Emily Chen, an analyst with FERC’s Office of Energy Market Regulation, gave a briefing on Orders 1920 and 1977 to members of the NYISO Management Committee on June 11 during a joint meeting with the ISO’s Board of Directors.

“We’ve had a busy year, and a busy May with two commission meetings, as I’m sure you’re well aware of,” Chen said. (See FERC Issues Transmission Rule Without ROFR Changes, Christie’s Vote.)

Order 1920 requires transmission planners to use a 20-year horizon to identify long-term needs and the facilities to meet them. Long-term planning must occur at least once every five years using at least three plausible scenarios with the best available data and incorporating factors such as retirements, policy goals and corporate commitments.

“We also require that you consider at least seven benefits to evaluate these regional proposals, including production, cost savings, or mitigation of extreme weather and unexpected system conditions,” Chen said.

She noted that the order had been published in the Federal Register just that day, and it will go into effect Aug. 12.

The rule also requires transmission providers to propose a default method of cost allocation to pay for long-term regional facilities and to hold a six-month engagement period before submitting their compliance filings.

Order 1977 updates the process FERC uses when it is called upon to exercise its siting authority to include a Landowner Bill of Rights and a codified Applicant Code of Conduct for applicants to demonstrate good faith effort to engage with landowners in the permitting process. It also directs applicants to develop engagement plans to environmental justice communities and federally recognized tribes. The order was published May 29 and is effective July 29.

Project Prioritization Process

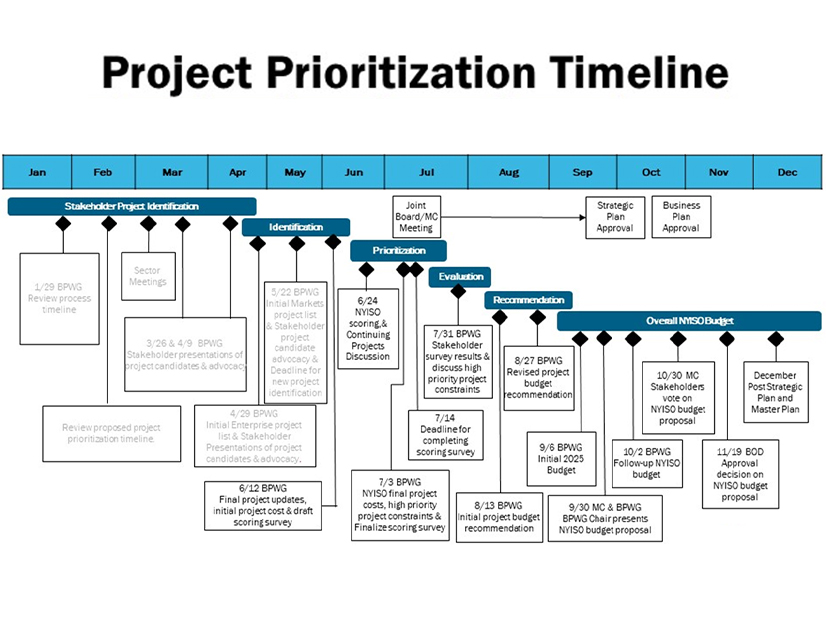

Kevin Pytel, director of product and project management for NYISO, presented the proposed internal project prioritization for 2025 and outlined changes to the process since last year.

“This process is not perfect, we know that, and we try to make it better every year,” Pytel said.

NYISO had 53 proposed market projects this year; of those, eight were continuing projects. They include implementing five-minute transaction scheduling and ancillary service shortage pricing.

The primary changes were to how NYISO handles “continuing” projects, which are those that were approved in a prior year that have progressed to the functional requirements specification, software design, development completion or deployment stages.

Stakeholders had requested that the ISO revise the timeline for stakeholders to decide whether to continue with a project; they now have until June, pushed back from March.

“The hope is that by moving this back three months, we will have a more healthy discussion and be able to come to a resolution quicker on which projects should be considered ‘continuing,’” Pytel said.

The ISO also shifted the stakeholder scoring survey from June to July, which it said will allow it to develop a project set for budgeting purposes by early August.

The Budget and Priorities Working Group will decide on the continuing projects at its meeting June 24; NYISO will also provide its own project scores at the meeting. The survey will be distributed July 3, with a deadline of July 14. The ISO will present the results to the working group July 31.

NYISO’s internally facing enterprise projects that do not involve market rule changes are not subject to stakeholder approval.

Rate Schedule 1 Allocation of the NYISO Budget

Chris Russell, senior manager of customer settlements for NYISO, reminded the committee of an upcoming vote to determine whether a new cost-of-service study should be conducted to evaluate the Rate Schedule 1 allocation between withdrawals and injections.

Rate Schedule 1 is used by the ISO to collect its operating costs from members. The 2024 rate is $1.281/MWh, with 72% from withdrawals and 28% from injections.

The current allocation was set by the committee in July 2011. It was originally scheduled to be effective for January 2012 to December 2016, but in 2016, the committee voted to decline conducting a study and has done so annually every third quarter through 2023.

Russell said market participants have indicated that a study is necessary in the future because of the evolving market. Last year, the committee voted to waive the study by an overwhelming majority of 91.22%. (See NYISO Management Committee Briefs: July 26, 2023.)

The vote will take place at the committee’s July 31 meeting.