The momentum created by billions of dollars in federal incentives and tax credits has been tempered by supply chain constraints and the impacts of inflation and higher interest rates.

WASHINGTON, D.C. ― The year 2023 was record-breaking for sustainable energy in the U.S., according to the Business Council for Sustainable Energy’s 2024 Sustainable Energy Factbook.

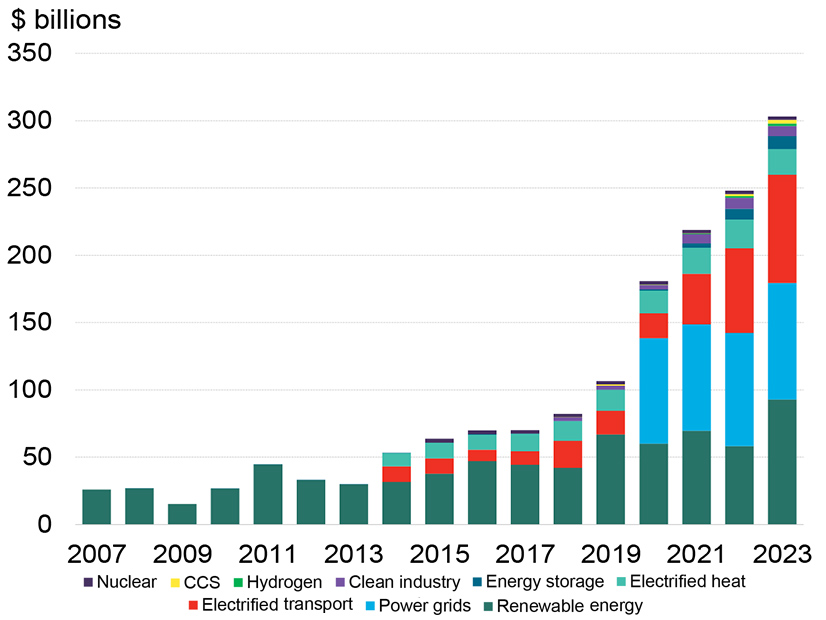

Renewables, EVs and the grid, among others, attracted a “record-shattering” $303.3 billion in private investment, while 42 GW of wind, solar and storage were added to the grid and more than 1.4 million new EVs hit the road, the factbook reports.

The challenge is maintaining and then accelerating such levels of growth, said Tom Rowlands-Rees, North America head of research for BloombergNEF, which compiled the factbook’s 69 pages of graphs and charts. Looking at clean energy investments on a global scale, “every country that we tracked, except Japan” had a record-breaking year, Rowlands-Rees said at a press briefing Feb. 20.

Now in its 11th edition, the factbook tracks a U.S. energy transition that is, as advocates like to say, hardwired into the economy but still facing uneven financial and political terrain. The momentum created by the billions of dollars in incentives and tax credits in the Infrastructure Investment and Jobs Act and the Inflation Reduction Act has been tempered by supply chain constraints and the effects of inflation.

High interest rates can have a significant impact on renewable energy projects “because they are [capital expense] heavy compared to alternatives like gas, where so much of the cost is in the fuel itself,” Rowlands-Rees said.

Permitting and interconnection bottlenecks also continue to slow solar, wind and storage deployments. According to the factbook, utility spending on transmission hit a record $30 billion in 2023, but estimates suggest it could remain flat for two more years.

Corporate Contracts and LCOE

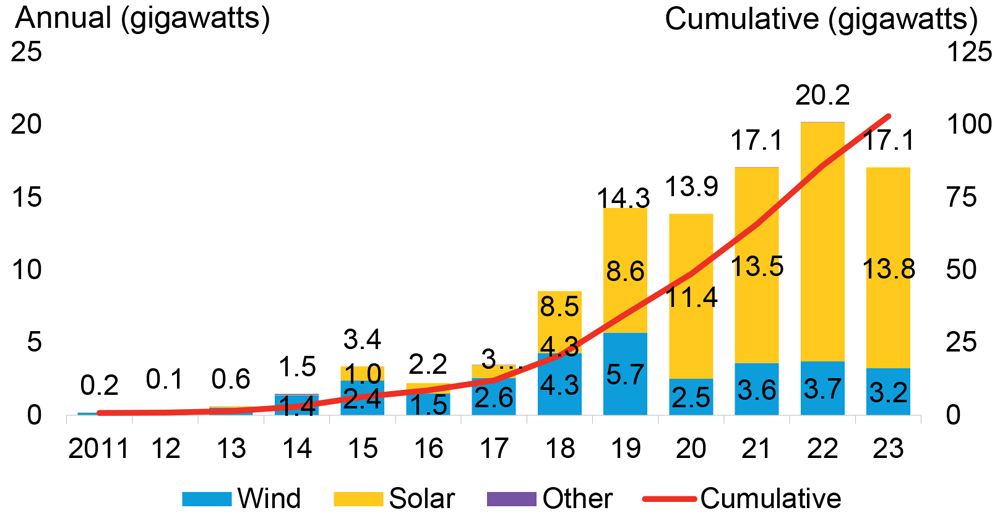

Corporate contracts for renewable energy ― a major growth driver ― are also feeling the pinch, falling 15%, from 20.2 GW in 2022 to 17.1 GW in 2023, the first year since 2017 with fewer than 100 deals.

Perhaps the biggest red flag is the levelized cost of electricity ― the all-in, lifetime cost for specific types of generation ― calculated without the IIJA or IRA’s tax credits and other incentives. For the first time since 2017, the LCOE for natural gas is lower than either wind or solar.

Rowlands-Rees sees LCOE as a benchmark of economic competitiveness, underlining the critical role of federal support.

With wind and solar tax credits, renewables “come out substantially cheaper than the alternatives,” he said. But wind and solar won’t “magically” overcome other issues if they are not sitting well economically.

Emissions and Productivity

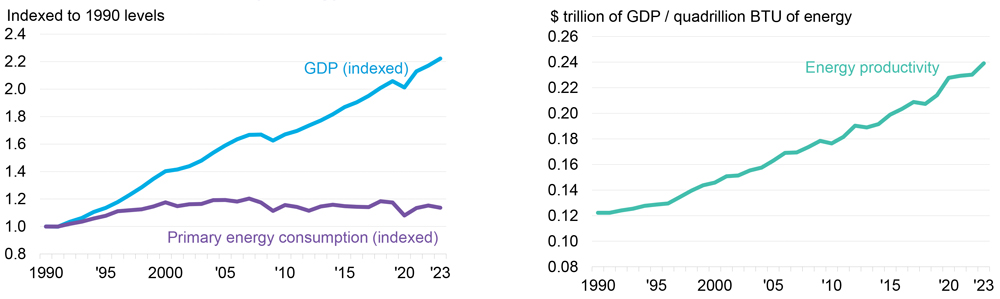

U.S. “energy productivity” has long been a key indicator in the factbook, and since 1990, it has risen steadily as gross domestic product increased while energy consumption stayed relatively flat.

In 2023, GDP was up 2.4%, while energy consumption dropped 1.4%, producing a 4% increase in energy productivity, the factbook says.

These numbers demonstrate “very simply that economic growth and energy consumption are not tied together at the hip,” Rowlands-Rees said. “You can have a thriving economy without a huge growth in energy consumption.”

At the same time, U.S. greenhouse gas emissions dipped 1.8%, signaling a possible downturn following the post-COVID rebound in energy consumption and emissions. The country still must slash emissions to reach its commitment under the 2015 Paris climate accords ― a 50-52% drop in emissions below 2005 levels by 2030 and net zero by 2050 ― but the downward turn is a step in the right direction.

The challenge is that clean energy investments aren’t completely aligned with the main sources of emissions, Rowlands-Rees said. While power, the grid and transportation are the top targets for private investment, industrial emissions now are the second largest source of U.S. GHGs. What’s needed is “to kickstart more investment in reducing industrial emissions,” he said.

Solar

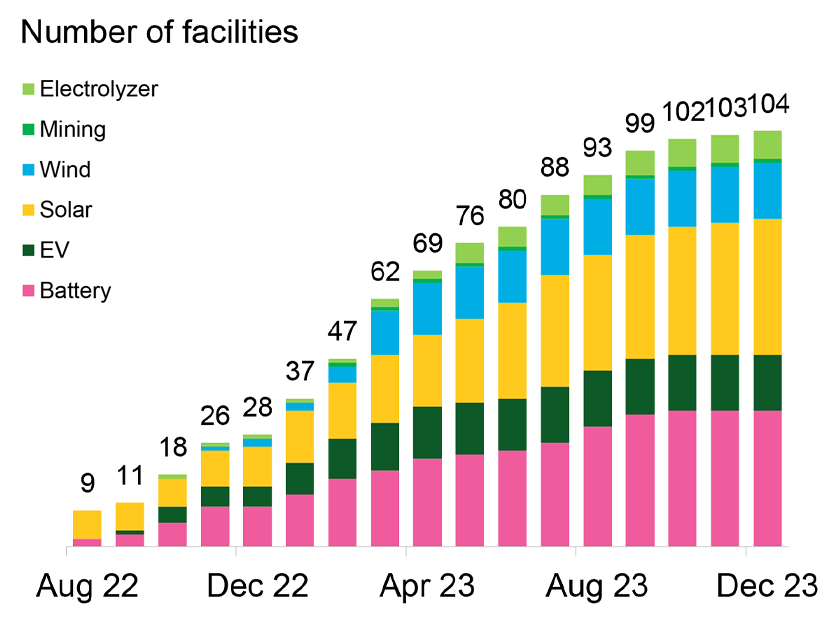

Also speaking at the Feb. 20 briefing, Justin Baca, vice president for markets and research at the Solar Energy Industries Association, pointed to a mismatch between supply chain investments and needs in the solar sector.

The industry is racing to build out a U.S. supply chain to meet domestic content provisions in the IRA and to blunt the June 2024 end of President Biden’s two-year moratorium on tariffs on solar cells and panels from Cambodia, Malaysia, Thailand and Vietnam. The Commerce Department finalized its decision on the tariffs in August 2023, finding that solar companies in those countries were using Chinese components already subject to tariffs.

While announcements for 34 solar manufacturing projects have been made since passage of the IRA, Baca said, “we have seen over 100 MW worth of solar module factory announcements, then closer to 50 for solar cell [factories] and closer to 20 for solar wafer[s].

“[That] means the further you go up the supply chain … we’re getting more and more constrained,” in an imbalance, he said, that “creates an opportunity for supply chain bottlenecks.”

The supply chain for high-voltage power transformers ― used to step power up and down on the grid ― is equally problematic, Baca said. Worldwide, only a few factories produce this critical equipment, “and we have back orders of about two years,” he said.

Energy Efficiency

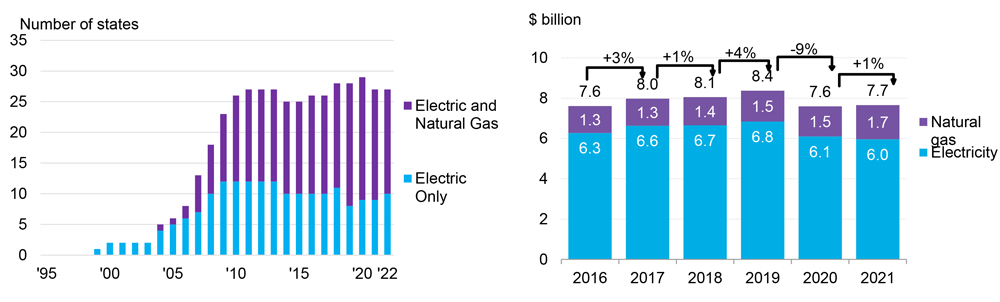

Energy efficiency is another example of potential misalignment of investments. The factbook shows that, as of 2022, more than 25 states have enacted energy efficiency resource standards, for electricity only or for electricity and gas.

But, as of 2021, the most recent figures available, utility investments in energy efficiency had yet to recover from their pandemic drop, from $8.4 billion in 2019 to $7.7 billion in 2021.

The U.S. is one of the 130 nations that committed to tripling renewable energy and doubling energy efficiency by 2030 at the United Nations 28th Climate Conference of the Parties in the United Arab Emirates in December 2023. That commitment means energy efficiency must be thought of as a “first fuel, not a secondary thing,” said Paula Glover, president of the Alliance to Save Energy.

Efficiency is vital to keep the curve on energy productivity going up, Glover said. “The more we grow our economy, the more energy we are going to need.” Energy efficiency can mean “less to build and displaces additional demand.”

Referring to the factbook’s energy productivity chart, Glover asked, “What would happen if we actually doubled efficiency? … What would it do to the energy productivity? What would that graph look like?”

Natural Gas and Carbon Capture

Perhaps one of the greatest challenges for clean energy advocates is the role of natural gas in the U.S. energy transition. While coal-fired generation provided less than 16% of U.S. electricity generation in 2023, it has been replaced primarily by natural gas, which now accounts for 43%, up from 40% in 2022.

Overall, power sector and liquid natural gas exports are driving demand, Rowlands-Rees said.

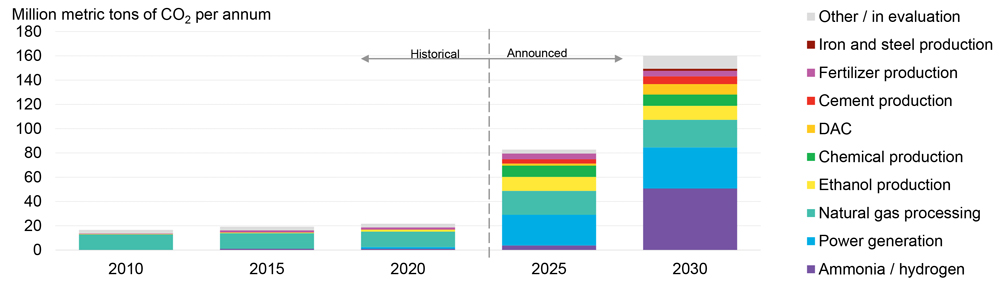

BloombergNEF anticipates that carbon capture, utilization and storage may become a growing factor in both natural gas processing and power generation, again supported by incentives from the IRA, specifically, the 45Q tax credit for carbon and direct air capture.

Carbon capture capacity is set to explode from around 23 million metric tons of CO2 per year in 2020 to 160 MMT per year by 2030 in projects announced. Natural gas processing and power generation could account for more than a quarter of that growth.

But the factbook cautions that, like solar and wind, permitting and other delays could slow growth.

EV Tax Credits

Rowlands-Rees downplayed recent negative headlines about EV sales, noting the U.S. has had three record years in a row, and “these are not just record years by a small margin. It’s very substantial,” he said.

Another encouraging sign is that 2023 saw Tesla’s market dominance slip as other automakers introduced more EV models.

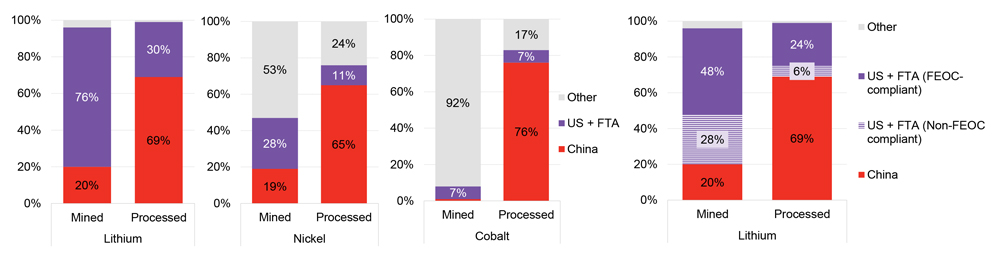

But new Treasury Department rules issued in December have cut the number of EV models that now qualify for the IRA’s top $7,500 tax credit. The new rules terminate tax credits for lithium and other materials mined or processed in China or other “foreign entities of concern” (FEOCs). The factbook shows that only about a quarter of lithium processed will meet the new requirements, with even smaller percentages for nickel (11%) and cobalt (7%).

The Election

The very large elephant in the room (pun intended) at the briefing is what will happen if Republicans take back the White House and both houses of Congress in the upcoming election, now just over 10 months away.

Former President Donald Trump, the all-but-certain GOP presidential candidate, did all he could to slow the growth of clean energy in his previous term, withdrawing the U.S. from the Paris Agreement and rolling back environmental and emission-reduction measures.

Some Republicans in Congress have called for the repeal of the IRA.

Lisa Jacobson, BCSE president, argues that multiple factors are driving the U.S. energy transition ― customer demand, supportive policy, digitization of the power system, and the growing interest and engagement in communities on being able to make choices about their energy supply and services.

“No one knows where we’ll be a year from now in terms of the makeup of our federal government,” Jacobson said. “But I feel very strongly these [clean energy] investments will go forward … because this is what people and communities want, and we have the technology available to offer improved, modern, efficient and better energy services.”

Other speakers pointed to the flow of IRA dollars into rural areas, red states and Republican-held congressional districts.

According to John Hensley, vice president for markets and policy analysis at the American Clean Power Association, “for the projects we’re tracking at ACP, 80% of those are located in congressional districts that are currently held by Republican representatives. So, there are a lot of reasons to be supportive of these policies, to embrace the investment, the job creation and the economic development benefits they’re bringing.”