Duke Energy executives highlighted how the return to load growth is impacting its utilities during its second-quarter earnings call with analysts Aug. 6.

The trend started to impact the utility at the start of the year, when it had to file an update to a still-pending integrated resource plan at the North Carolina Utilities Commission after load forecasts increased.

“We operate in some of the most attractive jurisdictions for both economic development and customer migration, which provide conviction in our 2% load growth forecast in 2024, and 1.5 to 2% load growth CAGR (compound annual growth rate) over the five-year planning horizon,” CFO Brian Savoy said.

Residential customers are moving at high rates to Duke’s territories in the Carolinas and Florida, where demand was up 2.4% in the first half of the year. Commercial demand growth exceeded Duke’s expectations, while industrial demand saw somewhat slower growth in its territory. Some large customers in Duke’s territory were impacted by interest rates and worries of a possible economic downturn, but the company expects growth in advanced manufacturing and data centers to rise significantly in the long term.

“It’s primarily what I would call our legacy industries of textile and paper that are feeling the pressure,” CEO Lynn Good said. “And we continue to track with all of that industrial volume we’re expecting from economic development; that is exactly on track. So, it’s a little bit of an old-industry/new-industry story that we’re seeing in the Carolinas in particular, and a little bit in Indiana.”

Duke recently entered into memoranda of understanding with large customers in the Carolinas, including Amazon, Google, Microsoft and Nucor, to explore tailored solutions to meet large-scale energy needs and lower the long-term cost of investing in clean energy, Savoy said.

“These voluntary programs, which are subject to commission approval, would be open to any large customer and would include protections for nonparticipating customers,” Savoy said. “We look forward to continued collaboration with all stakeholders as we work to meet the accelerating demand in our service territories.”

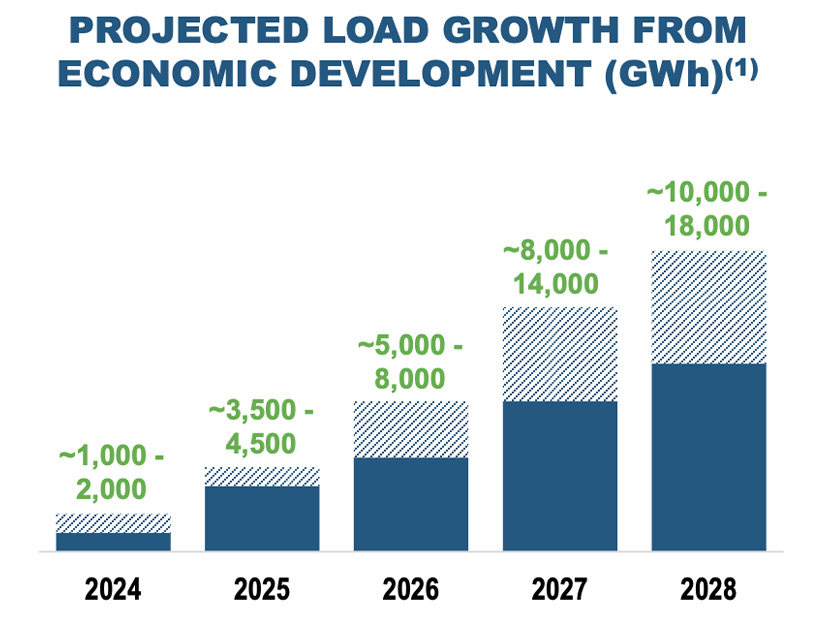

Of the forecasted “economic development” demand growth through 2028, just 25% comes from data centers, though Good said that in the longer term, that is forecasted to be a bigger chunk of new demand. The MOUs are meant to not only help the firmer load growth in its pipeline, but also encourage continued expansion in Duke’s territories, Good said.

“The discussions are early,” she added. “I think there’s a clear understanding that we are trying to do a couple of things here. We’re trying to meet the load. We’re trying to meet their sustainability goals. We’re trying to do so in a way that protects retail customers. We’re trying to meet their timelines. And I would say the discussion is very constructive, and the notion of risk sharing is something that we’re very clear on and have lots of experience in talking with customers about.”

Nucor has signaled interest in using nuclear power to fuel its steel-manufacturing operations, even investing $35 million in a potential fusion plant. Good was asked whether the MOUs with it and the others included work on nuclear.

“They have an interest, obviously, in carbon-free generation, and nuclear represents an around-the-clock option,” Good said. “But we all recognize we’re [in] the early stages of development. So, is there a structure? Is there premium pricing? Is there some method of equity investment? Is there some structure that would encourage the development at a perhaps a more rapid pace, or sooner, because of the partnership? So, all of that is being explored as we talk with them.”

Duke reported $886 million ($1.13/share) in net income for the second quarter, a big improvement over its loss of $234 million in the same quarter last year.