The New Jersey Board of Public Utilities awarded contracts to a new set of offshore wind proposals Jan. 24 (Docket No. Q022080481).

The Leading Light Wind and Attentive Energy Two projects would total 3,742 MW of capacity. The contract awards are a shot in the arm for the Garden State’s highest-in-the-nation offshore wind goals after Ørsted canceled the Ocean Wind projects in late 2023.

However, the bounceback will not be immediate.

The new projects are not expected to come online until 2031 and 2032. Ocean Wind 1 had already begun onshore construction, planned to start offshore construction this year and had projected completion in 2025.

Also, Ocean Wind 1 was a mature project, with a stack of approvals in hand including the all-important green light from the U.S. Bureau of Ocean Energy Management.

Attentive Energy Two (1,342 MW) and Leading Light (two phases of 1,200 MW each) must now navigate extensive local, state and federal review processes before beginning construction.

They must also avoid the financial and supply chain pressures that doomed the Ocean Wind projects — but many analysts expect those constraints to ease significantly for the U.S. offshore wind industry in the next few years.

In fact, the Attentive and Leading Light projects themselves will help ease the supply chain crunch, as both development teams have committed to expand New Jersey’s new offshore wind manufacturing and operations facilities, including fabrication of towers and monopile foundations.

In one example, EEW is expected to produce more and larger monopiles in-state because of this commitment.

New Jersey officials said Jan. 24 that the projects will result in a guaranteed direct impact of 5,218 job-years and $2.5 billion in spending. Adding indirect and induced jobs and spending, the impact rises to an estimated 27,103 job-years and $6.8 billion.

Ambitious Goals

New Jersey Gov. Phil Murphy (D) set a goal of 3,500 MW of offshore wind in 2018, then bumped it up to 7,500 MW in 2019 and 11,000 MW in 2022.

The state’s first solicitation yielded Ocean Wind 1 (1,100 MW). The second yielded Atlantic Shores Offshore Wind (1,510 MW) and Ocean Wind 2 (1,148 MW).

The third solicitation drew interest from four developers: Atlantic Shores, Attentive, Community Offshore Wind and Leading Light; Community subsequently withdrew its bid.

An expedited fourth solicitation is underway, with contract awards expected to be announced in the first half of this year.

Cancellation of Ocean Wind 1 and 2 was announced on Halloween 2023 — a nasty trick for those who had expended political capital on behalf of the projects and a delightful treat for the many opponents of offshore wind in New Jersey.

Opposition to offshore wind has been particularly vocal along the Jersey Shore, due to cost, environmental impact and visibility from popular beaches. On this last point, Leading Light and Attentive would be more than 40 and 47 miles from land respectively at their nearest point, and all but impossible to see from shore.

Those opposed to offshore wind due to its cost will have the following numbers to work with:

Leading Light Wind offered a first-year price of $112.50/MWh for offshore renewable energy credits (OREC). That works out to a 20-year levelized OREC price of $139.53 and a 20-year levelized net cost of $70.05 once revenue credits and avoided costs are factored in. Average monthly cost to ratepayers (in 2023 dollars) is estimated at $3.71 residential, $31.86 commercial and $278.42 for industrial.

Attentive offered a first-year price OREC price of $131, a 20-year levelized OREC price of $165.14 and a levelized net cost of $96.75. Average monthly cost to ratepayers is estimated at $3.13 for residential, $26.87 for commercial and $234.80 for industrial.

For comparison, the Ocean Wind 1 contract award (Docket No. Q018121289) in 2019 specified a first-year OREC price of $98.10, a levelized 20-year price of $116.82 and a levelized net cost of $46.46. Estimated monthly ratepayer impacts (in 2019 dollars) were $1.46 residential, $13.05 commercial and $110.10 industrial.

A reporter asked BPU senior scientist Kira Lawrence on Jan. 24 why Attentive Energy Two’s ORECs would be noticeably more expensive than Leading Light’s.

“There is an economy of scale associated with the Leading Light Project,” she replied. “It’s a 2,400-MW project, so there are a number of economies of scale that can be achieved with a larger project size. Attentive is a 1,342-MW project.”

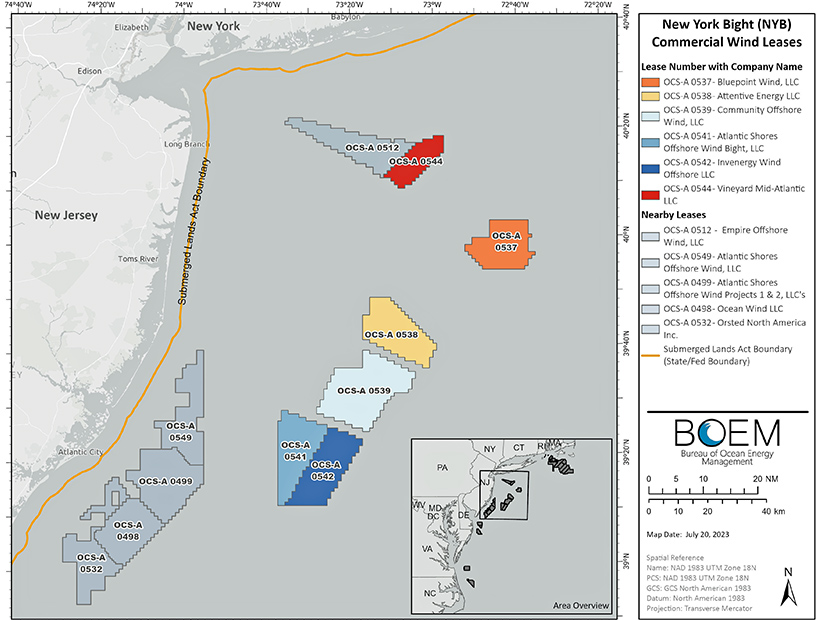

The reporter did not ask about the contract that Attentive is now negotiating with New York for the proposed Attentive Energy One in another portion of the same lease area off the New Jersey coast. Its capacity would be 1,400 MW, presumably creating some economies of scale.

Kate Klinger, a senior member of Murphy’s staff, added that bids were evaluated for not just cost but their holistic benefit to the community. “Some of what is included in that pricing is direct support for offshore wind supply chain facilities, for workforce development, benefits that will be felt directly in communities in New Jersey as well.”

Leading Light is a joint venture of Invenergy and energyRE. It said Jan. 24 it was reviewing the BPU order and looking forward to working with New Jersey to advance its clean energy transition.

Attentive Energy Two is a joint venture of TotalEnergies and Corio.

Mixed Reaction

The abrupt cancellation of Ocean Wind 1 and 2 — even after a financial concession by the state and even amid preparatory work by the developer — was a bitter setback for state leaders and offshore wind proponents. (See Ørsted Cancels Ocean Wind, Suspends Skipjack.)

BPU President Christine Guhl-Sadovy alluded to Jan. 24 before the board’s unanimous vote in favor of the two contracts.

“In spite of some setbacks,” she said, “we’re on track. If anything, this solicitation award shows that we’re moving full steam ahead. These two projects will help cement New Jersey’s position as an offshore wind leader and bring the clean energy and economic benefits to our state that have been such a critical part of Gov. Murphy’s agenda.”

Commissioner Zenon Christodoulou went a step further, warning the developers that the BPU would not let the state get skunked again, promising “fanatical, even tyrannical oversight” of progress, if necessary.

“The contracts we are awarding are tight and hold the awardees accountable to our production schedules and pricing schemes,” he said. “We will enforce those guarantees with relentless oversight and unwavering defense of our ratepayers. There will be no hat-in-hand requests, no unforeseen expenses, no nickel-and-diming.”

Clean energy groups greeted Jan 24’s’s action warmly.

Oceantic Network CEO Liz Burdock said: “New Jersey reasserts its leadership in the U.S. offshore wind sector with today’s 3.7-GW commitment and securing new supply chain investments in towers, foundations, and secondary steel manufacturing. The U.S. offshore wind market is entering a new phase of development; today’s action capitalizes the state’s early investments in a coordinated transmission system, the New Jersey Wind Port, and the EEW monopile facility to accelerate development and position the state at the center of the nation’s supply chain.”

Anne Reynolds, vice president for offshore wind at American Clean Power, said: “Today is a key step towards achieving the state’s goal of a 100% clean energy economy by 2035. Offshore wind will bring huge economic benefits to the state and region, creating jobs and new investment opportunities for manufacturing companies and suppliers to support the necessary infrastructure needed for this new and growing industry. It is also a significant commitment to developing the New Jersey Wind Port which will generate up to $500 million in new economic activity annually for the Garden State.”

Advanced Energy United Managing Director Nathan Willcox said: “Today’s awards set the stage for a vibrant offshore wind future in New Jersey. Offshore wind is critical to growing New Jersey’s economy, hitting our clean energy goals and improving grid reliability, and we are eager to see these projects move forward.”

Support was far from universal, however.

SaveLBI, a Jersey Shore activist group that sued the federal government in an attempt to block Ocean Wind, picked apart the BPU decision in a series of social media posts.

“A bad day indeed,” it said.

U.S. Rep. Jeff Van Drew (R-N.J.) said on X: “Today, NJBPU unanimously approved two new offshore wind projects despite overwhelming disapproval from New Jerseyans. The Murphy admin has once again ignored the will of the people in order to line the pockets of offshore wind companies at the cost of NJ ratepayers.”

On the Facebook page of Protect Our Coast, commentary on the news ranged from snark to dismay to anger, and suggested strongly that placing the turbines out of sight beyond the horizon would not mollify most opponents. “WTF. THEY WANT WAR,” one said.