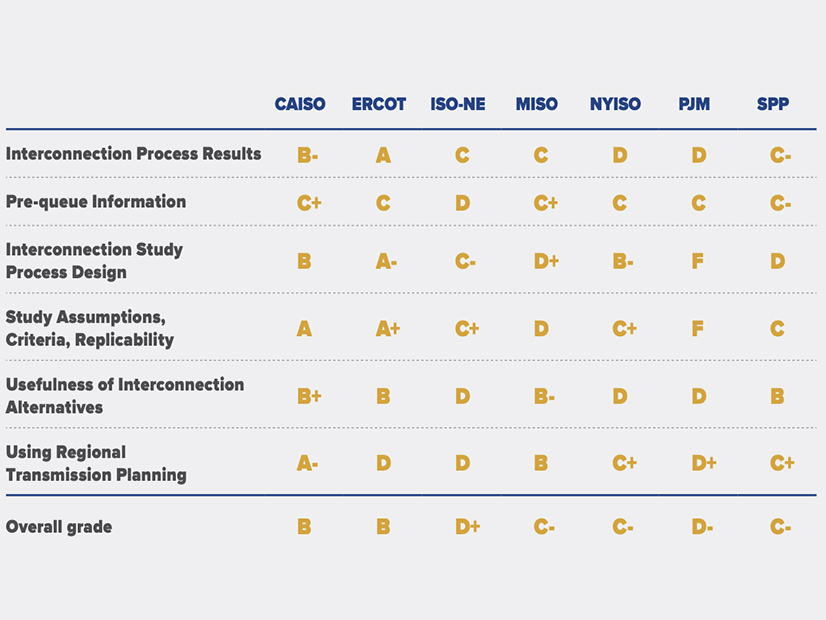

Advanced Energy United has released a scorecard that ranks the seven domestic ISO/RTOs on their generator interconnection processes, finding room for improvement in every one.

Brattle Group and Grid Strategies prepared the Generator Interconnection Scorecard for AEU, as they did for a similar project on transmission planning last year. (See Transmission Report Card Grades MISO “B,” Southeast “F”.)

The scorecard, released Feb. 26, comes after FERC issued Order 2023 and is meant to help track how those and other reforms are implemented, Grid Strategies President and report co-author Rob Gramlich said in an interview. (See FERC Updates Interconnection Queue Process with Order 2023.)

“We’re hopeful that those reforms happen and further reforms get done,” Gramlich said. “And we’re hopeful that in a year or two, if and when we do this again, all of the grades will improve. But the idea was just to kind of take a snapshot at this time.”

The flawed interconnection processes have more than 2 million MW of renewable power and storage waiting to connect to the grid, said Advanced Energy United Managing Director Caitlin Marquis.

“This scorecard confirms what we know about the interconnection process, that grid managers have moved too slowly to adapt to changing market conditions, allowing the process of connecting new electricity to the transmission grid to become dysfunctional,” Marquis said. “Without urgent improvement, the U.S. grid may struggle to keep up with growing energy demands, threatening our ability to keep the lights on and reach our climate goals. Strong implementation of FERC’s recent reforms will be an important first step toward improving the interconnection process, and it’s also clear that additional reforms will be needed.”

None of the ISO/RTOs managed to get an A, but both CAISO and ERCOT got Bs, with Gramlich saying one reason they did better was that they’ve proactively planned their transmission systems to add new resources.

“That has been a little bit less of a case recently in ERCOT,” Gramlich said. “And so ERCOT used to be great from a developer perspective, but they got marked down a little bit because of a lack of transmission. Because you can connect, but there’s a lot of congestion once you connect. California has always done proactive transmission planning pretty consistently … so the grid has been prepared in advance to accommodate more generation.”

Both also scored highly on giving developers a sense of certainty, with ERCOT assigning limited costs to interconnection customers and CAISO being credited with good transparency.

No other market scored above a C- on AEU’s scorecard, which highlights the need for changes to meet rising demand from new large loads, electrification, and state policies and customer demand driving more renewables onto the grid.

“Currently, most of the regions are undergoing significant efforts to reform their interconnection practices and policies in response to stakeholder concerns and FERC Order No. 2023,” the report said. “The scorecard is not an assessment of those ongoing or recently adopted reforms that have not yet impacted the generator interconnection processes.”

The growth of wind, utility-scale solar and storage has resulted in interconnection projects popping up everywhere, Gramlich said.

“Twenty years ago, when the current rules were designed, everybody was building just gas plants,” he added. “They were large and lumpy. You could put them at the intersection of a pipeline and a transmission line. And so, the rules were designed just with one technology in mind.”

The scorecard measures six categories, the first of which is interconnection process and results, which measures an interconnection’s success rate, cost reasonableness and uncertainty. It also grades prequeue information, queue design, assumptions and criteria, availability of interconnection alternatives, and whether transmission planning takes future generation needs into account.

That final category is the only one where the graders looked at rules now in place, which have not impacted the queues yet.

Along with CAISO, MISO scored well there due to the Long-Range Transmission Planning process Tranche 1, with two other tranches being developed. None of those lines have impacted the queue yet, but interconnection customers view them favorably, as one of the benefits studied was transmission projects’ ability to bring the lowest-cost generation to market.