Transmission upgrades that are needed to avoid overloads in a fully electrified New England by 2050 could cumulatively cost between $22 billion and $26 billion, ISO-NE told its Planning Advisory Committee on Wednesday.

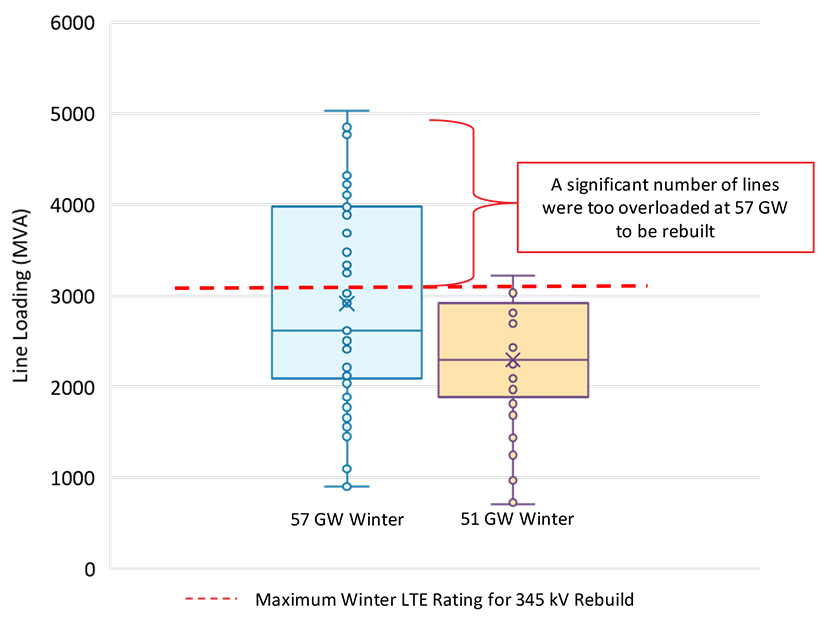

The RTO emphasized that limiting the 2050 winter peak from the anticipated 57 GW to 51 GW would save the region about $8 billion in avoided transmission costs.

The projections were part of the results of ISO-NE’s 2050 Transmission Study, which was requested by the New England States Committee on Electricity in 2020. ISO-NE is now developing a process to better facilitate transmission infrastructure projects based on the findings.

The study focused strictly on thermal overloads on the system during peak load and did not include costs associated with interconnection, distribution, transient stability and other system needs. “The total transmission and distribution costs are anticipated to be much higher,” it said.

“Reducing the peak load can significantly reduce the transmission costs,” Reid Collins of ISO-NE told the PAC. The region could reduce this peak by either investing heavily in demand response, building insulation and heat pump efficiency, or by reducing the levels of electrification during the times of peak load, he said.

As a part of the study, ISO-NE identified a set of “high-likelihood concerns” that will need transmission investment. These include the need to increase transfer capability from Maine and New Hampshire into the Boston area, and to boost import capability into the regions of Burlington, Vt., and southwestern Connecticut.

ISO-NE outlined a set of potential solutions for each of these concerns, including the potential of an offshore grid to address Boston imports. The study also found that the region will likely need many new transformers no matter where the new loads appear.

“It may be worth looking into ordering some of these up front, not knowing exactly where they’re going,” Collins said, noting the long lead times associated with acquiring new transformers.

Some stakeholders expressed concern about the study’s assumptions about the amount of energy storage on the grid in 2050. The study projected that the region would have just over 5,000 MW of nameplate capacity by then, which Collins acknowledged seems to be a low-end estimate. He added that most of the new storage assessed was of four-hour duration.

“There is already more battery storage expected to be online by 2033 than the 2050 Transmission Study’s input assumption for 2040,” Collins said.

While the study assumed that all oil, coal, diesel and municipal solid waste resources would be retired by 2035, it also assumed a significant remaining role for natural gas, with almost 17,000 MW of nameplate capacity expected for 2050.

Economic Planning for the Clean Energy Transition

Also at the PAC, ISO-NE’s Patrick Boughan and Benjamin Wilson presented additional “sensitivity results” of the RTO’s Economic Planning for the Clean Energy Transition pilot study, modeling different scenarios following requests from stakeholders.

The scenarios included running the study without the electrification of heating and transportation, with nuclear retirements, and with biodiesel as a carbon-neutral stored fuel. (See ISO-NE Projects Decrease in Gas, Increase in Coal and Oil for 2032.)

ISO-NE found that added demand from transportation and heating would increase the cost to load by 114% compared to the no-electrification base model.

“Because the additional heating and electrification load peaks in colder conditions, the additional load likely requires more stored fuel generation,” Wilson said, noting these additional loads would greatly increase the expected need for oil generation, from 11 GWh to 834 GWh.

While ISO-NE anticipates that heating and transportation electrification would drive a 67% increase in electricity-sector emissions compared to the no-electrification scenario, Wilson noted that these emissions “are expected to be offset by emission reductions in other sectors.”

In the scenario modeling nuclear retirements, ISO-NE found they would drive increased solar and wind generation but also increase emitting generation, especially during the interim years of 2030 and 2040. During these years, the model showed that nuclear retirements would lead to “a significant increase in gas generation and emissions.”

In the biodiesel scenario, the RTO found that biodiesel — along with synthetic natural gas — would be a useful but expensive fuel for generation.

“Higher carbon prices or [renewable energy certificates] would be needed to allow carbon-neutral fuels to be utilized if they had to compete with existing emitting fuels,” Wilson said.

Asset Condition Projects

Kyra Lagunilla of Rhode Island Energy presented to the PAC on three proposed asset condition projects totaling about $88 million. Lagunilla said the projects are necessary because of deteriorating and out-of-date transmission infrastructure that has led to poor performance on the lines.

The proposed line rebuilds are:

-

- the Rhode Island portions of the 115-kV M13 Pottersville-Jepson and L14 Bell Rock-Jepson lines, with a projected cost of $56.5 million and an in-service date of Q4 2025;

- the 115-kV S-171N Woonsocket-Hartford Ave and T-172N Woonsocket-Hartford Ave lines, with a projected cost of $22.3 million and an in-service date of Q3 2026; and

- the 115-kV E-183W Franklin Sq-Wampanoag line, with a projected cost of $10.6 million and an in-service date of Q4 2025.