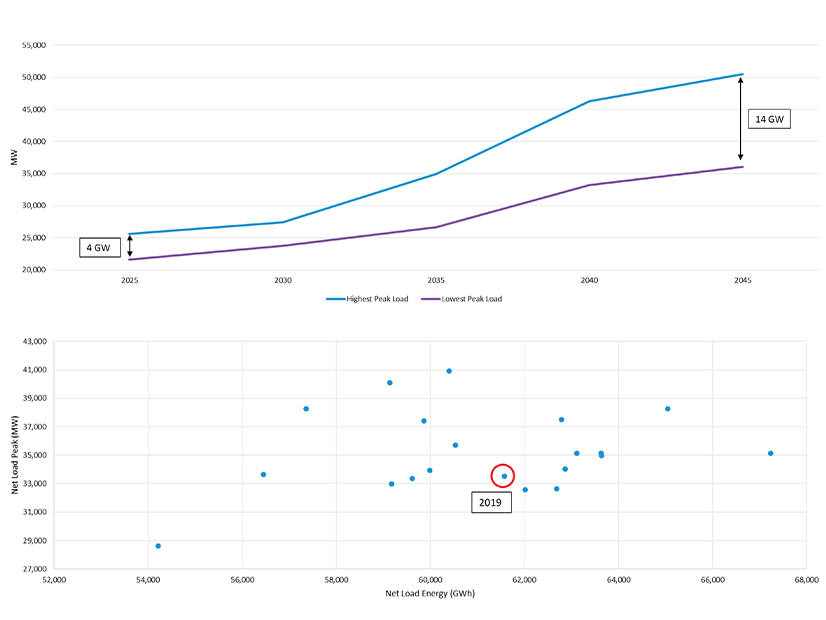

Increased electrification and reliance on solar and wind resources will make electricity supply and demand more weather-dependent, resulting in more variable winter peak loads on the New England grid, Benjamin Wilson of ISO-NE told the RTO’s Planning Advisory Committee (PAC) on Dec. 12.

Analyzing the results of the Economic Planning for the Clean Energy Transition (EPCET) pilot study, ISO-NE anticipates the range between maximum and minimum peak load weather years will reach 14 GW by 2045, a significant increase compared to the 4-GW range expected for 2025.

This gap could require a large subset of dispatchable resources that run only in high-end cases, Wilson told the PAC.

“The region may end up paying for a pool of resources which are only needed once every few years,” Wilson said. “Uncertainty surrounding how often dispatchable resources will actually be needed may lead to a need for higher capacity payments.”

Wilson noted that even with the continued penetration of wind and solar, dispatchable generators still will need to cover about 90% of the expected peak load, underlying the importance of ensuring adequate revenue sources for dispatchable resources.

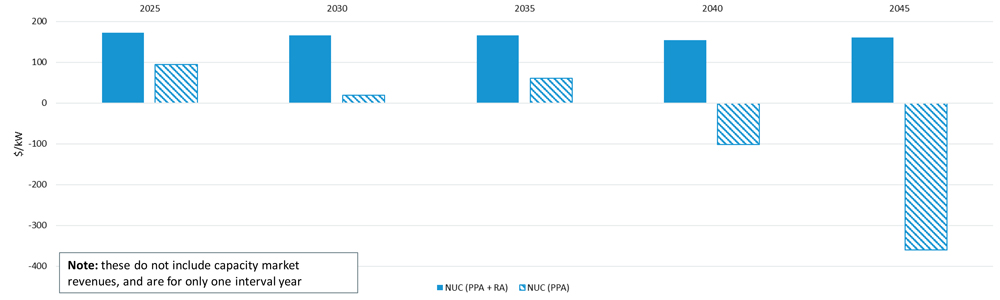

The EPCET study also compared two future policy scenarios focused on resource compensation. One scenario focused on the continued use of power purchase agreements (PPAs) similar to state procurements. The second scenario included PPAs along with a reliability adder (RA) charge to fossil resources that would be allocated to non-emitting dispatchable resources.

The scenarios included a carbon constraint of about 6 million tons by 2045. For context, the New England power system was responsible for about 30 million tons of carbon emissions in 2021.

In both scenarios, ISO-NE found the cost of PPAs will increase significantly between 2035 and 2045, with new intermittent resources lowering the capacity factor of existing intermittent resources. Both scenarios also projected declining revenues for existing solar and wind resources through 2045, as these resources are “increasingly underbid by new resources with higher priced PPAs,” Wilson said.

In the PPA-only scenario, nuclear profits also declined significantly by 2045, coinciding with the decline in energy prices. In contrast, profits remained relatively stable with the introduction of the RA.

The RA likely would result in lower capacity market prices compared to the PPA-only scenario by increasing the revenue available to clean dispatchable resources in the energy market, Wilson said.

“The PPA plus RA scenario generally does a better job of securing resource revenue adequacy,” Wilson said. “Providing greater revenues to baseload resources may reduce the likelihood of retirement.”

Wilson added that demand response resources may play a role in reducing demands but could be limited in their ability to ease extended winter peaks.

“Significant development of demand response resources could help alleviate the uncertainty surrounding multiple weather years. However, it may prove difficult to curtail some load (such as heating, cooling or transportation) during periods of extreme weather,” Wilson said.

Asset Condition Project Updates

Also at the PAC, Alan Trotta of Avangrid provided an update to the New England Transmission Owners’ (NETOs) proposed asset condition project forecast database. The NETOs presented a draft version of the database at the Nov. 15 PAC meeting. (See New England Transmission Owners Issue Draft Asset Condition Forecast Database.)

Instead of categorizing transmission lines’ original in-service year, the database will list the in-service year of each line’s oldest component to account for line rebuilds. For transformers, the database will list both the in-service year and the manufacturing year.

Trotta said cost projections would not be included in the database. He said including accurate cost metrics would require a significant amount of work and noted that cost projections were included in a pair of recent presentations.

He said the NETOs plan to update the database annually, and that the transmission owners will “evaluate the feasibility of adding additional information to the database,” including asset health scores and data on other pool transmission facilities, such as circuit breakers and control houses.

The first iteration of the database, along with related stakeholder comments, will be published in January, Trotta said.

Project Presentations

Eversource presented to the PAC a project to replace deteriorating wood structures on two 115-kV lines in New Hampshire with a total projected cost of $15.7 million. The expected in-service dates for the replacements are mid-2024.

In accordance with the new asset condition presentation guidelines, Eversource is soliciting stakeholder feedback due Jan. 11.