NYISO made significant updates to its assumptions as part of its final Reliability Needs Assessment, which now shows no concern of a capacity deficiency and a loss-of-load expectation of less than 0.1 in 2034.

The dramatic change came from considering certain large loads as flexible, with the ability to reduce total consumption during summer and winter peaks by about 1,200 MW, the ISO told the Electric System Planning Working Group and Transmission Planning Advisory Subcommittee on Sept. 27.

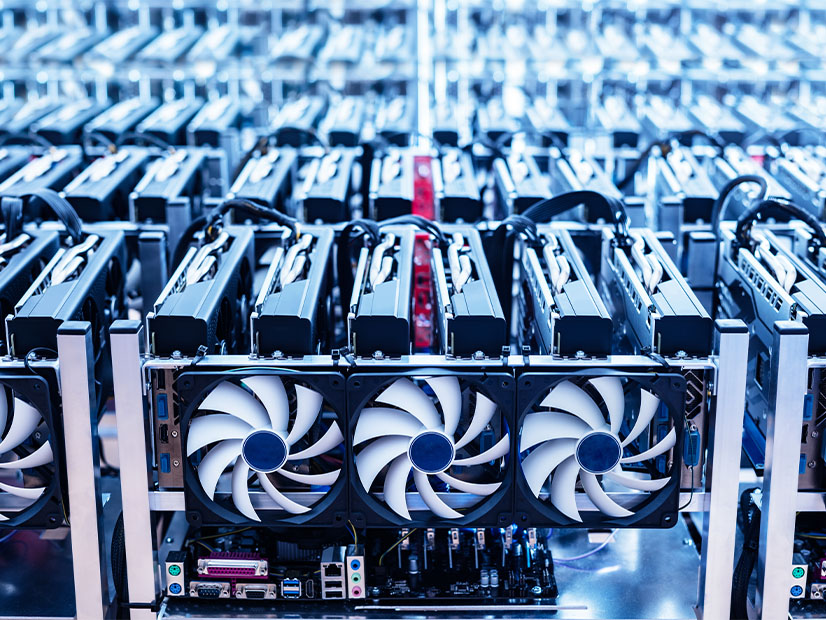

“Based on recent operating experience and outreach to load developers, cryptocurrency mining and hydrogen-production large loads are considered as flexible during peak load conditions,” NYISO said. “This type of load is assumed to be more price responsive and likely to participate in demand response programs than other loads.”

The change in assumptions reduced the forecasted LOLE in 2034 from the preliminary 0.289 that the ISO expected in July to 0.094. NYISO had warned of a potential shortfall of as much as 1 GW in its preliminary results in July. (See Prelim NYISO Analysis: 1-GW Shortfall by 2034.)

“We feel comfortable in certain large loads, primarily like cryptocurrency and hydrogen-producing large loads, to consider them flexible,” said Ross Altman, senior manager of reliability planning for NYISO. “When you have peak load conditions due to either price responsiveness or participation in demand response programs, they would curtail under peak conditions.”

Altman said semiconductor plants, other data centers and most other large loads were not assumed to be flexible.

Several stakeholders asked whether the flexible loads also were modeled as special-case resources formally enrolled in the DR program. Altman replied they were not, merely that they were assumed to be price responsive in some manner.

One stakeholder asked whether there was anything binding cryptocurrency miners to stay as cryptocurrency miners. He made the point that the servers could be put to other, less flexible uses than arbitraging the cost of energy against the purported value of the currency.

“If one or two of them change their use case, it’ll produce a very different outcome in this study,” they said. “You’ll lose that flexibility.”

“That is true,” Altman said. “Hold on to that thought. I’ll show scenarios that will show what things change on the higher end of the forecast, which includes large loads that are not flexible.”

NYISO stressed that “there is a lot of uncertainty about key assumptions over the next 10 years.” In a high-demand forecast risk scenario, the LOLE would jump to 2.744. The delay of the Champlain Hudson Power Express transmission project also is a concern.

“This still seems to be somewhat gambling,” another stakeholder said. “If these loads aren’t in the SCR [program] or they’re not participating in the emergency demand response program, unless you have a tariff or contract under a dynamic load management program, you don’t have any commitments to them to vary their load.”

The working group will review the full draft Reliability Needs Assessment report on Oct. 4. The Operating Committee and the Management Committee will review and vote on the final report on Oct. 17 and 31, respectively, and the Board of Directors will review and post the final report in November.