FERC on Friday granted NextEra Energy Transmission (NEET) Southwest’s request to recover 100% of “prudently incurred costs” to construct a competitive transmission project in New Mexico, should the project be abandoned or cancelled for reasons beyond its control (ER23-2630).

The commission agreed with NEET Southwest’s contention that the project faces certain regulatory, environmental and siting risks beyond the developer’s control that could lead to its abandonment. FERC said its abandoned plant incentive will address those risks by protecting NEET Southwest.

“Thus, we find that NEET Southwest has demonstrated a nexus between its requested incentive and its planned investment and that NEET Southwest has tailored its incentive rate request to its identification of risks and challenges associated with the project,” the commission said.

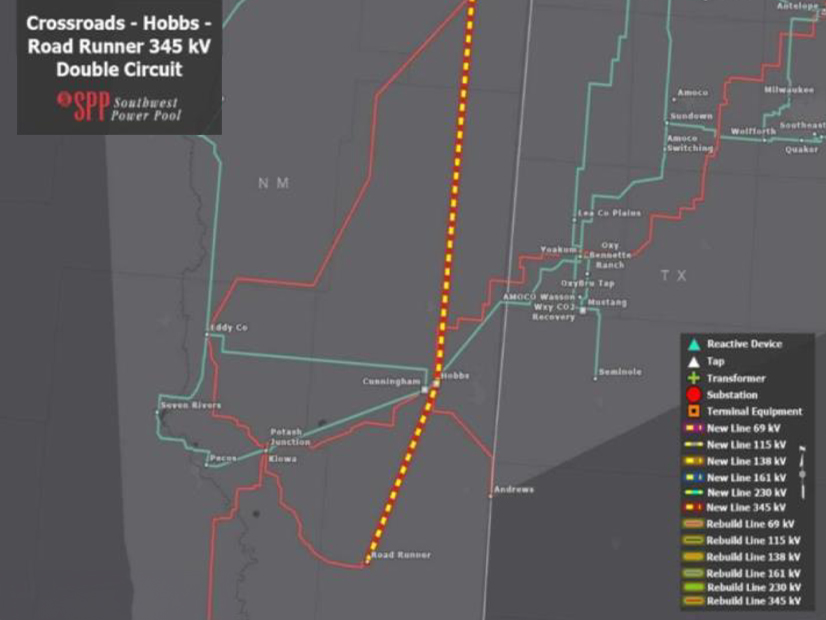

SPP awarded the NextEra subsidiary the Crossroad-Hobbs-Roadrunner 345-kV project in July. The project, 135 miles of double-circuit 345-kV lines at either end of the Hobbs generating substation, is estimated to cost $291.6 million and has a proposed in-service date of May 2026. (See SPP Awards NextEra 3rd Competitive Project.)

In August, NEET Southwest filed a request with FERC under Section 205 of the Federal Power Act and the commission’s 2012 policy statement on transmission incentives for incentive rate treatment.

The commission previously accepted the developer’s 2017 filing for a formula rate designed to be incorporated into SPP’s tariff. In its order, FERC also granted NEET Southwest’s request for several incentive rate treatments: a 50 basis point return on equity incentive for participating in an RTO or ISO; a regulatory asset for prudently incurred pre-commercial and formation costs for later recovery; and a hypothetical capital structure of 60% equity and 40% debt until its first transmission project is commercialized.

Commissioner Mark Christie concurred in a separate statement, but also called for FERC to revisit “the array of incentives offered to transmission developers.” Those include construction-work-in-progress and hypothetical capital structure incentives, and RTO participation adders.

“A core principle of utility law and regulation for decades is that consumers can only be forced to pay costs for assets that are ‘used and useful’ to them,” he wrote, noting that under Order 679, the commission may have to overlook that principle to address the “substantial challenges and risks” in building transmission facilities.

Christie said he previously questioned the commission’s determination of “whether ‘substantial challenges and risks’ exist when granting the abandoned plant incentive and other incentives has become nothing more than a check-the-box exercise.”