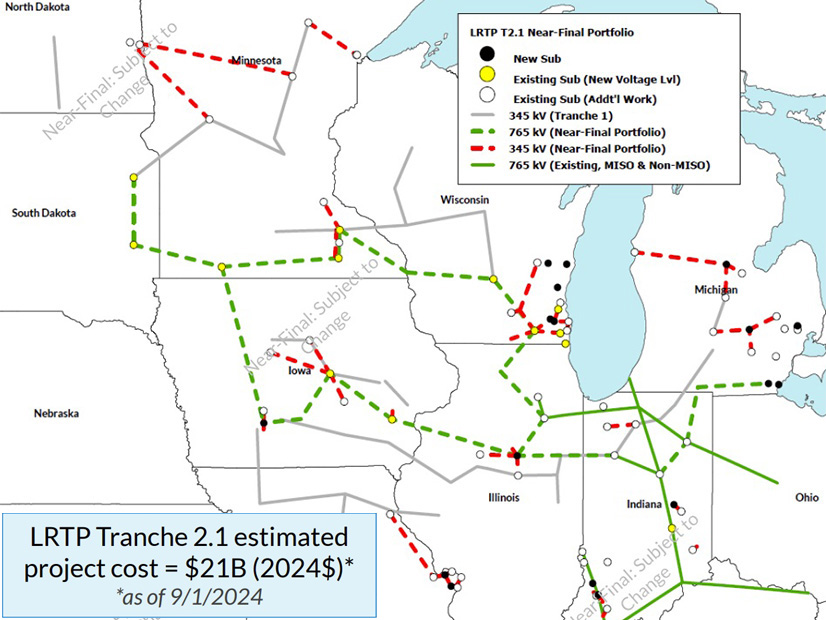

MISO said its second, mostly 765-kV long-range transmission plan will provide the Midwest region with at least a 1.9:1 benefit-cost ratio and cost $21 billion, lower than its earlier estimated $23 billion to $27 billion.

The grid operator announced the approximations at stakeholder workshops Sept. 10 and 13. Even with the slightly lower costs, MISO’s Independent Market Monitor is incredulous the portfolio would deliver nearly double its cost in benefits.

Jeremiah Doner, MISO director of cost allocation and competitive transmission, said MISO refined its cost estimate using facility-specific details.

“That number may move around a little bit. But I think that $21 billion is where the portfolio stands,” he told stakeholders. “We don’t expect at this point in the process to be adding projects, so we don’t expect that number to materially change.”

Doner said MISO tried to minimize costs by proposing to co-locate some of the new 345- and 765-kV lines with existing structures.

“We know there’s always more risk in the regulatory permitting process when you have to seek new rights of ways,” Doner said. He added that MISO is in discussions with its transmission owners about what would be the most feasible route for the line.

MISO also is exploring routing a 765-kV line on an existing 161-kV route because it will cross an “environmentally sensitive” area from Wisconsin into Minnesota over the Mississippi River, Doner said. “We recognize that’s not a common practice,” he added.

At $21 billion and roughly 4,000 line miles, the second plan doubles the first LRTP portfolio, both in terms of costs and line miles. Doner reminded stakeholders the second portfolio has been in the works since 2022, when MISO moved to establish a projection of what the system would look like in 20 years.

The Ratio

Doner said the portfolio demonstrates “at least” a 1.9:1 benefit-to-cost ratio when analyzing its projects using MISO’s nine benefit metrics, which include the advantages of decarbonization, ability to withstand extreme weather and assistance in avoiding loss-of-load events, in addition to the more mundane adjusted production costs.

“We know these assets are going to be in service much longer than that,” Doner explained, adding that MISO was intentionally conservative to show the projects will more than pay for themselves over their first 20 years of service.

Doner said if MISO assumes the lines have a 40-year lifespan, total benefits could rise to 3.8:1. He added that with the conservative estimate, all of MISO’s cost allocation zones in the Midwest region are set to experience at least a 1.3:1 benefit-cost ratio.

“I think it’s important to show at least a 1:1 benefit-cost ratio in each of the cost allocation zones,” Doner said.

On a 20-year basis, MISO estimates the second LRTP portfolio will conservatively save MISO Midwest $16.3 billion because of the mitigation of reliability issues; $15.7 billion from avoided capacity costs; $8.1 billion in congestion and fuel savings; at least $7 billion in decarbonization assistance; nearly $3 billion in capacity and energy savings from a decrease in system losses; and $1 billion in avoided transmission investment. MISO also estimates the LRTP portfolio will save the Midwest at least $392 million from the reduced risk of extreme weather and $76 million in reduced transmission outage costs.

Skepticism

However, Monitor David Patton said he continues to believe three of the nine benefit metrics (avoided capacity costs, avoided reliability risk and decarbonization) are outright invalid or overstated and if they are deleted or significantly scaled back, the portfolio’s benefits would not come close to covering its costs. (See MISO Closing in on Final, $25B LRTP; Monitor Repeats Reservations.)

“If you adjust for those metrics, the overall benefit metric goes down to 0.5:1,” Patton said, adding he thinks it is “really, really important to scrutinize” MISO’s methodology.

“This is not about reliability. This is about a choice to build generation to further others’ policy goals,” North Dakota Public Service Commission staffer Adam Renfandt said in criticizing the portfolio.

Doner said when MISO developed its 20-year outlook that the portfolio is built upon, it examined which direction members were taking “across the whole footprint, not just in pockets of the MISO system.”

MISO planner Joe Reddoch said the analysis showed the portfolio would reduce constraints and increase system capacity so the RTO can meet its capacity needs with fewer resources.

Patton pushed back on the message that MISO faithfully followed its members’ resource plans when crafting the portfolio. He said that to model resources, the RTO relied on the Electric Power Research Institute’s Electric Generation Expansion Analysis System (EGEAS), which he said only minimizes costs in deciding what to build and ignores potential revenues entirely, leading to “very unrealistic” fleet assumptions.

Patton said he doubted the avoided capacity costs MISO has estimated and that members naturally would build more deliverable resources on the other side of transmission constraints if the transmission were never constructed. He said it’s highly unlikely members would continue to build generation in sites that are undeliverable to load. Patton added that if MISO approached its members and said it was not going to meet its resource adequacy obligations, members would adjust resource planning, which “pretty quickly” would reduce the LRTP’s benefits by “tens of billions.”

“You’ve cited an undeliverable collection of resources if we don’t build [the second portfolio], but our markets are designed to take care of that. To characterize that as a benefit is pretty misleading,” Patton said.

Doner said members have asked MISO to build a dependable system around their future plans. He also said it is not so simple for members to “move generation around,” citing wind- and solar-rich locations in the footprint.

“We have transmission planning responsibilities, not resource planning responsibilities. We really do rely on what our members are telling us that they’re going to build,” Doner countered.

Patton also said MISO is off base by establishing the value of the portfolio’s avoided reliability risks on the value of lost load (VoLL). He said in “no world” would the RTO allow reliability risks to become severe enough to shed load. Instead of lost load, Patton argued MISO should base the benefit on which transmission facilities would be built without the LRTP portfolio. MISO needs “an accurate ‘but for’ case,” in which it analyzes which shape its system will take without the second portfolio, he argued.

“Calculate something that’s real. This is not real,” Patton said. It’s “unconscionable” to expose customers to transmission investment based on “imaginary” and “massively overinflated” benefits, he said.

Jim Dauphinais, an attorney representing multiple industrial customers in MISO, said the use of VoLL in the benefit is “highly problematic.”

However, Jeff Eddy, director of transmission planning for ITC Holdings, warned stakeholders “there are big dollars behind outages” and pointed to Texas as an example. Eddy said that if anything, MISO was being conservative on the portfolio’s $16 billion reliability value.

“We know that these backbone lines really do provide benefits,” Sustainable FERC Project attorney Lauren Azar added. “I hope no one is questioning the benefits that regional backbone lines bring to the region.”

Reddoch said it’s difficult to compare the numerous, scattershot baseline reliability projects MISO would need on a five- to 10-year horizon with the 20-plus-year reliability benefits that the second LRTP portfolio would achieve. However, he said the portfolio likely would be more economical than smaller, piecemeal projects to comply with NERC standards.

“This has always been a challenge in the industry to monetize reliability,” Doner added.

North Dakota PSC Commissioner Julie Fedorchak said she was “dubious” that all MISO members would know where their projects will be located 20 years into the future, suggesting the RTO took liberties with its siting assumptions.

WEC Energy Group’s Chris Plante said he would like MISO to admit its planners fashioned a hypothetical resource expansion only with its members’ carbon reduction goals in mind. “My expansion plans don’t go out much more than seven years,” he said.

Doner said while it is not “100% member plans” that make up the 20-year future, it nevertheless comprises mostly member plans, and where there are not explicit plans, MISO sought extensive member input.

MISO Vice President of System Planning Aubrey Johnson said the RTO made “over 500 adjustments” to its original resource siting assumptions after speaking with its stakeholders throughout the planning process.

“Good golly, I really wish we could build regional backbone projects sooner than eight to 15 years in the future,” Azar said, urging stakeholders to consider the timeline to build transmission. “MISO has no choice but to essentially site the resources in the models. All modeling is necessarily wrong, but that doesn’t mean we shouldn’t be doing it. I really just urge folks to think about the reality of how long it takes to build these really big projects.”

“I’ve never known a resource planner who can tell me exactly what they’re going to do,” Eddy agreed. “This is high-level stuff, and I support what MISO is doing.” He said stakeholders seem to be losing sight of what MISO’s big-picture, future planning was intended to accomplish.

Plante said it seems MISO is rushing for December board approval rather than making sure “sound planning principles” are applied to the portfolio.

“Given the magnitude of the expansion planning here, we need to be careful that we establish sound foundations,” Plante said, adding the projects will be subject to scrutiny at state regulatory agencies.

“We disagree that there’s a lack of analysis here. We believe this is thorough,” said Jeanna Furnish, MISO director of expansion planning.