FERC rejected SPP’s proposed market power test for the Western Energy Imbalance Service, saying it gave the Market Monitor too much discretion.

FERC rejected SPP’s proposal to modify its market power test for the Western Energy Imbalance Service, faulting a provision granting the Market Monitoring Unit discretion in applying the rules (ER23-2183).

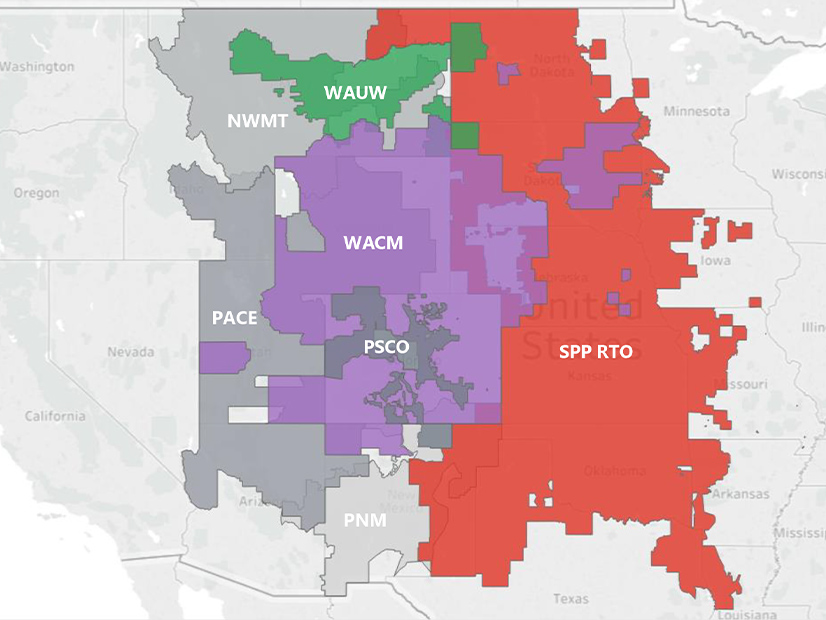

SPP proposed tariff changes to address a finding in the MMU’s August 2020 WEIS Market Power Study, which identified a high level of structural market power in the WEIS market.

SPP said its residual supply index (RSI) — the ratio of capacity not owned by a market participant to total market demand — failed to consider the total capacity from affiliated market participants together. That created an opportunity for an entity to split its fleet of resources into multiple market participant registrations to avoid failing the test, the MMU said.

FERC’s Dec. 19 order approved new tariff language specifying that the RTO would consider together “all on-line resource capacity from any affiliate of the market participant.”

But the commission rejected a second change that would have allowed the MMU to exclude from the RSI calculations capacity associated with an affiliate if the monitor was convinced the participant maintained “safeguards and corporate controls to prevent coordinated or collusive market activity,” such as maintaining electronic permissions and access controls and physically segregating the personnel who make daily bid/offer or strategic market decisions.

FERC said the second change would undermine the first and thus was not just and reasonable.

“Accordingly, we reject the entire proposal as filed, but we note that SPP may resubmit a proposal that addresses the concerns described above,” the commission said.