Proponents of SPP’s Markets+ contend in their latest “issue alert” published Sept. 18 that the framework provides a much more equitable solution to tackling market seams than does CAISO’s Extended Day-Ahead Market (EDAM).

In an email to RTO Insider, Jeff Spires, director of power at Powerex, said seams in the West have “resulted in inequitable outcomes, shifting value and reliability risk between subregions, and these outcomes are largely not captured in available studies to date.” (See SPP Briefs: Week of Nov. 7, 2022.)

It’s a point that Powerex — the first and, so far, only entity to tentatively commit to joining Markets+ — has broached before. In March, the Canada-based energy trader issued a report criticizing CAISO’s operational practices in the Western Energy Imbalance Market (WEIM) during the January 2024 cold snap in the Northwest. The report argued CAISO’s processes unjustifiably limited energy transfers into the region during the weather event and squeezed wholesale electricity price spreads between the Northwest and Southwest through congestion charges at the ISO’s border with Oregon, benefiting California parties at the expense of those in the Northwest. (See Powerex Report Expands NW Cold Snap Debate.)

Reiterating the points in the issue alert, Spires added that Markets+ “creates the opportunity for more equitable outcomes by leveraging its independent governance, its impartial operator and SPP’s demonstrated ability to negotiate seams agreements on a peer-to-peer basis with neighboring markets.”

The alert is the fourth published in a series of seven notices intended to highlight Markets+’s purported advantages over CAISO’s Extended Day-Ahead Market (EDAM) and WEIM. The first covered differences between how the two markets would be governed, the second focused on reliability, and the third compared pricing practices.

The contributing parties include Arizona Public Service, Chelan County Public Utility District (PUD), Grant County PUD, Powerex, Public Service Co. of Colorado, Salt River Project, Snohomish PUD, Tacoma Power, Tri-State Generation and Transmission Association, and Tucson Electric Power.

In the recent alert, the backers argue that Markets+ is a neutral market operator and can, therefore, resolve seams issues between adjacent balancing authority areas and adjacent transmission service providers (TSPs) more equitably than CAISO’s EDAM.

“For entities outside California, joining EDAM would mean accepting that their BA-to-BA and TSP-to-TSP seams will be resolved by market rules developed by the CAISO under its governance framework, and implemented by a market operator that is also one of the participating BAs and one of the participating TSPs,” the alert said.

Additionally, allowing CAISO to set the rules could lead to the California load receiving priority over other regions during heat waves, according to the alert. The parties also argued that CAISO’s market rules have led to concerns over inequitable distribution of congestion value, a point emphasized in Powerex’s March report.

Instead of relying exclusively on CAISO to resolve seams issues, the entrance of Markets+ will lead to each market operator attempting to ensure “that its participants receive the fair value of trade at each applicable seam, including through seams agreements negotiated between these peer market operators, as is the practice today between adjacent organized markets in the Eastern Interconnection,” according to the alert.

Trade across seams also is enhanced under Markets+ because it removes trade barriers and uses a flow-based dispatch, which will “facilitate greater reliability and economic benefits relative to today by enabling more transfers across the same transmission infrastructure, including across BA-to-BA and TSP-to-TSP seams,” according to the alert.

‘Equitable and Efficient’

In response to the issue alert, CAISO spokesperson Anne Gonzales told RTO Insider the ISO remains focused on “implementing EDAM in a manner that best meets the needs of the region’s diverse interests.”

“We continue to work with our partners to advance the Western energy markets, including the equitable and efficient management of seams with neighboring areas — whether in organized markets or not — and to grow its footprint to deliver maximum reliability, economic and environmental benefits to customers West-wide,” Gonzales said.

In its own March report on the January cold snap, CAISO contested the negative characterization of how it managed flows across its seam with the Northwest during the deep freeze, contending that the event mostly demonstrated the value of the WEIM under stressed grid conditions, while the associated congestion charges reflected the functioning of mechanisms seen in any organized electricity market. (See NW Freeze Response Shows WEIM Value, CAISO Report Says.)

The prospect of seams has been an especially fraught issue in the competition between Markets+ and EDAM.

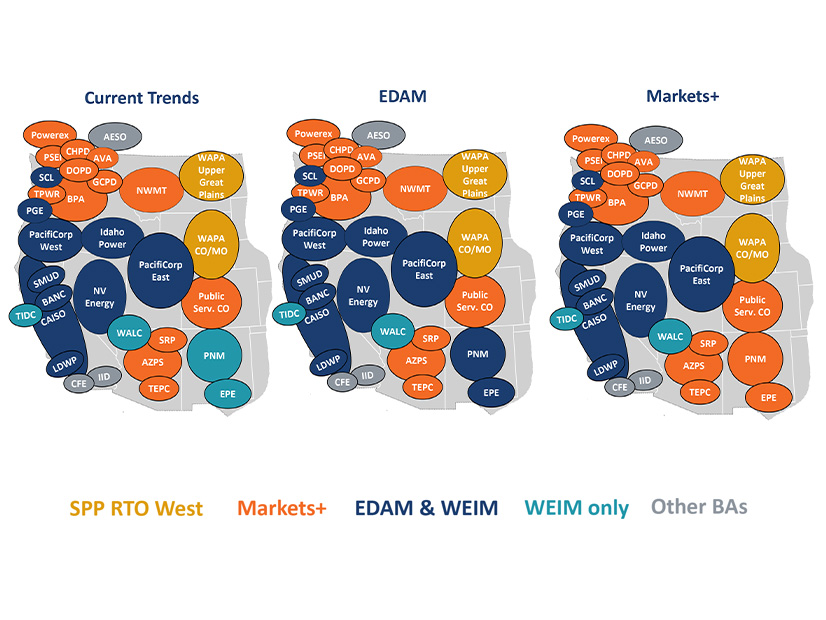

EDAM’s key supporters, who champion the cause of a single electricity market in the West that pointedly includes California, have warned that a divided West will prevent the region from realizing the full “diversity benefit” of resources across its broad footprint and could increase future reliability risks.

On the other hand, Markets+ backers have played down any risks associated with seams. During a May workshop, Bonneville Power Administration officials noted the agency has deep experience dealing with market seams and made clear that seams concerns would not dictate its choice. (See Seams Concerns Won’t Drive Day-ahead Market Decision, BPA Says.)

For its part, SPP has said it is prepared to take a leadership role in managing Western seams based on its own experience developing seams policies with markets neighboring its RTO in the Eastern Interconnection — a point reprised in the Sept. 18 alert. (See SPP’s Experience with Seams Could Help Markets+.)

Robert Mullin contributed to this article.