Allowing utilities to own generation again in New York state could speed up their deployment, according to a Brattle Group white paper prepared for Consolidated Edison released Sept. 24.

“Con Edison has been the champion for renewable energy generation for its customers for decades,” Vice President of Distributed Resource Integration Raghu Sudhakara said in a statement. “We believe that utility ownership of renewable energy will provide New Yorkers with additional renewable generation for the green energy that they need when they need it, and with the highest value.”

The state’s Climate Leadership and Community Protection Act requires 70% of load be met with renewables by 2030 and full decarbonization by 2040, which translates into the need to add tens of thousands of megawatts to the grid over the next decade.

Currently renewables outside of Long Island are largely procured with New York State Energy Research and Development Authority contracts and New York Power Authority ownership, the paper says. NYSERDA runs competitive solicitations, and while it has attracted some new supplies, since the end of 2020, it has only procured 2.7 GW of new onshore wind and solar.

“New York greatly needs to add large amounts of renewable resources in the next decade if it is going to meet the state’s ambitious decarbonization and renewable generation goals,” Brattle Principal and report co-author Metin Celebi said in a statement. “Utility ownership of renewables alongside private ownership of assets could not only help expedite the development of new renewable resources but ultimately even save utility customers in the state money, alongside other benefits.”

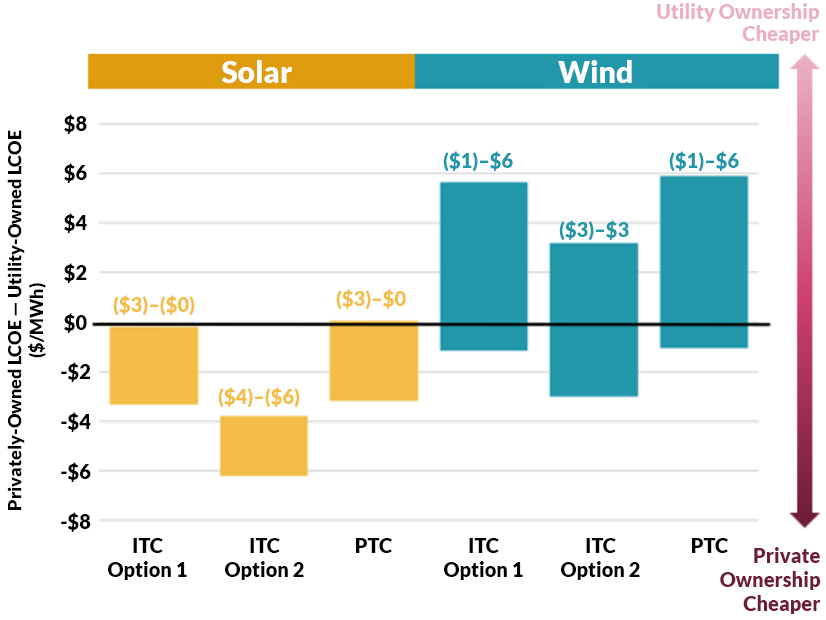

The paper evaluated the costs customers would incur during the first 30 years of operation for a new 100-MW onshore wind or solar facility under both utility and private ownerships, with different scenarios based on energy market prices, financing costs, contract durations and repowering assumptions. The renewable projects were identical except for the different ownership, with the only difference in final costs to customers based on cost recovery mechanisms, expected rates of returns and how tax credits are treated.

Allowing utility ownership “with sufficient guardrails against anticompetitive behavior” could allow customers to benefit from the advantages of both utility ownership and private ownership of renewables. When power prices are high and the cost of capital is high for private developers, utility-owned generation saves up to 14% compared to private developers, but other scenarios have privately owned renewables coming in cheaper for consumers by up to 11%.

The data for the costs of the power plants and how much money they are likely to make in the energy markets came from the National Renewable Energy Laboratory. The utility cost of capital is based on what the New York Public Service Commission has approved — 6.75% — while the private cost of capital is based on current market conditions at 6.99%.

“The cost of capital for private renewable developers is uncertain, especially recently due to supply chain constraints, which have put further risk on the development of renewable energy projects in the United States and New York in particular,” the report says.

To account for uncertainty, the study includes higher costs in one scenario: 7.5% for private solar developers and 9% for wind developers.

“We find that the customer costs are broadly comparable between the utility ownership option and the private ownership option,” Brattle said. “However, in the scenarios we analyzed, customer costs for new solar generation tend to be slightly lower under private ownership, while utility ownership tends to result in lower costs for new onshore wind generation.”

Ultimately, both ownership models result in a similar level of costs, and the different ownership models come with their own pros and cons, the paper says.

Utility-owned generation can help bring more renewables online and offers effective project execution and risk management to provide benefits and cost savings under some circumstances.

“However, utility ownership would likely shift most risks currently borne by private owners to electricity customers with respect to asset performance and investment cost overruns,” the report says. “In addition, depending on the implementation rules, utility ownership may raise concerns about cross-subsidization of costs and the availability of open access to information on the transmission and distribution systems to all developers of renewable generation in the state.”

The state will need 110 GW of nameplate capacity and 240 TWh of energy by 2040, but most of the projects in NYSERDA’s last five solicitations have been canceled, the paper notes. Of the 85 projects awarded by the authority between 2018 and 2021, all but eight have been canceled.

In its most recent solicitation in November, of the 68 projects that bid, 60 of them had been previously awarded contracts from which they backed out. NYSERDA ultimately picked 24 of those, representing 2.4 GW of capacity.

With the cancellations, the percentage of load served by renewables in 2022 was down compared to 2014. And with demand growth back in the mix, the gap is only getting wider.

The paper specifically highlights Dominion’s Coastal Virginia Offshore Wind Project as a successful utility development, noting that the firm financed and built a Jones Act-compliant vessel to install the project. The lack of such vessels was overlooked by some competitive suppliers, which led to project abandonments.

“Ideally, regulated utilities’ particular understanding of the regulatory and permitting environment in New York state, a direct interest in a highly reliable energy system in the state and a long-term commitment to the state increase the likelihood of project completion,” the paper says. “However, there is still no guarantee in this regard, given utilities’ exposure to similar market forces that would also impact competitive suppliers, including financing costs, rising capital costs and supply-chain limitations.”

In addition to competitive concerns, which crop up in part because the utilities own the transmission and distribution systems their competitors also need to connect with, the paper also says that letting the utilities into development would put the risk of failed projects onto customers.

“Despite the significant project cancellations described above, as a result of New York’s competitive procurement model, which allocates risks and benefits to private companies instead of customers, customers have not borne the costs of these canceled projects,” the paper says. “In contrast, if the costs of a canceled utility-owned project were determined to be prudently incurred, those costs would be recoverable from customers.”