Resource Capacity Accreditation Impact Analysis

ISO-NE on Feb. 6 presented the NEPOOL Markets Committee with the initial results of the RTO’s Resource Capacity Accreditation (RCA) impact analysis modeling, providing a preliminary look at how the changes will affect the accreditation values and capacity market revenues of different resource classes.

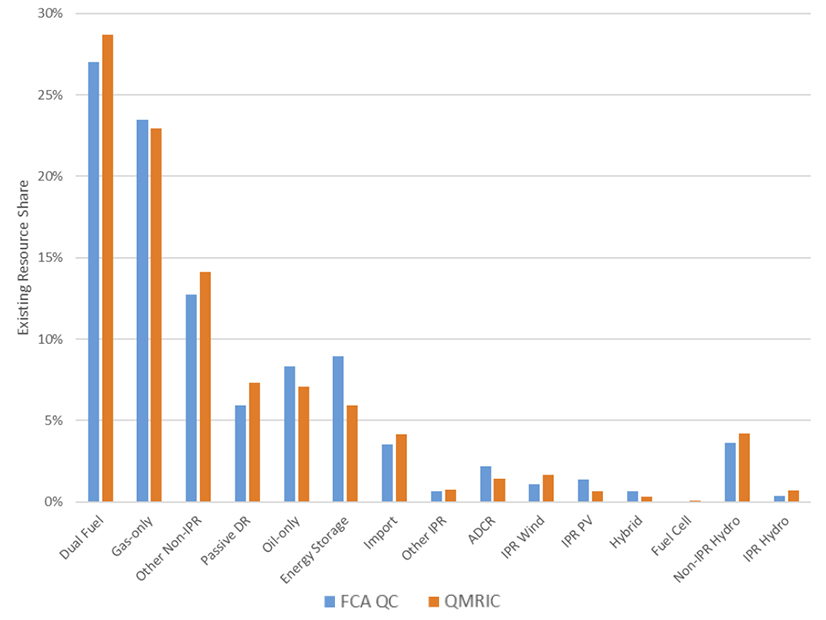

The initial results showed that the accredited capacity value of the entire resource mix decreased by about 17%. The resource classes generally boosted by the RCA updates include wind, energy efficiency and hydro. Accreditation values also increased slightly for dual-fuel gas and oil resources, as well as for a broad category of nonintermittent resources including nuclear, coal, wood, municipal solid waste and landfill gas.

In contrast, the RCA changes would significantly decrease the accredited capacity of oil-only, battery storage, active demand response and solar resources. Gas-only resources would also take a modest hit.

ISO-NE’s Dane Schiro noted that the resource class impacts are aggregations. He highlighted some of the main factors that could impact an individual resource’s accredited capacity.

For thermal resources, having a high rate of historical forced outages was generally a significant factor in the loss of accreditation. Resource size also plays a role: Smaller thermal resources typically have higher accreditation values, because a forced outage of a smaller resource is less likely to cause shortfalls.

The accredited capacity of storage resources depends largely on duration, Schiro said. For intermittent resources like solar and wind, higher accreditation values will go to resources that typically produce energy during the times it is most needed.

As the resource mix and the timing of reliability concerns continue to shift, the capacity values and revenues for different resource classes will also shift. While ISO-NE assessed that about 80% of the loss-of-load risk occurs in the summer, the shift in risk toward winter will likely increase the annual accreditation values of resources that perform better in that season.

In March, ISO-NE is planning to present to the MC the results of modeling sensitivities related to the resource mix and load profile and will detail how these factors affect accreditation values.

Nonfirm Gas Modeling Concerns

Pallas LeeVanSchaick of Potomac Economics, ISO-NE’s External Market Monitor, outlined for the MC some concerns about the RTO’s proposed approach to accrediting non-firm gas capacity.

ISO-NE said at the previous MC meeting that a “market constraint approach” that would limit the total amount of capacity available to gas resources would be its preferred method, but it said this method “is not implementable” for Forward Capacity Auction 19. (See NEPOOL Markets Committee Briefs: Jan. 11, 2024.)

LeeVanSchaick said ISO-NE’s proposed interim “derating approach” will likely overaccredit nonfirm gas resources, reducing the incentives for firm fuel contracts that would increase winter reliability.

He proposed that ISO-NE should instead “estimate the marginal reliability impact (rMRI) of nonfirm gas-fired units in the same manner as other resource types,” and accredit capacity using an rMRI floor “that would be sufficiently high to ensure available nonfirm gas is fully utilized in periods of reliability risk.”

The Massachusetts Attorney General’s Office expressed concerns in a January letter to the RTO that its proposal would overaccredit nonfirm gas resources while showing interest in expediting work on a market constraint approach.

“The opportunity to bypass ISO’s transitional derating approach would be a substantial benefit to the development of a seasonal capacity market proposal for FCA 19,” the AGO wrote.