The Renewable Thermal Collaborative contends electrification should be a major component of any plan to decarbonize industrial thermal energy use.

The Renewable Thermal Collaborative (RTC) on Jan. 23 released an Electrification Action Plan that contends electrification should be a major component of any plan to decarbonize industrial thermal energy use.

“When cost-competitive heat pumps, electric boilers and electrified thermal batteries are powered by low- or zero-carbon electricity, they can significantly and immediately reduce emissions,” the report said. “Deployment of improving electrification technologies like high temperature heat pumps can reduce emissions even more over the long term.”

Only 5% of the industrial heat in the U.S. is electrified, so near-term opportunities abound.

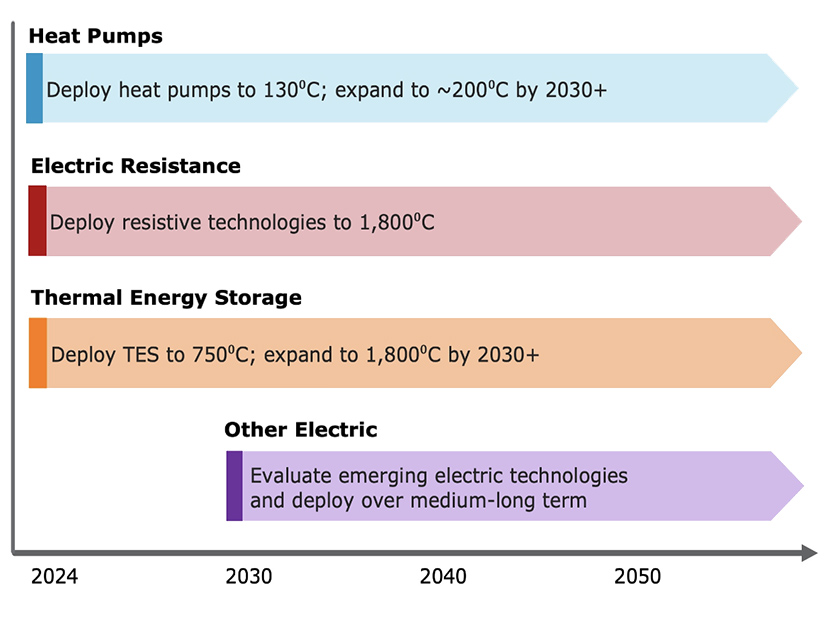

Industrial heat pumps (IHPs) can replace fossil fuel-powered systems for applications under 130 degrees Celsius, which represents 29% of industrial thermal demand. Electric resistance technologies can electrify processes up to 1,800 degrees Celsius.

“More than 75% of the emissions from industrial heating come from low- and medium-temperature (<500°C) industrial applications, which are [predominantly] served by natural gas,” the paper said. “These applications include washing, drying, sterilizing, distilling and more and are common in the food, paper and chemicals sectors. Industrial heat pumps, electric boilers and thermal battery systems can replace fossil fuel-powered technologies in these industrial processes to significantly reduce emissions by 2030.”

Thermal energy storage (TES) systems, or thermal batteries, can deliver heat and steam up to 750 degrees Celsius now and should be able to support temperatures of 1,500-1,800 degrees by the next decade.

While the technologies are available now, they are more expensive than producing steam and heat from natural gas due to upfront costs, related infrastructure upgrades and the higher cost of electricity compared to gas.

“Industrial energy buyers seeking to deploy electrification technologies must pay for a variety of expenses throughout project development and operation, including new equipment, process integration, electricity infrastructure upgrades and electricity,” the paper said. “Despite findings that electrification technologies like IHPs and thermal batteries can be cost-competitive with natural gas and that the former may have simple economic paybacks under two years, the cost of electrification remains a significant barrier to adoption.”

The Department of Energy offers incentives that can cut capital costs, but the report said additional federal and state funds are needed to drive electrification.

Power prices are higher than natural gas due to utility rate structures, which increase that difference during peak demand hours.

“These rate structures conflict with decarbonization goals and require policy intervention to reduce the cost of electrification and enable rapid deployment,” the paper said. “Thermal batteries, which can source electricity when it is cheapest, may circumvent the price gap barrier and deliver heat at or below the cost of heat from natural gas combustion.”

Buyers also have less confidence in the electric technologies due to their limited track record. The lack of experience extends to investors, which can translate into higher costs for projects.

“Buyers and investors must see more demonstrations and case studies featuring electrification projects across U.S. industrial applications to become confident in their operational and financial viability, thereby driving demand for these critical technologies,” the report said.

The technologies that can produce industrial heat and steam are in limited supply — as is the workforce that knows how to install and maintain them.

More Grid Resources Needed

Electrified processes also need renewable energy to decarbonize, with widespread electrification of industry potentially doubling demand for electricity. That presents an additional challenge for planners already struggling to transition the grid to cleaner resources.

“The slow pace of long-distance transmission construction and the long wait time for grid interconnections both present significant barriers to meeting increased electricity demand from electrification,” RTC said. “Long-distance transmission and a better-connected, cleaner grid would ensure that industrial facilities [could] access affordable, abundant renewable electricity to meet their needs and protect against outages.”

RTC has set a goal of cutting industrial emissions by 30% by 2030. New federal and state policies to fully electrify will be needed to hit that target.

Federal tax incentives can unlock project opportunities that would otherwise not be viable, and while the Infrastructure Investment and Jobs Act and the Inflation Reduction Act offer a bevy of subsidies for clean technologies, RTC said they were light on industrial decarbonization funding.

“To fill this gap, the RTC is educating members of Congress on the potential for electrification to decarbonize industry,” the report said. “We are also advocating for new investment tax credits to lower costs for industrial end users to electrify and expanded production tax credits that strengthen the economic case for manufacturers to increase supply. Because this will require new legislation, we are laying the groundwork now for action in 2025.”