Limits on imports from the Western Energy Imbalance Market into the CAISO balancing authority area between July 25 and Nov. 16, 2023, led to increased transmission congestion in the ISO’s 15-minute-ahead market and lower prices in the five-minute market, the Department of Market Monitoring told stakeholders March 6.

While CAISO operators’ actions helped the ISO maintain reliability during a brutal summer in the West, “it is not clear why the CAISO area continued these transfer limitations after the mid-August heat wave and through Nov. 16,” the department said. It recommended “that CAISO work with stakeholders to consider other methods of achieving the intended reliability outcomes without creating the large and systematic modeling differences between the 15-minute and five-minute markets.”

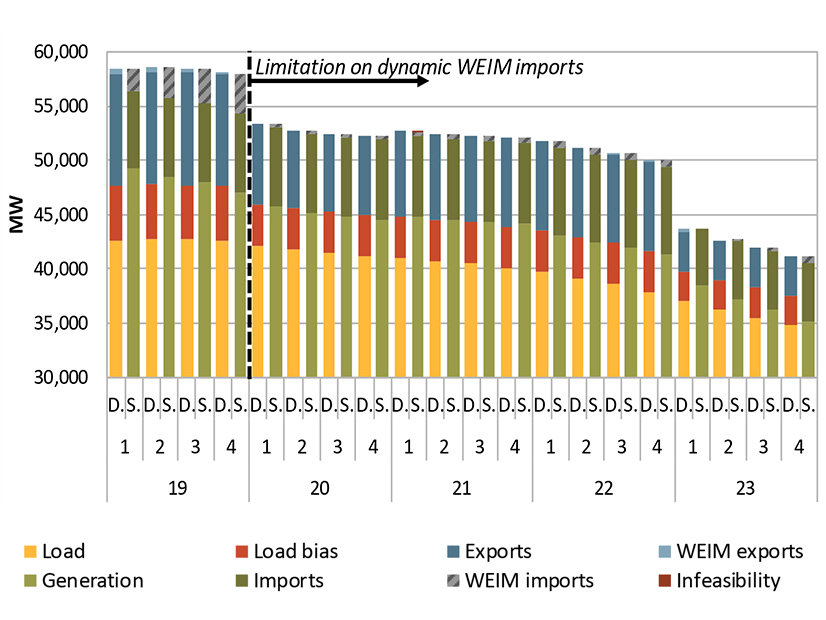

Presenting the department’s State of the Market report for the third quarter of 2023, Ryan Kurlinski, senior manager of market and policy analysis, said CAISO operators began limiting WEIM import transfers for the hour-ahead and 15-minute markets in late July when stressful weather conditions led to high levels of unfulfillable self-scheduled exports. (See CAISO DMM: High Exports to Southwest Led to July EEAs.) The limitations were then lifted in the five-minute market.

The limiting action was taken to mitigate the risk that during critical hours, internal generation and hourly block intertie schedules could be displaced by WEIM imports that might not materialize in real time. CAISO issued energy emergency alerts on three days in late July but was not forced to shed load.

“This limitation on these tight days did have the intended effect of reducing advisory WEIM imports into CAISO and replacing it with increased hourly block imports and decreased exports out of CAISO,” Kurlinski said. “While that limitation had the intended reliability impact, it also significantly impacted the rest of the West,” driving down prices.

Load adjustments in the hour-ahead and 15-minute markets were lower on average in the third quarter than those in the same quarter in 2022, though after July 20, they rose back to 2022 levels of about 2,000 MW.

“The combination of high load adjustments in the 15-minute market and much lower adjustments in the five-minute market contributed to the lower average prices in the latter market,” the report says. “When the CAISO balancing area limited WEIM transfer imports to zero in the hour-ahead and 15-minute markets, most of the WEIM footprint was collectively export constrained at a lower price based on regional supply conditions outside of the CAISO area,” the report reads.

Kurlinski used transfers in and out of Arizona Public Service as an example. Before the transfer limitation was implemented, there were significant transfers from APS to CAISO and other BAs, but after the limitation was put in place in the 7-8 p.m. hour on July 26, dynamic transfers from Arizona to CAISO stopped.

The “DMM has recommended that CAISO work with stakeholders to consider if there may be other methods or other ways to try to achieve the same reliability outcomes that the CAISO BA is trying to achieve but without potentially creating this significant difference between the 15-minute market and five-minute markets,” Kurlinski said. “At the very least, it would be good to have a more transparent discussion about what the ISO is seeing in its systems that would lead them to do this again and to be more transparent about when they are going to do this.”