The burgeoning power demand from data centers and artificial intelligence can be met by other means than new natural gas-fired power plants that could hinder state and local emission-reduction goals, according to a new report from the Electric Power Research Institute (EPRI).

The centers’ insatiable appetite for electricity could more than double by 2030, the report says; so, tech developers and utilities should work together to turn the passive demand of these megawatt-guzzling facilities into grid assets, by using their backup generators to provide system reliability and flexibility.

“The data centers all have 100% backup generation on site” — usually diesel generators — “to prevent catastrophic failures,” said David Porter, EPRI’s vice president for electrification and sustainable energy strategy. “The backup generation has the ability to function as a grid resource in times of need; it doesn’t have to be long term.”

But creating these “shared energy” systems first will mean gaining data center willingness to set them up by addressing industry fears about how any use of their backup power might affect the reliability of their own operations, Porter said. In addition, utilities also will have to offer “the right incentives financially to the data centers to make it worth their while to participate in a program like that,” he said.

EPRI’s other options for keeping data center demand growth at lower levels include improved energy efficiency and better forecasting for new centers and the power they will need.

“Forecasts need to make better projections describing new point load locations, magnitudes and timing alongside better techniques for making decisions ― to build or not build long-lead-time infrastructure ― while facing the economic, regulatory and political uncertainty associated with siting these large [centers],” the report says.

EPRI’s research and recommendations stand in contrast to those recommending pushing back the closure of some fossil fuel-fired plants and adding new gas generation to deal with the load.

The prime example is Virginia, which boasts of having the largest concentration of data centers in the world in its northern, D.C.-area suburbs — the so-called “Data Center Alley” in Loudoun County. Local concerns center on the environmental impacts of the thousands of diesel backup generators already located at the centers and a new 500-kV transmission line being planned by PJM, as well as likely increases on residential utility bills.

The 2020 Virginia Clean Economy Act requires Dominion Energy, its largest investor-owned utility, to deliver 100% of its power from renewable sources by 2045.

The utility’s most recent long-term integrated resource plan sees most new generation between now and that deadline coming from solar and storage. But among the options considered in the IRP, Dominion’s preferred plan keeps some coal-fired generation online through 2030, converts a 415-MW coal plant to natural gas and builds at least three new natural gas plants with a combined capacity of 1,708 MW, with the final, 523-MW facility coming online in 2049.

The EPRI report counters with a focus on “scalable clean energy supply,” primarily solar, wind and storage. Tech giants like Amazon, Apple, Google, Meta and Microsoft — known in the industry as “hyperscalers” — are procuring thousands of megawatts of new clean energy to cover their operational power demands, the report says.

Top data center developers ― including Iron Mountain, Digital Realty Trust, QTS Realty Trust and Switch ― similarly have increased their procurement of clean energy, according to a 2023 report by S&P Global. Google, Microsoft and Iron Mountain have led industry efforts to match their power demand with carbon-free generation hour for hour 24/7.

In the long term, many in the industry are looking toward small modular reactors as an option for the kind of clean, dispatchable power that data centers need, but Porter does not expect the technology ― now in the early stages of demonstration and deployment ― to reach broad, commercial scale until the 2030s.

The coming clash between data center and AI load growth and the clean energy transition “is not going to be easy,” he said. “Even solar and wind resources that can really help with zero-carbon electrons … are not coming online as fast as might be needed to support this and other growth.”

To keep electricity abundant, reliable and affordable, Porter said, “optionality is still our best opportunity for that, so, I think a collection of different types of resources.” Data centers might replace their backup diesel generators with a mix of renewables and energy storage, biofuels or green hydrogen.

Just How Much?

The EPRI report also provides a detailed picture of the power demand of data centers, their uneven geographic distribution and the dramatic impact AI is having on growth trends.

While a regular Google search eats up about 0.3 Wh of power, a similar search via AI takes close to 10 times as much electricity: 2.9 Wh. The appetite of generative AI, which can produce images, video or text, multiplied by millions of worldwide users, could “lead to a step change in power requirements,” the report says.

Hyperscale data centers require 100 MW or more of power ― the equivalent demand of 80,000 homes ― and can be built and brought online within two years.

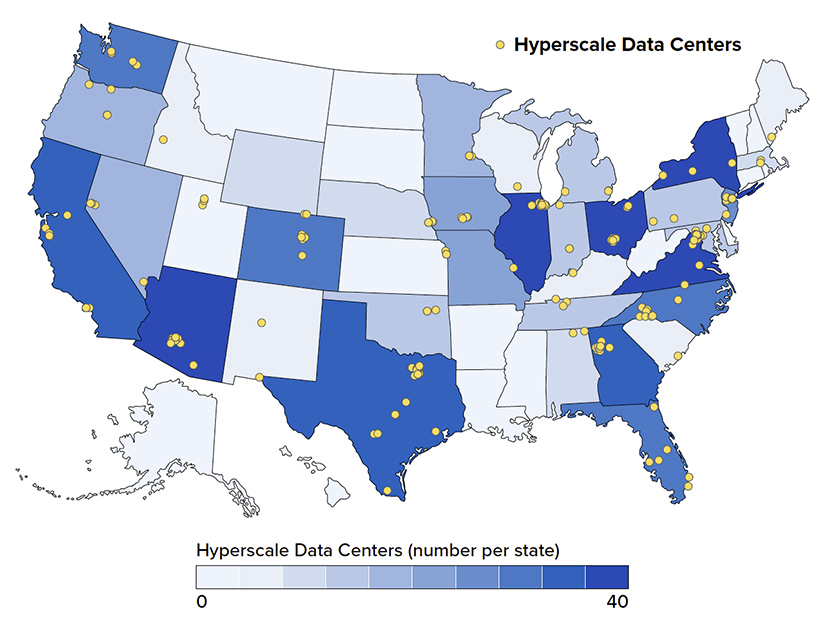

Virginia’s data centers currently represent 25% of the state’s electricity consumption. But given ongoing high growth, EPRI estimates data center power demand in the state could almost double by 2030, to 46%. According to the Virginia Economic Development Partnership, the state already has 150, or 35%, of the world’s hyperscale data centers.

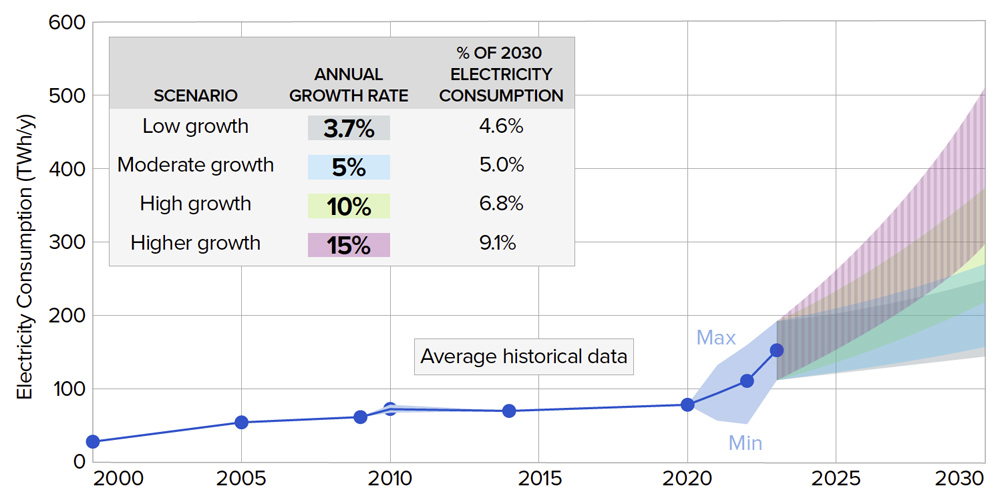

On a national level, data centers accounted for 4% of electricity consumption across the U.S. in 2023. EPRI’s report models low-, moderate-, high- and higher-growth scenarios, with data center demand either edging up to 4.6% of total consumption by 2030 (low growth) or more than doubling to 9.1% (higher growth).

Virginia and 14 other states spread across the U.S. make up 80% of that demand, the report says. Consequently, forecasts of demand growth should be looked at regionally, Porter said. Decisions about where data centers are located may depend on “several key things … like what’s the communications infrastructure, what’s the price of electricity, what’s the price of land and is there still workforce available in the area?” he said.

“Power availability is also part of that, and depending on where you are, in some parts of the country, it’s easier to get large blocks of power than others,” he said.

While not specifically mentioned in the report, grid expansion must be part of the bigger picture on meeting data center power demand, Porter said. Hyperscale centers are “not going to be distribution-served facilities; [their power] will come from transmission,” he said. “That’s part of why there’s a need for better communications, particularly with the near-, mid- and longer-term [planning] from the data centers to the utilities,” given the yearslong process for planning and permitting new transmission lines.

Grid-enhancing technologies ― such as upgrading existing lines with advanced conductors ― should be looked at as both interim and longer-term solutions for expanding transmission capacity, he said.

Energy Efficiency

Historically, data centers have been able to offset their increasing power demand through efficiency, but with the U.S. economy and data centers growing at unfamiliar and accelerated speeds, whether efficiency can keep up remains uncertain.

EPRI’s research has included “interesting conversations with hyperscalers,” Porter said. “They still firmly believe that as their capabilities to architect what happens inside data centers, coupled with continued improvements in chips … the [electricity] demand for data centers will not grow in huge leaps and bounds.”

Major efficiency gains may be made in facility cooling ― typically air conditioning ― which traditionally has accounted for 35% of data center power demand, the report says. Newer cooling technologies that use liquids to absorb and dissipate heat can cut demand by up to 50%.

Using system redundancy at data centers is another option, Porter said. Centers may have backup or redundant servers “that are running at 50% of their capability,” Porter said. “The challenge with this is that a server running at 50% of capacity uses as much energy as it would if it were running at 100% capacity.”

Other approaches include “pruning”: cutting unnecessary elements in neural networks, which reduces computational complexity — and energy demand — while “maintaining robust performance,” the report says. Power capping reduces energy use but may slightly decrease speed by 3 to 4%, Porter said.

A recent webinar sponsored by Canary Media also looked at the role of wholesale markets in responding to the increasing power demands of data centers and the potential inefficiency of non-RTO markets such as the Southeast.

“If we had an RTO that covered the whole region, you wouldn’t be building three or four gas plants for the same load,” said Maggie Shober, research director at the Southern Alliance for Clean Energy. “The flip side of that is we don’t have reserve margin sharing here in the Southeast,” so individual utilities may be predicting a need for larger reserves.

Shober and other speakers at the webinar zeroed in on the Georgia Public Service Commission’s recent approval of an updated IRP for Georgia Power after the utility predicted 17-fold growth in demand by 2030, largely from data centers. The new plan includes a power purchase agreement that would help keep a coal-fired plant in Mississippi online through at least 2028, along with three new, company-owned gas-fired plants with a total capacity of 1,400 MW.

The Clean Energy Buyers Association (CEBA) was able to push Georgia Power to a last-minute addendum to the IRP, committing the utility to develop a new program that allows large-demand customers, like data centers, to bring their own clean power into the utility’s system, said Priya Barua, CEBA’s senior director for market and policy innovation.

The utility has agreed to work with CEBA and other customers to design the program, which will be included in its 2025 IRP, Barua said. “I think it’s an important first step for opening a new path for Georgia to have kind of expanded options for meeting load growth” in the absence of an organized market.

Shober sees the Georgia Power and Dominion IRPs as a “trial run because we know this kind of load is coming. … My worry is that this sort of panic reaction and kneejerk reactions by a number of utilities means that we don’t have the right processes in place and the right level of transparency to meet that kind of load” with proactive planning and a diverse set of options.

Simon Mahan, executive director of the Southern Renewable Energy Association, said such changes should include a hard look at the value different resources bring to the grid. “Historically, natural gas, coal [and] nuclear resources … would get 100% accreditation. The utilities would just assume, ‘Oh yes, they’re always going to be around because we can turn them on and off.’

“The reality is showing that’s not the case. So, we need to appropriately accredit those resources as we’re also properly accrediting wind, solar [and] batteries.”

Barua agreed that new, more holistic thinking is needed — and maybe taking some risks. “We’ve reached the stage where we’re going to need to be uncomfortable to come up with the right kinds of solutions for the challenge that the system is facing right now.”