VALLEY FORGE, Pa. — The annual winter study conducted by the Operations Assessment Task Force (OATF) found no identified reliability risks for the 2024/25 season, PJM’s Mark Dettrey told the Operating Committee.

The study will be presented in full during the OC’s Nov. 8 meeting and includes a detailed power flow analysis to determine whether conditions such as the largest gas contingency or low/no renewable output could prompt a reliability emergency. While no such issues were found, a preliminary case replicating some of the factors at play in the December 2022 Winter Storm Elliott found the RTO could fall under the reliability requirement if the high forced outage rate were to repeat.

PJM’s Chris Pilong said the case was a “numbers game” looking at available capacity and forced outage rate without getting into the same detail as the power flow analysis.

The power flow analysis was built on the 50/50 non-diversified peak load base case of 141,233 MW and exports of 4,462 MW. It includes a preliminary installed capacity (ICAP) of 179,821 MW and forced outages of 17,955 MW. Pilong said the capacity figures used in the analysis include resources that do not hold a capacity obligation but historically have been available, including generation not obligated to offer into the capacity market.

The gas contingency case held a 7.1-GW reserve margin over the 90/10 diversified load forecast and a 6.4-GW day-ahead scheduling reserve requirement — the low/no renewables scenario had an 8.7-GW margin. The analysis assumed an 18-GW forced outage rate and 5.5 GW of exports.

The extreme winter storm scenario increased the forced outage rate to 46 GW to simulate the impact of a storm similar to Elliott. Exports were cut to the 3-GW firm interchange and 7.1 GW of load management added to the modeling, resulting in the reserve margin falling 13.8 GW below target.

PJM Seeking More Prompt Data Request Responses from Generators

PJM’s Eli Ramsay encouraged generation owners to self-schedule units for cold weather preparation exercises ahead of the winter and presented an overview of the data request process, which could result in members being found in breach of the Operating Agreement if they do not respond.

PJM will open a data request for generation owners Nov. 1 with a checklist of cold weather preparation steps and asking for any improvements that have been made to resources since Winter Storm Elliott. The request will be open through Dec. 15, with a reminder one week before the deadline.

Generation owners who do not respond to data requests will be notified they may be in breach of the OA, with 48 hours to supply the information through a remediation data request. Pilong said the response rates for the Cold Weather Preparation Checklist and Fuel and Emissions annual survey historically have been around 80%, which has trended in the mid- to high-90% range in recent years. Pilong said the increase followed outreach to generation owners, which PJM is trying to step back from, instead relying on members to report that information when requested.

PJM’s Kevin Hatch said operators rely on generators to update their parameters in eDART when cold weather advisories are issued, which provides dispatchers with visibility into unit availability. Self-scheduled drills ensure those parameters can be relied on if a generator is needed.

Monitor Presents Results of Synchronized Reserve Performance Inquiry

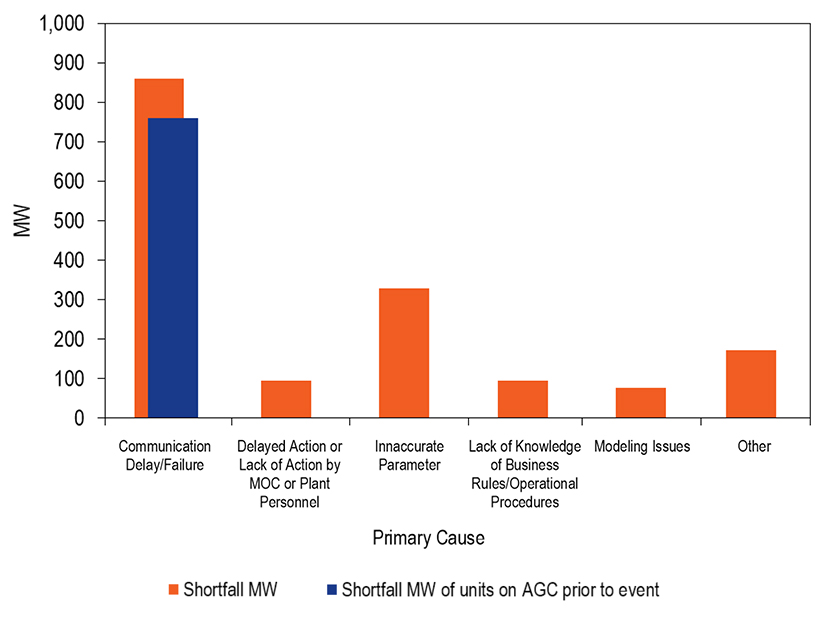

Joel Romero Luna, senior analyst with PJM’s Independent Market Monitor, presented the findings of outreach to synchronized reserve resources that failed to perform during a July 8 event, finding that a majority of the shortfall was due to communication failures or delays.

Synchronized reserve performance has lagged in recent years, leading PJM to increase the reserve requirement by 30% last year after backtracking on an earlier doubling of the target. (See “Stakeholders Reject PJM Synch Reserve Manual Change; RTO Overrides,” PJM MRC/MC Briefs: May 31, 2023.)

The Monitor spoke with 146 resources, representing about 93% of the total 1,755-MW shortfall during the July 8 synchronized reserve event, in an effort to better understand what led to the underperformance. More than 800 MW of shortfall could be attributed to communication issues, with most of those units following signals in PJM’s Automatic Generator Control (AGC) system. (See “Stakeholders Endorse Reserve Rework, Reject Procurement Flexibility,” PJM MRC Briefs: July 24, 2024.)

Luna noted that stakeholders have approved a PJM proposal to send synchronized reserve deployment signals through AGC, which he said could address some of the underperformance seen in July. If all units following their basepoints through AGC had responded to the synchronized reserve deployment, Luna said the performance rate would have been 76%, rather than the 46% seen July 8. While that would be an improvement, he said that would remain inadequate.

Inaccurate parameters, delayed action by plant workers, lacking knowledge of business rules and modeling issues all contributed to underperformance as well. In some cases, changes in ownership caused knowledge gaps about how to respond or resources were assigned reserve commitments for the first time and did not know how to respond.

“We saw a lot of that: units that were not aware that they were being assigned reserves and were required to respond,” he said.

The use of phone calls within companies to relay reserve deployment information contributed to the delays, Luna said. PJM Director of Operations Planning Dave Souder responded that the RTO’s All-Call signal results in a call to committed reserves within seconds of a deployment and the issue lies in how companies receive and process that information.

Quick Fix Proposal on Day Ahead Schedule Reserve Calculation

Hatch presented revisions to Manual 13: Emergency Operations seeking to clarify how PJM calculates the annual Day Ahead Scheduling Reserve (DASR) and uses the figure to determine when the 30-minute reserve target is insufficient. PJM proposed the change through the quick fix process, which allows a solution to be brought concurrent with an issue charge. Approval may be sought at the Nov. 8 OC meeting.

Hatch said the reserve target does not account for the varying risks and needs PJM can experience day to day, which can result in additional reserves being needed in some circumstances. The 30-minute target is set at the greater of the primary reserve requirement, the largest active gas contingency or 3,000 MW, whereas the DASR is based on underforecast load error and generation forced outage rates.

“We need to look for a percentage-based approach,” he said.

Souder said the revisions would codify existing practice around the reserve adequacy run and no changes would be made to market-based reserve procurement.

Stakeholders rejected an earlier PJM proposal to allow it to replace the 30-minute target with a formula that would select the greater of the load forecast error and forced outage rate together multiplied by the forecast peak load, the primary reserve requirement or the largest active gas contingency. (See “Stakeholders Endorse Reserve Rework, Reject Procurement Flexibility,” PJM MRC Briefs: July 24, 2024.)

First Read on Several Changes to Generator Operational Requirements

PJM’s Madalin How presented a package of revisions to Manual 14D: Generator Operational Requirements drafted through the documents’ periodic review.

New language was added requiring generation owners to provide PJM with information about changes to wind resources that may impact their characteristics without modifying the resource’s output to the extent to require going through the interconnection queue. PJM’s Joe Mulhern said information about changes in turbine technology could affect forecasting.

The revisions also include reformatting the Cold Weather Preparation Guideline and Checklist for readability, clarifying how generation owners should proceed if they lose remote control of MW or MVAR output and clarifying the requirement that all generators must provide PJM with reactive capability curves before entering operation and complete reactive testing within 90 days after coming online.

Several stakeholders questioned whether the changes were too substantive to be appropriate for the periodic review process and requested more time to review the language before moving to a vote next month.

September Operating Statistics

PJM experienced a 1.23% hourly forecast error in September, with a peak error of 1.74%, according to the RTO’s monthly operating report. PJM’s Marcus Smith, lead engineer for load forecasting, said Sept. 19 saw an approximately 6% underforecast due to weather forecast error, while Hurricane Helene contributed to overforecasting Sept. 27 and 28.

Two shortage cases were approved Sept. 4 due to high load and a reduction in dispatchable generation.