The results from a WMEG study indicate that many entities outside California would see more benefits from a two-market outcome while the Golden State has the most to lose from such a split.

The long-awaited results from a key study on the financial impact of an organized day-ahead electricity market in the West indicate that many entities outside California would see more benefits from a two-market outcome while the Golden State has the most to lose from such a split.

And while some industry stakeholders in the Northwest had speculated that the Bonneville Power Administration would be among the losers in a single-market solution, the findings — adjusted by BPA itself — paint a more complicated picture in which the federal agency could be either winner or loser in either scenario.

BPA discussed the findings during an Oct. 23 workshop, one of a series of stakeholder meetings related to its decision whether to join a day-ahead market.

The study was conducted by Energy+Environmental Economics (E3) on behalf of the Western Markets Exploratory Group (WMEG), a loose coalition of 26 transmission-owning entities covering most the Western Interconnection. The WMEG was established in 2021 to evaluate the region’s electricity market options, and its membership quickly expanded alongside broader discussions about the issue.

The WMEG asked E3 to limit the scope of the study’s cost-benefit analysis to variable production costs and energy market prices, while not considering potential investment savings that could be realized from lower capacity needs due to resource and load diversity, the ability to procure resources over a wider geographic area and coordinated regional transmission planning.

“Other market studies have shown those other benefit categories can create 2-10x the impact of production cost savings alone,” E3 noted in a presentation at the workshop.

“We think of our results as being quite conservative and intentionally so,” E3 senior partner Arne Olson said.

The study was structured to show a comprehensive picture of potential benefits for the West as a whole, while also breaking down results for individual utilities. While results were provided to WMEG study participants early this summer, they were not released publicly due to concerns about confidential information related to individual utilities. The BPA workshop offered a wider set of stakeholders and the public their first look into the analysis.

The study’s results are important because they likely will influence the choices of Western utilities weighing whether to join CAISO’s Extended Day-Ahead Market (EDAM) or SPP’s Markets+, decisions that likely will set the course for whether the West ends up with a single RTO in the future or two — or more — organized markets divided by seams.

“Today’s conversations represent just one element of the business case that Bonneville will use in helping arrive at a leaning [toward a market] in 2024,” Andy Meyers, BPA public utility specialist, said during the workshop. “And just to reemphasize something that we’ve shared before but want to make clear: We have not made any proposals about a leaning for 2024 at this point.”

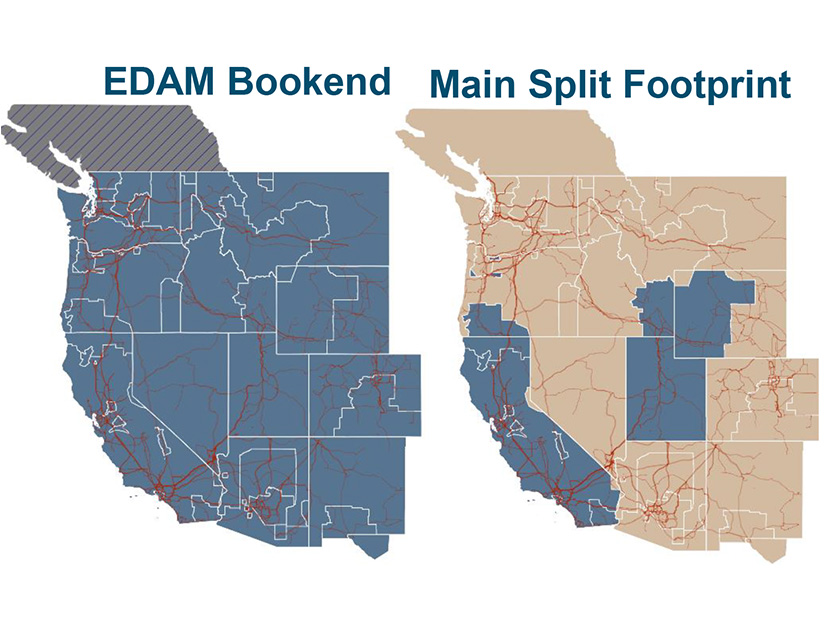

EDAM Bookend vs. Main Split Footprint

In presenting the findings, E3 noted that the study was designed to provide WMEG members with “credible information” about the benefits of joining either EDAM or Markets+.

The results focused on three core scenarios for 2026:

-

- A business-as-usual (BAU) case assuming continuation of the West’s current bilateral market for day-ahead energy combined with the existing footprint of CAISO’s Western Energy Imbalance Market (WEIM) for real-time trading. The BAU assumes no entities join either day-ahead market, E3’s Jack Moore said during the workshop.

- An “EDAM Bookend” case that assumes a single combined day-ahead and real-time market that covers the entire Western Interconnection, excluding the Canadian provinces of British Columbia and Alberta. This scenario assumed no charges for wheeling power within the system, Moore said.

- A “Main Split Footprint” that assumes participation in the EDAM by CAISO, PacifiCorp, Los Angeles Department of Water and Power, Balancing Authority of Northern California, Turlock Irrigation District and Imperial Irrigation District, while the rest of the West (excluding Alberta) participates in Markets+. This scenario assumed charges at the seams between the two markets, Moore said, noting that it was difficult to know what would be required to coordinate between the two, given that they wouldn’t be full RTOs.

Compared with the BAU case, the study found, the EDAM Bookend scenario results in $60 million in annual savings for the West as whole. But in breaking the results down by balancing authority area, the study indicates that California entities would realize $80 million in savings in that scenario, while WMEG members outside California would see a $20 million loss compared with the status quo. And results even vary among those WMEG members, Moore noted, with some realizing net benefits while others suffer losses at varying levels. Exact results for individual utilities must remain confidential, he added.

The cost-benefit outcomes get flipped in the Main Split Footprint case. In the scenario with two markets, West-wide costs increase by $221 million compared with BAU, with California entities taking a $247 million hit. Most of those increased costs stem from California’s need to fire up relatively expensive internal natural-gas-fired generation to substitute for cheaper imports, Moore said.

However, the Main Split market scenario showed $26 million in savings for WMEG members in general, although some members would face losses compared with the BAU case.

“The trade-off has different effects for different entities,” Moore said.

E3 said the results indicate the importance of “critical” transmission lines between the Northwest and Southwest in the Main Split case, where transactions would depend heavily on paths in Idaho, Nevada and Montana to avoid wheeling through the EDAM.

“Northwest to Southwest becomes a pretty significant pinch point” in the Split scenario, Moore said. Olson added that the transmission constraints in that scenario also could depress energy prices in the Northwest and reduce the value of the region’s flexible resources.

BPA Findings

Presenters at the workshop saved the most anticipated findings — BPA’s results — for last.

The study’s initial findings showed BPA seeing financial losses relative to BAU in both the EDAM Bookend and Main Split scenarios, largely because of a sharp decline in transmission wheeling charge revenues within its territory under either market. E3 assumed that a more robust market would undercut the need for customers to secure wheeling contracts from BPA, reducing those revenues from $251 million in the 2026 BAU case to $5.5 million in EDAM and $31.8 million in Main Split.

But BPA Director of Market Initiatives Russ Mantifel said the agency drew a different conclusion about the impact of day-ahead market participation on those charges. Most wheeling revenues are derived from long-term contracts, the agency found, and counterparties are likely to maintain those agreements for the foreseeable future.

By restoring wheeling revenues to expected 2026 levels, BPA and E3 estimated the agency’s annual net benefits would rise to $134.7 million in the EDAM Bookend scenario and $28.8 million in the Main Split scenario.

“I think the wheeling revenue numbers in the study do a good job of articulating something that we as a region and that Bonneville has intuitively known, which is, for Bonneville, there’s probably some amount of transmission that for us, is probably long-term, firm point-to-point transmission that’s purchased and rolled over and over and over again,” Mantifel said.

But it was clear the recalibrated study results showing how BPA could benefit from both day-ahead market scenarios were not a clincher for either market.

“There’s no study that tells you exactly what you’re supposed to do,” Mantifel said. “These are big decisions with a lot of different complicated factors, and so Bonneville is going to try to utilize all this information, but we’re going to be based in the sort of decision framework” the agency has previously laid out for choosing which market to join.