clarify that the 300 MW load loss criteria — which is meant to address load loss impacting a large number of customers — would be expanded to specify that it covers numerous customers, rather than single large-load customers such as data centers. PJM also would be granted the ability to review instances of the rule case by case. The criteria is a consideration when modeling outages in the Regional Transmission Expansion Plan (RTEP).

Both sets of manual changes are set to be considered for endorsement by the PC at its Oct. 31 meeting.

Transmission Expansion Advisory Committee

AEP Proposes $216 Million in Transmission to Support New Steel Mill

American Electric Power (AEP) proposed a $215.8 million project to construct several 345-kV lines and a new substation to serve a new industrial customer with an estimated 450 MW load near Apple Grove, W.Va.

In the first phase of the project, two new 345-kV lines would be cut into the Sporn–Tri-State line to run to a new Mercers Bottom 345-kV substation. The customer would be served by two single-circuit 345-kV feeds around 0.75 miles from Mercers Bottom, as well as a 138-kV line that would be cut into the Apple Grove–South Point line. The total phase one cost is estimated at $70.8 million with an estimated in-service date of Dec. 15, 2025, to meet the customer’s request to interconnect by the end of 2025.

Phase two would focus on meeting the customer’s short circuit strength needs under N-1 contingencies and would involve constructing an additional 26-mile 345-kV line from Sporn to Mercers Bottom, accompanied by an additional circuit breaker at Sporn. The projected in-service date for phase two is Dec. 15, 2029.

AEP said the industrial customer is a steel mill planned in the region, but it could not provide further detail at this time. Nucor is planning to construct a $3.1 billion electric arc furnace steel mill in Apple Grove with power supplied by a new Appalachian Power substation, according to an announcement from U.S. Sen. Joe Manchin (D).

Other Supplemental Projects:

-

- Commonwealth Edison (ComEd) proposed a $149 million rebuild of its 26.4-mile Kincaid–Pana (Ameren) line, saying 56-year-old wood poles and components are at their end of life and have sustained woodpecker damage. The line also suffered outages when crossarms broke under clear weather conditions. The project, still in the conceptual phase, has an estimated in-service date of Dec. 31, 2026.

- ComEd also proposed a $264 million project to replace a 345-kV straight bus with a gas insulated substation with 34 circuit breakers in a breaker and half configuration. The utility stated that 14 breakers are deteriorating and a failure of one could cause an outage on seven 345-kV lines and two autotransformers. The project is in the conceptual phase with an estimated in-service date of Dec. 31, 2028.

- Dominion submitted needs for two new 230-kV substations, World Gate and Mercator, in Fairfax County, Va., to serve data centers with loads exceeding 100 MW. The needs have a targeted in-service date of June 1, 2027.