New Jersey’s Assembly Transportation and Independent Authorities Committee on March 7 backed a bill that would levy a $250/year fee on electric vehicle registration beginning in July, brushing aside criticism from car sellers and environmental groups that it would be excessive.

The fee is part of wide-ranging bill A4011, which would amend the law governing the state’s Transportation Trust Fund Authority, which raises funds to pay for transportation investment projects and mass transit. The bill, sponsored by Democrats in both the Assembly and Senate, would reset the fund’s revenue system from 2025 to 2029 to help meet state capital initiatives.

The initiative comes as states across the U.S. are wrestling with how to raise funds for infrastructure projects that have traditionally been funded through a gas tax as drivers shift from fossil-fueled vehicles to EVs, cutting gas consumption and gas tax income.

Annual fees on EV ownership are now levied in 30 states, with the highest fee levied in Washington at $225, with Georgia charging $211 and Alabama charging $203, according to a report by Money in August 2023.

New Jersey’s would start at $250 on July 1 and rise by $10 every year until it reaches $290 on July 1, 2028. The fee would be paid when the vehicle is initially registered and when it is renewed.

Environmental groups said they have no problem with a fee on EV buyers but that the proposed level was way above what would be fair.

Speaking for ChargEVC, which seeks to advance the EV market through the development of sustainable programs and policies, Gabel Associates’ Eve Gabel-Frank said the fee would be “punitive” and the “highest fee in the country.”

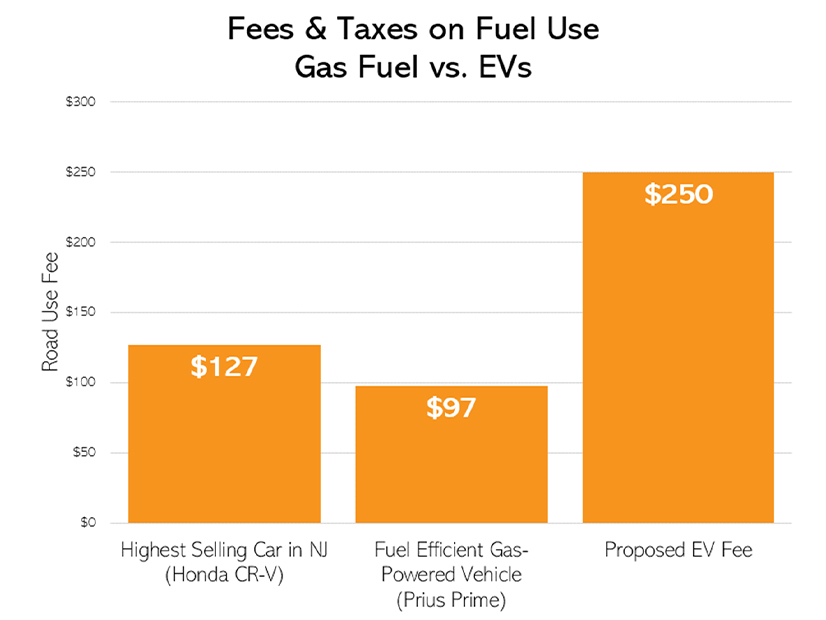

She said that under the bill, an owner of the hybrid Toyota Prius Prime would pay $97 in gas taxes a year, while an owner of the Honda CR-V, a small SUV, would pay $127.

“So paying a $250 fee is way higher. They’d actually be paying double” what an owner of an efficient, gas-powered vehicle pays, Gabel-Frank said, suggesting the committee cut the fee to $75.

But Eric DeGesero, speaking for the Fuel Merchants Association of New Jersey, said the fee should actually be higher. He said the average vehicle uses 569 gallons of gas a year, which generates about $245 from the state gas tax of 43 cents per gallon.

“The fee should be rounded up to $300, set there immediately and adjusted annually,” he said.

‘Pay Their Fair Share’

Business groups and unions broadly supported the bill, saying the resulting capital investments would create jobs and stimulate economic development in the state.

Steven Gardner, director of the New Jersey Laborers Employers Cooperation and Education Trust, said transportation is essential to the state, and as it transitions to EVs, it needs to look at new ways of raising revenue. He noted that in a sign of the shift, Gov. Phil Murphy’s administration in November adopted the Advanced Clean Cars II rules, which require zero-emission vehicles to account for all vehicles sold by 2035.

“This legislation begins to include the fee on zero-emission vehicles to ensure they begin to pay their fair share for the roads they also drive on,” he said. “Without a trust fund making consistent investments, none of us could get to our jobs, our children’s schools, the shore or any of our state parks. New Jersey’s entire economy is wholly dependent on having a first-class transportation network.”

Voting 7-4 in favor of the bill, largely along party lines, committee members focused their comments mainly on the gas tax and need for infrastructure investment and how to achieve it, paying little heed to the EV fee issue. A similar bill in the Senate has not advanced.

Aside from the EV fee, the bill would enable the fund to raise revenue by gradually increasing the target income from 2025 to 2029 and setting the gas tax rate at a level to meet that target. The income target would start at $2.032 billion in 2025 and rise by about 16% to $2.36 billion in 2029.The revenue raised would go into a general capital reserves fund to support capital projects, but the bill also specifies that it can’t be used to pay debt service on bonds.

‘False Narrative’

Opposing the bill, Gabel-Frank sought to correct what she said is a “really common false narrative” — and one put forward by DeGesero — that EVs are heavier because of their batteries than a gas-powered vehicle.

In that argument, the weight of the EVs would cause more road damage, which would need to be repaired with transportation investment funds.

“We did a review of studies,” Gabel-Frank said. “We found that road damage is not caused by passenger vehicles. It’s caused by vehicles that are over 26,000 pounds” — heavy-duty trucks.

Doug O’Malley, director of Environment New Jersey, said the fee — along with Murphy’s recent proposal to remove the exemption for EV buyers from paying the state’s 6.25% sales tax — would hurt the consumer uptake of ZEVs.

Jim Appleton, president of the New Jersey Coalition of Automotive Retailers, said his members are “all in on EVs,” but the fee would “make it more difficult for dealers to turn EV-curious consumers into EV owners.”

“No one disputes the idea that EV drivers must pay their fair share to maintain roads and bridges,” he said. But “New Jersey cannot achieve higher EV adoption without generous cash-on-the-hood incentives and sales tax incentives.”

“We have conflicting policies at play here. If we’re going to ask EV drivers to pay into the Transportation Trust Fund — and we should — we shouldn’t make them pay for it all upfront in the showroom,” Appleton said. “What we’ve got to do is try to come up with a way that avoids EV buyers having to come up with that extra $1,000 at the point of purchase.”