FERC on Dec. 29 approved Dairyland Power Cooperative’s request for transmission rate incentives for its investment in the Wilmarth-North Rochester-Tremval project, a 169-mile line spanning Minnesota and Wisconsin that is part of MISO’s 2021 Transmission Expansion Plan (MTEP 21) (ER24-260).

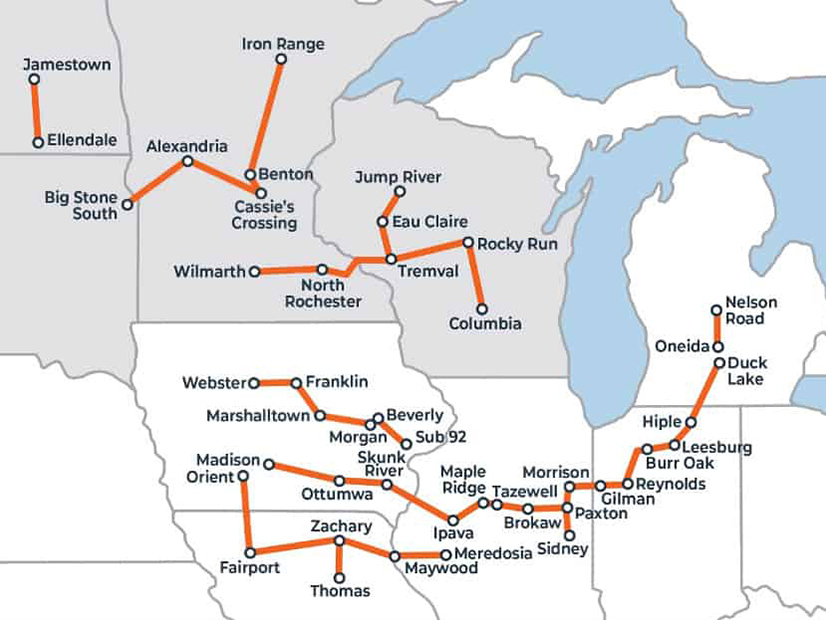

The Wisconsin-based cooperative received authorization for the construction work in progress (CWIP) and abandoned plant incentives for the 345-kV span, which will connect the Wilmarth substation near Mankato, Minn., to the Tremval substation near Blair, Wis. The project involves building a new 161/69-kV substation near Kellogg, Minn., north of Rochester, and upgrading existing 161-kV facilities.

FERC also granted Dairyland a hypothetical capital structure of 50% equity and 50% debt for the life of the financing of the project. The line is expected to be in service by June 2028 and cost about $689 million.

“Dairyland expects to invest an estimated $207.5 million in the project, or 44% of its projected 2023 net transmission plant in rate base,” the commission said. “The project’s multiple owners and complexity present significant risk, and the record shows that this investment could put downward pressure on Dairyland’s financial metrics. We find that the hypothetical capital structure and CWIP incentives will provide upfront certainty, bolster Dairyland’s financial metrics to help ensure maintenance of its current credit rating and facilitate its participation in the project.”

Xcel Energy, Southern Minnesota Municipal Power Agency and Rochester Public Utilities are co-owners of the project.

In a concurrence, Commissioner Mark Christie continued to urge the commission to reconsider its policies on incentives, although he acknowledged that Dairyland met the standards the commission laid out in Order 679.

“Just as the CWIP incentive effectively makes consumers the bank for transmission developers, the abandoned plant incentive effectively makes them the insurer of last resort as well,” he wrote. “As this commission considers other potential reforms related to regional transmission planning and development, it is imperative that incentives like the CWIP incentive, abandoned plant incentive and RTO participation adder are all revisited to ensure that all the costs and risks associated with transmission construction are not unfairly inflicted on consumers while transmission developers and owners stand to gain all the financial reward.”

Commissioner James Danly, who left the commission at the end of the year, recused himself.