Two New Mexico utilities said they need to conduct more analysis before they make a choice between competing day-ahead markets in the West, despite the results from a key study on the financial impacts.

The comments from representatives of Public Service Company of New Mexico (PNM) and El Paso Electric (EPE) came during a Jan. 25 workshop hosted by the New Mexico Public Regulation Commission.

The focus of the workshop was a cost-benefit study conducted for the Western Markets Exploratory Group (WMEG) by Energy+Environmental Economics (E3).

E3 analyzed two different footprints across the West for participation in either CAISO’s Extended Day-Ahead Market (EDAM) or SPP’s Markets+. The study examined production costs under two different market participation footprints as compared to a business-as-usual scenario.

EDAM and Markets+ are both expected to launch in 2026, and potential participants are scrambling to understand what choice would be best.

Emmanuel Villalobos, director of market development and resource strategy at EPE, said the utility is planning “very involved, robust studies” as a follow-up to the WMEG analysis.

The next step will be to layer onto the WMEG study real-world operational constraints and resource adequacy considerations, he said. That work, expected to take place this year, will be followed by a gap analysis. EPE expects to choose a day-ahead market in 2025.

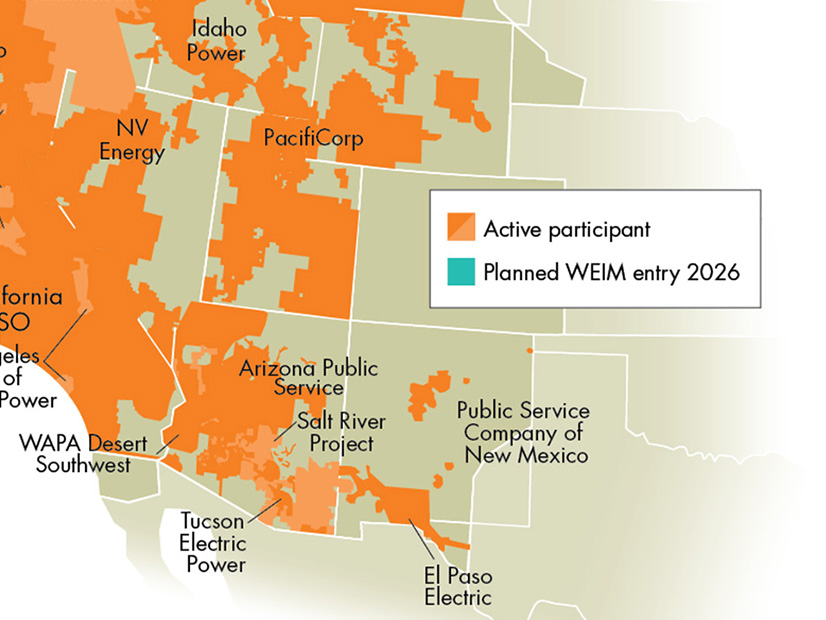

Kelsey Martinez, PNM’s director of regional markets and transmission strategy, said in a previous PRC workshop that the footprint of each day-ahead market would be a major deciding factor — a point she reiterated during the latest workshop. (See New Mexico Contemplates Organized Market Choice.)

“The market footprint is a key factor in determining the realization of a lot of the benefits that come with day-ahead market participation,’ Martinez said. “So [are] the production and trade benefits, the resource diversity and increased reliability as well.”

Martinez called the WMEG study “one tool in our toolbox.” She said PNM is gathering information on each market’s rules for third-party transmission usage and the rules’ impact on PNM benefits.

Another issue, she said, is the likelihood that either market will evolve into an RTO, which PNM strongly supports.

Martinez said PNM is following closely the West-Wide Governance Pathways Initiative for changes that might allow “wider adoption of the CAISO markets and evolution of those markets.” (See Western RTO Initiative Outlines Governance Options.)

Footprint Analysis

The workshop was part of the PRC’s effort to develop guiding principles for utilities when deciding whether to join a day-ahead market or RTO. (See NM Commission to Set Standards for RTO, Day-ahead Participation.) More workshops on the topic are possible.

During the workshop, Jack Moore of E3 gave an overview of the WMEG cost-benefit study. E3 presented the findings previously. (See Study Shows Uneven Benefits for Calif., Rest of West in Single Market.)

One of the two footprints evaluated was the EDAM Bookend, a single combined day-ahead and real-time market covering the entire Western Interconnection except for British Columbia and Alberta.

Under the EDAM Bookend, the West as a whole would save $60 million a year compared with a business-as-usual case, although results varied among individual balancing area authorities.

The second scenario is called a Main Split footprint, in which most of the West would participate in Markets+, but CAISO, PacifiCorp, Los Angeles Department of Water and Power, Balancing Authority of Northern California, Turlock Irrigation District and Imperial Irrigation District would join EDAM.

In the Main Split, West-wide costs would rise by $221 million relative to business as usual. Results again varied by agency.

‘EDAM Island’

PNM and EPE asked E3 to analyze an additional scenario similar to the main split footprint, but in which New Mexico goes with EDAM rather than Markets+. This would create a “New Mexico EDAM island,” with neighboring Arizona in Markets+. The scenario is just a “what if,” E3 said, and not an indication of which market the states will ultimately join.

In the EDAM Island scenario, a New Mexico-California transaction might face wheeling charges between New Mexico and Arizona, and again from Arizona to California. The impacts potentially could be reduced if transmission arrangements or market-to-market coordination agreements were in place, E3 said, but such agreements weren’t included in the modeling.

E3’s analysis found PNM would see a $41 million cost increase in the EDAM Island scenario compared with business as usual, excluding wheeling revenue. PNM was modeled as being a “heavy exporter” of low-cost wind and solar resources.

For EPE, costs would decrease by $23 million in the EDAM Island scenario, as the utility would be able to buy energy from the PNM zone at lower prices.

WEIM Impacts

PNM and EPE both are participants in CAISO’s Western Energy Imbalance Market (WEIM), a regional real-time energy market.

Martinez of PNM noted that selection of a day-ahead market would be “bundled” with participation in a real-time market. So if PNM decided to join Markets+, the utility would leave WEIM and instead enter SPP’s real-time market.

From the time it was launched in 2014 through the end of 2023, WEIM participants achieved $5 billion in benefits, including $392 million in benefits in the fourth quarter of 2023 among its 22 participants, CAISO reported Jan. 31.

Fourth-quarter benefits were $6.1 million for PNM and $4.0 million for EPE.

During the workshop, Vijay Satyal, deputy director of regional markets for Western Resource Advocates, asked whether the analysis of the Main Split scenario considered the impact of PNM and EPE leaving WEIM if they joined Markets+.

“Was that potential loss of benefits factored into the net total cost impact?” he said.

Moore said the study accounted for those factors.

Michael Barrio, a senior principal with Advanced Energy United, pointed to what the group considers to be limitations of the WMEG study.

“The study focuses narrowly on operational costs, failing to account for broader benefits, like reliability, capacity savings and resource diversity, which could be much larger,” Barrio said during the workshop.

Despite all the effort going into choosing a day-ahead market offering, Martinez of PNM noted that the barrier for leaving either market will not be high.

“If there are major topological changes or generation changes or market footprint changes, that could very easily trigger another benefit analysis from us, and we could shift to a different market operator,” she said.