FERC on June 14 called for stakeholder briefings on the Southeast Energy Exchange Market (SEEM) as a step toward satisfying a D.C. Circuit Court of Appeals order last year remanding the commission’s approval of the market (ER21-1111, et al.).

The vote was 2-1, with outgoing Commissioner Allison Clements filing a dissent calling the commission’s briefing request “a dead end” that “ignores the court’s explicit conclusion” on SEEM’s fairness.

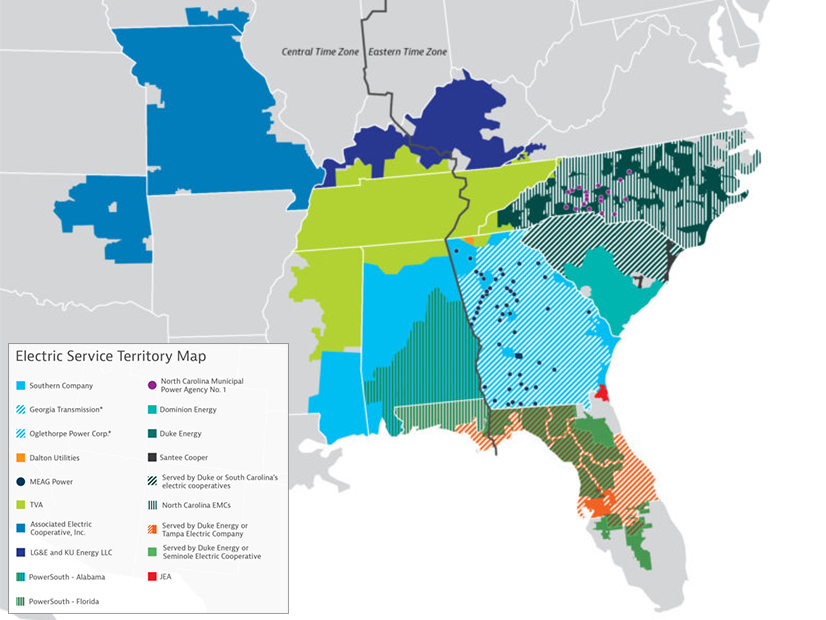

SEEM has been controversial since it first was proposed in 2021. Its founding utilities, which included Duke Energy, Southern Co., Dominion Energy, and LG&E and KU Energy, contended the market would reduce trading friction and promote the integration of renewable resources through automated trading, elimination of transmission rate-pancaking and allowing 15-minute energy transactions.

However, some opponents argued the market would favor transmission-owning utilities and promote monopolistic behavior, while others pushed for alternative structures like an RTO.

FERC’s latest order arises out of legal wrangling that began with the commission’s original approval of the SEEM agreement in 2021. At the time the commission had only four members, who split 2-2 when the deadline for approval arrived. Under the Federal Power Act, in such a situation the measure under consideration is automatically considered approved.

As a result, the SEEM agreement became effective by operation of law. FERC later approved — by majority vote — revisions to the agreement along with the market’s non-firm energy exchange transmission service (NFEETS) and tariff revisions by the founding utilities. (See FERC Accepts Key Tariff Revisions to SEEM.)

A consortium of environmental groups including Advanced Energy United, the Clean Energy Buyers Association and the Southern Alliance for Clean Energy, which had opposed SEEM since its original proposal, filed a request for rehearing in 2021. FERC denied the request, claiming it was submitted after the 30-day deadline for rehearing motions expired.

The opponents then appealed the denial to the D.C. Circuit, which agreed their request was filed within the deadline and remanded the approval back to FERC. (See DC Circuit Sends SEEM Back to FERC.) The court also found FERC failed to adequately explain why SEEM should not be considered a loose power pool under Order 888. Opponents had argued NFEETS made the market a loose power pool, which under FERC’s rules must be open to nonmembers.

FERC’s order last week stopped short of addressing the court’s directives. Instead, the commission’s majority called for “supplementing the record” with briefings from stakeholders on whether SEEM qualifies as a loose power pool and whether the market’s requirements that entities transacting in it have a source and sink inside its footprint violates Order 888.

The commission provided a series of questions that respondents should answer, including:

-

- whether SEEM is a loose power pool;

- if so, whether and how SEEM “is consistent with or superior to the open-access requirements for loose power pools” in Order 888;

- if SEEM is not a loose power pool, whether and how it is superior to or consistent with the pro forma open access transmission tariff;

- whether NFEETS should be considered a non-pancaked rate;

- whether NFEETS is “comparable to traditional transmission arrangements in bilateral markets”; and

- whether entities with a source or sink outside of SEEM’s territory could conform with the technical requirements of the market’s matching platform.

Stakeholders must submit their responses within 60 days of the commission’s order; reply briefs are due 30 days thereafter.

Clements Says Briefings Only Delay the Inevitable

In her dissent, Clements argued the commission was only delaying an inevitable recognition that its “previous decision-making [on SEEM] was arbitrary and capricious.” She cast the court’s decision as a vindication of those who have questioned SEEM’s usefulness and fairness.

“Commissioners supporting SEEM have constructed a straw man, attempting to dismiss my and petitioner’s concerns as stemming from a desire for a full Southeastern RTO, of which SEEM falls short,” Clements wrote. “But my concerns have been and remain focused only on … whether SEEM as proposed is legal under the requirements of the Federal Power Act, Order No. 888 and Order No. 888-A.”

Clements insisted the court’s “clear conclusions and directives obviate further record development” that would only serve to further waste “the valuable time of stakeholders we ask to engage in these proceedings.” Concerning FERC’s question about whether SEEM’s geographic requirements are necessary for it to be technically feasible, Clements asserted the court already had determined that such necessity “does not render the construct permissible.”

Clements concluded by pointing out the court last year ordered FERC to consider both the Order 888 questions as well as the requests for rehearing. She emphasized that “the majority’s order fails to accomplish either task.”