Duke Energy saw its third-quarter earnings drop from a year ago as it dealt with mild weather and low demand from industrial customers, but executives told analysts Thursday those trends should turn around.

Earnings per share fell to $1.59 on the quarter, compared to $1.81 in the summer of 2022. On top of a return to growing demand, Duke CEO Lynn Good also highlighted plans to transition its utilities around the country to cleaner resources.

“With the closing of the commercial renewable sale last month, our portfolio repositioning is completed,” Good said. “We are now a fully regulated company, operating in some of the fastest-growing and most attractive jurisdictions across the U.S.” (See Duke Sells Distributed Renewable Business to Arclight.)

The firm’s biggest market is the Carolinas, where it dominates the utility space. The North Carolina Utilities Commission (NCUC) recently approved new rates for Duke Energy Progress and has a pending case before it for Duke Energy Carolinas (DEC) that Good said should wrap up in the fourth quarter.

The NCUC approved a rate base of $12.2 billion and $3.5 billion in investments for the firm, while a settlement pending in DEC’s case would set its rate base at $19.5 billion and approve $4.6 billion in funding. While the firm has several subsidiaries serving the Carolinas, it plans their system jointly, and it filed the latest iteration of its resource plan with the two states in August.

“The single unified resource plan for the Carolinas is designed to meet the needs of this growing region spurred by rapid population growth and significant economic development activity,” Good said. “The plan maintains an all-of-the-above strategy with a diverse deployment of additional resources, including renewables, battery storage and natural gas, as well as energy efficiency and demand-side management.”

Sales volumes are down 1.2% on a rolling 12-month basis, with industrial customers saying they are scaling back their business slightly because of uncertainty in the economy, said CFO Brian Savoy.

“Most are describing the pullback as temporary, and there’s optimism that it’s about to turn around in mid- to late 2024 and into 2025,” Savoy said. “We continue to see strong customer growth from population migration and robust economic development, giving us confidence in growth over the long term.”

Textiles and the paper industry have been hit by slowdowns, but other industries are facing issues with the supply chain, labor and interest rates that have contributed to lower demand, Good said. Others have built up a significant inventory of product and have cut back on production to sell off the excess.

Residential demand had been impacted by the trend of returning to work after the pandemic, but that is over, Good said. Lingering residential demand weakness will be offset as Duke moves to decoupled rates in North Carolina next year, Savoy said.

“We’ve got customers sort of working through the macro-term trends here in the short term,” Good said. “But over the long term, we continue to see this economic development being incredibly strong.”

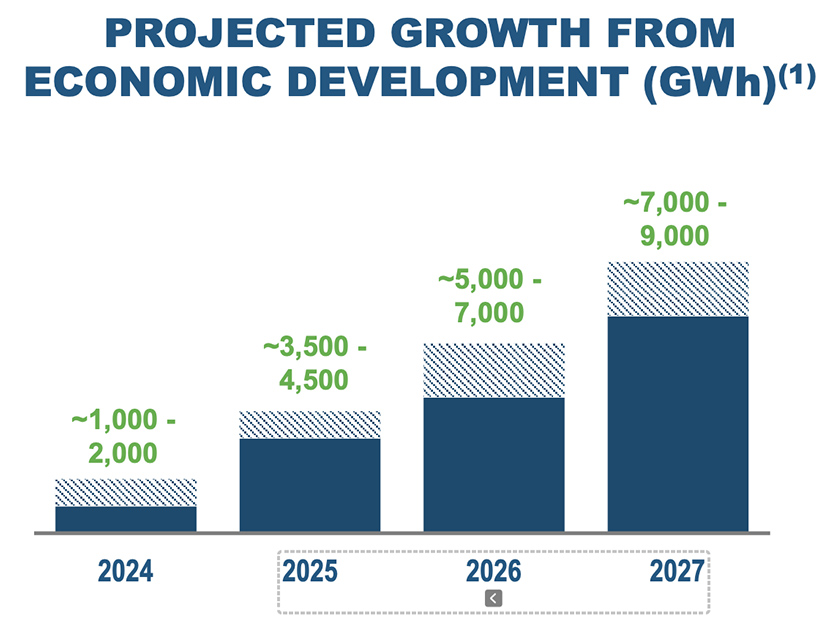

Economic development projects coming online next year add up to 1,000 to 2,000 GWh of new demand, with Duke expecting to add 7,000 to 9,000 GWh by 2027, a growth rate of between 0.5 and 1%, Savoy added. That load growth is reflected in Duke’s plans to expand its generation in the Carolinas.

“We see a need for additional megawatts in the Carolinas really driven in large measure by population growth, economic development and reserve margin,” Good said.

Populations are also growing in the other states in Duke’s footprint. The utility is planning to start transitioning its Indiana utility away from coal-fired generation to rely more on natural gas and renewables, Good said. Duke expects to file certificates to build new generation in the Hoosier State in the next several months.

The plan in North Carolina also calls for new natural gas. One analyst asked Good about potential pushback against new fossil infrastructure.

“We believe what we’ve put forward is a very balanced, all-of-the-above strategy that provides the right balance between reliability, affordability and increasingly clean, which is our commitment to the state,” Good said. “So, we think all of those elements will be closely reviewed and evaluated as part of the process in front of the commission.”