CAISO released a draft transmission plan identifying 26 new transmission projects aimed at accelerating California’s ability to meet its ambitious clean energy goals and costing an estimated $6.1 billion.

CAISO released a draft transmission plan April 1 identifying 26 new transmission projects aimed at accelerating California’s ability to meet its ambitious clean energy goals and costing an estimated $6.1 billion.

The 2023-2024 Draft Transmission Plan is based on projections the state needs to add more than 85 GW of capacity by 2035, a “significant increase” from the base portfolio amounts used in last year’s plan, reflecting the rapidly escalating need for new generation.

“The ISO’s 2023-2024 draft Transmission Plan identifies the next installment of critical infrastructure development that will be needed to bring historic amounts of new clean energy onto the grid, including the first projects to deliver offshore wind from California’s North Coast,” CAISO spokesperson Anne Gonzales told RTO Insider in an email.

As with last year’s plan, the ISO coordinated with the California Public Utilities Commission and the California Energy Commission to implement the blueprint outlined in the joint memorandum of understanding signed by the three agencies in December 2022.

The MOU “tightens the linkages” between resource and transmission planning, interconnection processes, and resource procurement to meet reliability needs and clean energy policy objectives set in Senate Bill 100, which requires the state’s electricity system be emissions-free by 2045.

“To help ensure we have the transmission in place to achieve this transition reliably and cost-effectively, the ISO’s 2023-2024 Transmission Plan builds on the much more strategic and proactive approach adopted in last year’s 2022-2023 Transmission Plan to better synchronize power and transmission planning, interconnection queuing and resource procurement,” the plan reads.

Emphasis on Renewables

The plan outlines the resource development needed to meet emissions reductions targets, including:

-

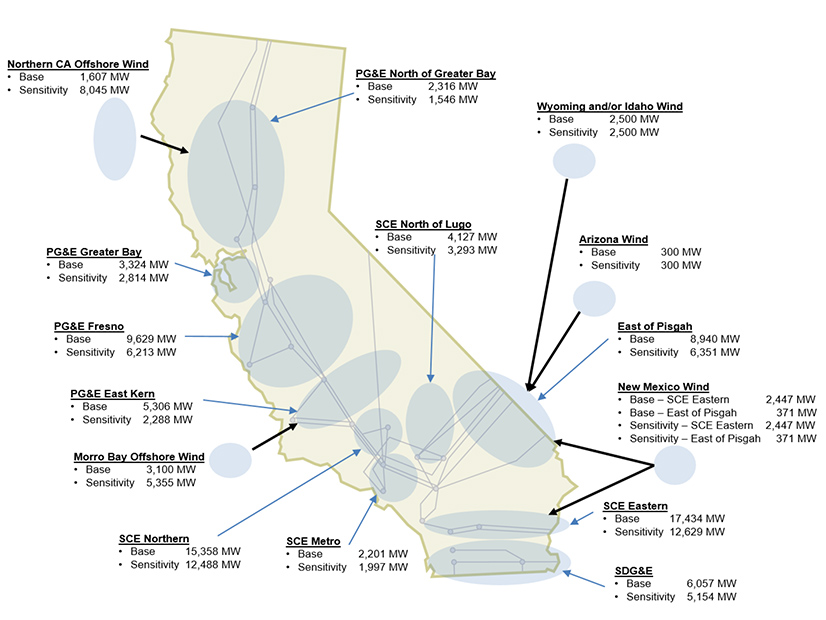

- More than 38 GW of solar generation in regions that include the Westlands area in the Central Valley, Tehachapi, the Kramer area in San Bernardino County, Riverside County, southern Nevada and western Arizona.

- More than 3 GW of in-state wind generation in existing wind development regions, including Tehachapi.

- More than 21 GW of geothermal development, mainly in the Imperial Valley and southern Nevada.

- Access for battery storage projects co-located across the state with renewable generation project and standalone storage located closer to major load centers in the Los Angeles Basin, greater Bay Area and San Diego.

- The import of more than 5.6 GW of out-of-state wind generation from Idaho, Wyoming and New Mexico.

- More than 4.7 GW of offshore wind, with 3.1 GW in the Central Coast (Morro Bay call area) and 1.6 GW in the North Coast area (Humboldt call area).

This year’s plan places a greater emphasis on the development of floating offshore wind off California’s North Coast. Major projects include a new Humboldt 500-kV substation, a 260-mile HVDC line interconnecting the Humboldt substation to the Collinsville substation, a 140-mile 500-kV AC line connecting Humboldt to the Fern Road substation and a 115-kV line from the new Humboldt station to the existing Humboldt station.

“The infrastructure investments also have tremendous reliability and economic benefits for California and its dynamic economy and in this year’s plan, significant amounts of new offshore wind generating capacity and the associated transmission upgrades are required to cost-effectively bring reliable decarbonized power to California consumers and industry across all seasons of the year,” the plan says.

Out of the 26 newly identified projects, 19 are reliability-driven, representing $1.54 billion of the total cost. Examples of reliability-driven projects that CAISO recommended for approval include PG&E’s Martin-Millbrae 60-kV area reinforcement in the greater Bay Area, the Eldorado 230-kV short circuit duty mitigation project led by Southern California Edison, and San Diego Gas & Electric’s Valley Center System Improvements.

CAISO also identified seven policy-driven projects, those needed to meet renewable generation requirements established by the CPUC, representing $4.59 billion. Projects include PG&E’s new Humboldt substation and the new line connecting to Fern Road.

The ISO also conducted studies aimed at identifying economics-driven projects, those that could reduce ratepayer costs, but no such projects were recommended.

CAISO scheduled a stakeholder meeting April 9 to discuss the plan and expects to seek approval from its Board of Governors on May 23.