The West-Wide Governance Pathways Initiative on Sept. 26 released its “Step 2” draft proposal for dividing up functions between CAISO and the new “regional organization” (RO) that initiative backers are seeking to create to oversee the ISO’s Western real-time and day-ahead markets.

The draft proposal calls for the RO to launch in the form of the “Option 2.0” structure discussed in Pathways meetings, one in which the RO would serve primarily as a “policy-setting” body around market rules for the Western Energy Imbalance Market (WEIM) and Extended Day-Ahead Market (EDAM).

The plan stops short of adopting “Option 2.5,” which would have the RO take on more of CAISO’s market functions and legal responsibilities — but also the accompanying financial and legal risks.

But Pathways backers — and the proposal itself — are leaving open the potential for transitioning to the second option once the new entity is established.

“This is really the recommendation for creating a new independent entity that can have sole authority over [CAISO] market services,” Kathleen Staks, co-chair of the Pathways Launch Committee, said during a joint meeting of the CAISO Board of Governors and Western Energy Markets (WEM) Governing Body shortly after release of the proposal.

“It was very important to make sure that we were communicating with the West that we intend for this thing to continue to be able to grow as the West wants it, as utilities demand it and stakeholders demand it. We need this new regional organization to be able to add market services,” said Staks, who is executive director of Western Freedom.

A fact sheet accompanying the proposal notes the plan (emphasis Pathways’) “is not a consensus document but a draft proposal with wide-ranging recommendations to solicit additional stakeholder feedback.”

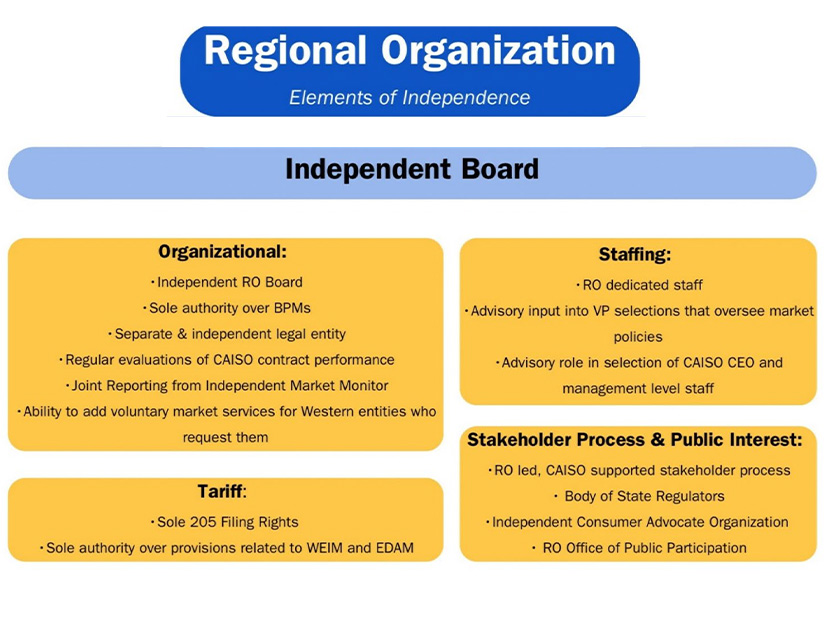

According to the fact sheet, under Option 2.0, the RO “will have full authority over market rules, sole Federal Power Act Section 205 rights and ultimate authority over associated business practice manual provisions.”

Under CAISO’s existing tariff, the ISO’s board and WEM Governing Body share joint authority over the WEIM and EDAM. In August, both bodies voted to implement the Pathways “Step 1” proposal, which grants the WEM body “primary” authority over the markets, a tariff change still pending approval by FERC. (See CAISO, WEM Boards Approve Pathways ‘Step 1’ Plan.)

Option 2.0 would elevate that “primary” authority to “sole” authority and shift the oversight to the RO, which would effectively assume the role of the Governing Body.

“Sole 205 rights in Step 2 means that the CAISO board does not have any lingering unilateral authority, which exists today and persists in Step 1 in some exigent circumstances, to make a 205 filing at FERC that unilaterally imposes the CAISO board’s policy view regardless of the views of the other body,” the proposal says.

The only area for which CAISO’s board would retain sole 205 authority is for rules “applicable specifically” to the ISO’s balancing authority or grid.

But the proposal has the ISO continuing to perform day-to-day market operations “within the scope of its existing corporate authority, with varying levels of input from the RO.” Under the plan, RO and CAISO rules would also reside within a “single integrated tariff,” and the ISO would remain the counterparty for existing market contracts.

“One premise of the Pathways Initiative is that consumers across the West would be better served by drawing on the existing CAISO software, hardware, facilities and expert operators, rather than designing, building and paying for this infrastructure and expertise from scratch,” the proposal says. “This premise goes hand in hand with the notion that the widest possible integrated footprint, inclusive of California, would be better for consumers than the alternative.”

Because Step 2 grants the RO sole authority over CAISO markets, its implementation will require a change to California law, according to legal analysis performed by law firm Perkins Coie, an adviser to Pathways. The campaign to begin lobbying lawmakers was already in evidence this past summer, but Pathways supporters say the effort will begin in earnest with the next legislative session starting in January 2025. (See California Labor Groups Affirm Support for Pathways Proposal and California Energy Officials Pitch Pathways Plan to State Senators.)

Passage of a bill would put the ball back into CAISO’s court.

“The ultimate tariff changes will have a [CAISO] stakeholder process, but that wouldn’t begin until after a bill passes in California,” Staks told RTO Insider in an email.

Structure

At 133 pages, the Step 2 draft proposal goes well beyond governance functions to detail the proposed structure of the RO, which would be incorporated as a 501(c)(3) nonprofit corporation in Delaware and maintain its principal place of business in Folsom, Calif., near CAISO’s headquarters. It would be overseen by a seven-member board of directors selected to meet FERC’s independence requirements.

The proposal’s fact sheet says the RO’s “articles of incorporation, bylaws and other corporate documents will center on public interest protections and transparency,” while a Public Policy Committee of the board “will engage with states, local power authorities and federal power marketing administrations about potential impacts to state, local or federal policies before final board adoption of a tariff change or an initiative through the stakeholder process.”

The proposal additionally calls for the RO to engage with the WEIM’s existing Body of State Regulators and establish a Consumer Advocate Organization and Office of Public Participation. It would also create a joint structure for CAISO’s Department of Market Monitoring to report to both the ISO and RO boards.

The draft plan also outlines formation of the RO’s sector-based Stakeholder Representatives Committee (SRC), “which will serve as the primary body responsible for overseeing and guiding the development of new initiatives.” The proposal describes the SRC’s three-part process, consisting of issue identification and prioritization, discussion and solution development, and RO board approval. (See Comments on Western RO Stakeholder Plan Show Complexity of Effort.)

“By incorporating sector-based representation, the SRC will ensure that a balanced range of perspectives is considered, promoting collaboration and consensus through sector-specific discussions. This structured approach will enable stakeholders to identify and address key issues collectively, thereby influencing policy development outcomes in a meaningful way,” the proposal says.

The exact constitution of the SRC is still a work in progress, and the Launch Committee has scheduled an additional meeting to discuss the subject on Oct. 7.

Planting a Seed

The proposal additionally calls for the RO to consider transitioning — “over a defined period of several years” — to Option 2.5 after performing more analysis and gathering stakeholder input on making such a move. Under that option, the RO would take on more of CAISO’s market functions and legal responsibilities, and potentially reorganize itself under its own tariff while maintaining a vendor contract with ISO as market operator.

“In Option 2.5, deeper division of liability between two corporations, overall higher cost both to the CAISO and RO, and to stakeholders as a whole, plus the extensive negotiations we anticipate will be involved to rework dozens of pro forma regulatory contracts in Option 2.5, prevent us as a committee from strongly (as opposed to tentatively) recommending Option 2.5 at this stage,” the proposal says.

A financial table in the proposal shows the RO’s estimated annual operating costs under Option 2.5 would be nearly $23.9 million, including $17.7 million for in-house staffing, compared with $13.7 million under Option 2.0, which would incur about $10.6 million for labor.

The proposal calls for the RO board to perform “a deeper feasibility analysis, with stakeholder input, to assess the costs, benefits, possible expanded market functions, implementation details of how to achieve the additional corporate independence and responsibility, and to determine whether a departure from Option 2.5 is warranted.”

The analysis should be one of the board’s “initial priority tasks,” to be started within nine months of the RO’s formation, the draft adds.

“The idea here is that we will plant a seed. … We’re working with stakeholders and with you to plant the seed into fertile soil and to help water it and help it grow,” Launch Committee Co-Chair Pam Sporborg, of Portland General Electric, said during the CAISO board meeting. “But we do envision that as this organization takes root, that it will grow into what we call Option 2.5, [which] will have expanded authority and take on the actual responsibility, including a lot of the liability and compliance obligations associated with running the market.”

The Launch Committee will hold a stakeholder meeting to discuss the draft proposal on Oct. 4 and is accepting written comments on the plan until Oct. 25. It expects to release a final recommendation the week of Nov. 15.