Members of the Southeast Energy Exchange Market (SEEM) told FERC in a filing that, contrary to what SEEM’s opponents claim, the market “is bringing savings to customers and should be allowed to continue” (ER21-1111, et al.).

Participants in the Aug. 13 filing included Southern Co., Dominion Energy, Duke Energy and Louisville Gas & Electric, all of which were among the founding utilities that first proposed SEEM in 2021. They aimed to answer questions commissioners posed in a June 14 filing seeking information on whether SEEM qualifies as a loose power pool under FERC Order 888 and whether the market’s requirements that entities transacting in it have a source and sink inside its footprint violate Order 888. (See FERC Requests Briefings on SEEM After DC Circuit Order.)

FERC ordered the briefing as a step toward satisfying last year’s order by the D.C. Circuit Court of Appeals that remanded the commission’s approval of the market — which occurred by default when the commission split 2-2 when the deadline for approval arrived. (See DC Circuit Sends SEEM Back to FERC.)

The court also found FERC failed to explain why SEEM should not be considered a loose power pool. Opponents argued the market’s nonfirm energy exchange transmission service (NFEETS) made SEEM a loose power pool, which under FERC’s rules must be open to nonmembers.

FERC provided a series of questions for SEEM members, including whether it is a loose power pool and, if so, whether and how it meets or exceeds Order 888’s open-access requirements for power pools and, if not, whether it is consistent with the pro forma open access transmission tariff (OATT). The commission also asked whether NFEETS should be considered a non-pancaked rate and whether entities with a source or sink outside of SEEM’s territory could conform with the technical requirements of the market’s matching platform.

In their response, SEEM members argued that SEEM does not quality as a loose power pool because “the commission has already found that NFEETS is neither a discount not a special rate” and that the D.C. Circuit did not find fault with FERC’s reasoning on that point.

Members claimed the court instead was concerned about a possible inconsistency because it read part of Order 888 to “equate a discount with a non-pancaked rate.” The filing countered this by claiming that NFEETS is pancaked because charges for losses and imbalances are cumulative across balancing authorities (BA). In addition, members asserted that NFEETS is “available to everyone, including SEEM members, on the same terms and conditions, and at the same price, under the [OATT] (or equivalent) of each member.”

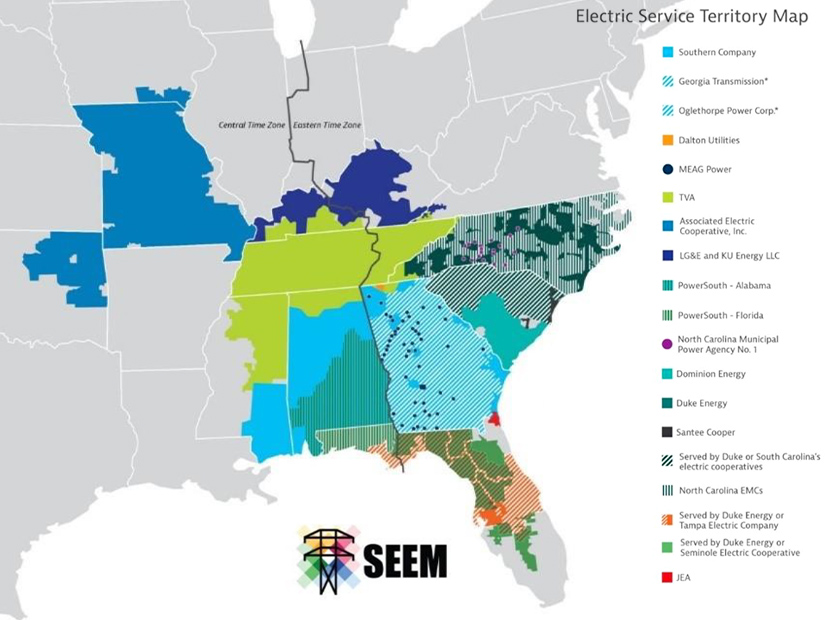

The respondents confirmed that owning a source or sink connected to a SEEM transmission provider is necessary for SEEM to be technically feasible, explaining that SEEM was never intended to be a “fundamental, ground-up reconstruction of the market design in the Southeast,” quoting the initial SEEM filing.

However, they argued the requirement is not “unduly discriminatory to entities outside the SEEM territory” because there are other ways loads and resources outside the SEEM territory can participate in the market. Members held up pseudo-ties — which are used to represent interconnections between two BAs where no physical connection exists between the load or generation and the power system network — as one possible means of participation by outside entities.

Finally, members urged FERC to maintain SEEM as the best choice currently available for Southeastern ratepayers, claiming that despite their technical arguments, the market’s opponents have an overarching motive for their objections.

“At the outset of this litigation, petitioners made their real objective clear: They want a different kind of market for the Southeast,” members said. “But … every prior effort at increased coordination in the Southeast has failed. More importantly, SEEM benefits customers, and those customers should not become victims of petitioners’ ulterior objective. SEEM is the proposal on the table now and must be evaluated on its own merits. And it passes the test easily.”