NYISO on Feb. 29 took the first steps to creating market rules enabling hydrogen to participate in its marketplace, after kicking off the market design concept for the clean energy resource.

The ISO’s current rules do not cover how an emissions-free generator co-located with a load resource like an electrolyzer, producing clean hydrogen using energy from a nearby solar or wind facility, could participate in New York. NYISO proposes investigating if it can enable this either by creating new, or modifying existing, participation models.

NYISO estimates its clean hydrogen market participation models will be deployed in 2027 but acknowledges hydrogen is a nascent technology and so any proposed enhancements must be adaptable to innovations.

Aaron Breidenbaugh, senior director of regulatory affairs at CPower Energy Management, sought clarification on whether the final proposals, though tailored to hydrogen, could apply to a range of future resources. CPower aggregates demand response and distributed energy resources, advocating for NYISO to always incorporate evolving technologies into its proposals. (See Providers See ‘Mixed Signals’ on Demand Response in NYISO.)

Harris Eisenhardt, a market design specialist with NYISO, responded that the ISO’s objective is to propose a final market concept that is “technology-agnostic” and “suitable for other use cases as well.”

New York has devoted less attention to developing hydrogen and other less prominent fossil fuel alternatives, like nuclear or bioenergy, because they can be controversial among climate activists. (See Take the Long View on Clean Energy, NY Legislators Urged.) Instead, the focus has been on yet-unknown technologies that NYISO collectively terms dispatchable emission-free resources (DEFRs). These DEFRs are not yet commercially available, prompting the state’s Public Service Commission to explore clean energy technologies, including hydrogen, bioenergy, nuclear power and carbon capture (15-E-0302). (See NY Drills Down on Statutory Meaning of ‘Zero Emissions’.)

New York has, however, seen some actions recently promoting hydrogen development. State senators have introduced a handful of bills this year to facilitate its deployment (S378A) (S8455); Gov. Kathy Hochul (D) announced several multimillion-dollar investments in hydrogen initiatives across the state last year (14-M-0094); and New York now leads a multistate regional clean hydrogen hub competing for federal funds. (See NY Moves to Boost Hydrogen Production and Development and Vermont Joins Northeast Clean Hydrogen Hub.)

Additionally, Constellation Energy’s Nine Mile Point Nuclear Plant in Oswego, N.Y., started producing hydrogen with nuclear energy last year. (See Constellation Expands Nuclear Clean Energy Matching.)

NYISO plans to review its draft market design concepts with stakeholders in the second quarter of this year and expects to finalize the proposal by the end of the third quarter.

Capacity Accreditation

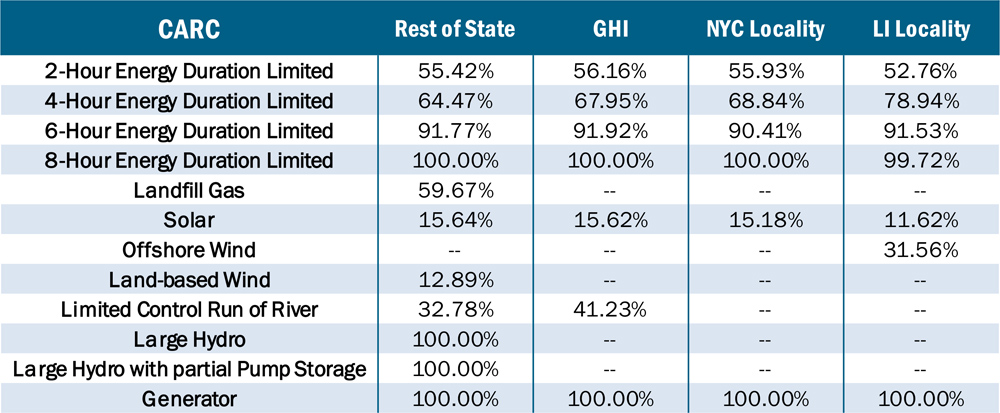

NYISO also informed the ICAP/MIWG that the final capacity accreditation factors (CAFs) and capacity accreditation resource classes (CARCs) for the 2024/25 capability year are published online.

CAFs calculate the marginal reliability contribution of “representative” generators for each CARC, a differentiation based on technology and operating characteristics. The CAFs reflect factors such as energy duration limitations and correlated unavailability due to weather or fuel supply limitations and were used alongside resource-specific derating factors to account for differences in a unit’s output from the modeled CARC profile.

Last year, NYISO addressed issues in its capacity accreditation modeling, such as misrepresented marginal reliability contributions of some resources, leading to inaccurate CAF and CARC calculations. (See “Capacity Accreditation,” NYISO Finds No Need for New Capacity Zones and “Capacity Accreditation Modeling,” NYISO BIC Stakeholders OK Modeling, Market Design.)

ICAP suppliers who notice a discrepancy in their assigned values must notify NYISO by 5 p.m. March 18, when CAF assignments will be considered official.