While the deployment of utility-scale battery storage has accelerated in recent years, additional regulatory and policy support is needed to scale up the industry and fully realize its potential benefit to the grid, a panel of experts convened by the Clean Energy States Alliance said Jan. 29.

The panel’s discussion focused on the lack of revenue available to battery storage resources in restructured wholesale markets, despite studies showing overall cost savings associated with deploying large-scale solar on the grid.

“The revenue does not equal the costs, so we need state support, and we need policy,” said Julian Boggs, director of state policy for Key Capture Energy.

Boggs pointed to the large risks investors assume when developing battery storage projects that rely on wholesale market revenues. For the industry to reach the scale needed to support the clean energy transition, “it’s going to take a lot more certainty in those revenues,” Boggs said.

States should step up to help provide this stability, Boggs added. “You need long-term contracts at scale; that’s the name of the game. I think policy makers are increasingly getting that.”

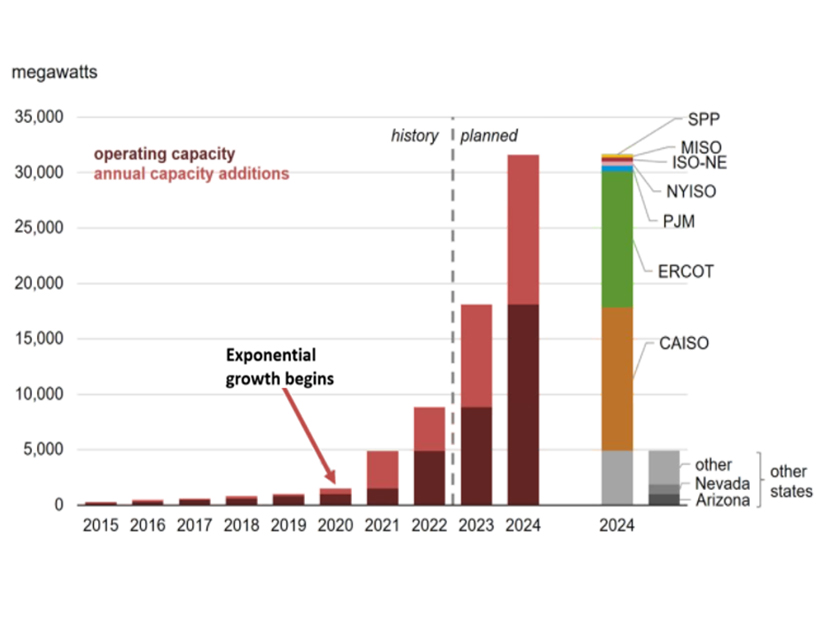

Joan White, director of storage and interconnection for the Solar Energy Industries Association, said California and Texas have led the country in storage deployment because “the market fundamentals really are there.”

“When the value of storage truly is captured in a market design, you can see a market take off in this exponential curve,” White said. “We’ve seen that in California and Texas — they’ve got really big deltas between their off-peak energy and their on-peak energy costs.”

White added that the lack of carbon pricing in wholesale markets distorts the true value of battery storage.

“When we look at wholesale markets, there’s no reflection of the cost of climate change or the cost of carbon,” White said. “I think the biggest thing we can do in terms of market design is incorporate the cost of carbon into market prices.”

Ted Ko, executive director of the Energy Policy Design Institute, also advocated for a carbon price, while highlighting Massachusetts’ Clean Peak Energy Standard as an “interim solution.”

The Clean Peak Energy Standard mandates that electricity suppliers buy an increasing number of certificates from qualifying clean resources, including energy storage and demand response.

“You eventually want to get to carbon pricing in the wholesale markets,” Ko added.

Regarding ongoing issues with interconnection, White said FERC Order 2023 contains “a couple small wins for storage,” including improvements to how system operators and transmission owners model storage resources in interconnection studies.

At the same time, White stressed that structural changes at a federal level are needed to “clean up the dumpster fire that is interconnection at the RTO level.”

“In order to reach our decarbonization goals, we need a grid that is two to three times our current size, and FERC Order 2023 does not plan or finance that grid in any way,” White added.

White also expressed concern that FERC Order 2222, which requires ISOs and RTOs to allow distributed energy resource aggregations to participate in wholesale markets, will not address the underlying revenue deficiencies that serve as barriers to entry.

“If the underlying market fundamentals aren’t there … the resources aren’t going to show up,” White said. “The timeline is long, and the revenue isn’t there in most markets.”

Looking at the long-term outlook of the battery storage industry, the panelists also emphasized the need for strong regulations and standards around fire safety.

“Getting fire safety right is a must, must, must for the industry,” said Boggs, who expressed support for requirements for storage systems to follow the National Fire Protection Association’s 855 standard, submit emergency response plans, and provide emergency training for first responders.

“This is coming whether we ask for it or not,” Boggs said.

The webinar was a presentation of the Energy Storage Technology Advancement Partneship (ESTAP). ESTAP is funded by the U.S. Department of Energy Office of Electricity, managed by Sandia National Laboratories, and administered by the Clean Energy States Alliance.