Most of the FERC-jurisdictional ISO/RTOs have made progress on transmission planning practices in response to Order 1920, Americans for a Clean Energy Grid said in an Oct. 24 report.

The report, “2024 State of Regional Transmission Planning: An Interim Transmission Planning and Development Report Card” was meant to follow an ACEG report in 2023 that graded grid operators’ rules. (See Transmission Report Card Grades MISO ‘B,’ Southeast ‘F’.)

“We find that across the country, several regions have initiated steps to reform their long-term regional transmission planning processes,” the report said. “Many of those reforms are promising improvements. However, despite the promise, many of these reforms are also in early stages of implementation and it is not clear what the final outcome will be or how it will impact actual transmission development.”

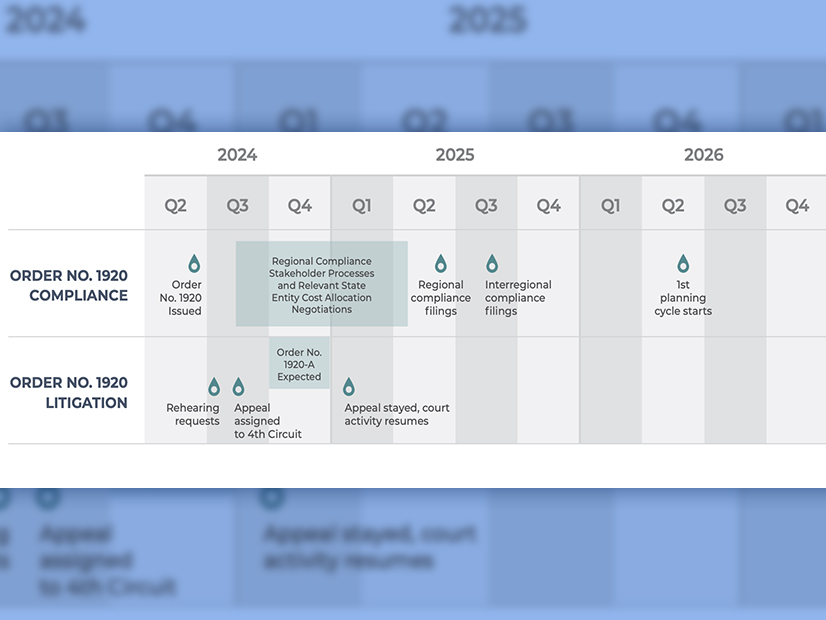

Compliance with Order 1920 is required by June 2025, though the report noted this could change as FERC acts on rehearing. FERC gave entities an extra 30 days after issuing a substantive rehearing order for Order 2023 on interconnection reforms. It is also uncertain whether all transmission planning regions around the country will comply with Order 1920 because of court challenges, though parties generally comply with orders even as they are being considered by courts.

“Two regions, the Southwest Power Pool (SPP) and the California Independent System Operator (CAISO), are pursuing reforms to more fully integrate or harmonize transmission planning and generation interconnection processes, which is encouraged but not required by Order No. 1920,” the report said.

SPP expects to send FERC its Consolidated Planning Process reforms in coordination with its Order 1920 compliance filing.

“The intent of the CPP is to fully integrate SPP’s interconnection and transmission planning process,” the report said. “The CPP has the potential to be a significant improvement, and the first of its kind in the country, but the process is still in its early stages, and it is not yet clear what the outcome will be.”

SPP has also improved its load and resource forecasting, including the incorporation of extreme weather scenarios.

CAISO received one of the highest grades in the original report, a B, with the new report noting it is the only organized market that has consistently done proactive long-term, scenario-based planning for a decade. The state’s energy and climate goals require major investments in the coming decades with CAISO’s latest 20-year transmission outlook calling for $45.8 billion to $63.2 billion in transmission investment to interconnect 165 GW of additional supply.

It has continued to build on that with its 2023-2024 Transmission Plan, which was the result of close coordination between the ISO and state agencies like the PUC and Energy Commission. It recommended 26 projects with a cost estimate of $6 billion.

“The plan builds on the previously established zonal approach, where specific resource zones and related transmission upgrades are identified,” the report said. “This coordinated process between CAISO, CPUC, and CEC and the resulting identification of resource zones helps better synchronize transmission planning, the interconnection process, and the CPUC’s Integrated Resource Planning process and resource procurement by Load Serving Entities.”

New York continues to make investments in transmission with more than $20 billion planned through NYISO and state initiatives. Shortly after the last report, the state’s utilities started the Coordinated Grid Planning Process (CGPP), a long-term, scenario-based process to better integrate their local planning processes with NYISO’s regional efforts.

“There is still work to be done to better integrate NYISO’s reliability, economic, and public policy planning as well as opportunities to optimize NYISO and the New York Public Service Commission (NYPSC) processes, and it is not yet clear how much of that can be accomplished through the CGPP,” the report said.

ISO-NE and PJM are both taking steps to develop and implement improved long-term regional transmission planning.

“ISO-NE is further along with its process,” the report said. “The region conducted a state-led, proactive, multi-value transmission study to evaluate transmission needs in 2050 required to meet state law and received tariff approval from FERC for its long-term transmission planning rules that enable the states to move forward with transmission investments in connection with the study.”

The states signaled their intent recently to focus new transmission development on unlocking generation in Maine and New Hampshire and to strengthen transfer capacity along the North-South interface. ISO-NE has also initiated the state engagement period that Order 1920 sets up to give state regulators a chance to come up with a cost allocation proposal.

PJM proposed reforms to its long-term regional transmission planning process, which would have included the development of three scenarios and more proactive generation forecasts, but those have been delayed as stakeholders decided the RTO should focus on complying with Order 1920. The reforms were a noted improvement in the new report for PJM, after it got a low grade in the initial version.

In the interim, PJM has seen needs for new transmission grow as load growth is driving new needs, with annual energy use now predicted to rise nearly 40% by 2039 and summer peak by 42 GW, or almost 30%.

MISO got one of the best grades in the previous report – a B – for its transmission planning process that was largely in line with Order 1920 already, but it has asked FERC for a one-year extension on compliance.

Still, the region has stayed the course with its long-range transmission planning (LRTP) initiative and other planning rules.

“For its second tranche, MISO has proposed a $21.8 billion portfolio of 1,800 miles of 765-kV backbone transmission lines and 1,800 miles of 345-kV lines to support the development of the backbone transmission lines,” ACEG said.

One lingering concern with MISO is its lack of a planning process in “MISO South,” which is largely Entergy’s territory, said the report.

ERCOT is the one domestic organized market FERC does not oversee, and in the 2023 report card it had low grades for transmission planning as it had not done much proactive planning in recent years.

“The region needs to improve its high-capacity transmission planning as it is facing some of the most significant load growth in the country and extreme weather will continue to stress a system that is islanded from its neighbors,” the report said. “This combination of load growth and extreme weather spurred legislation requiring reforms to transmission planning by the Public Utilities Commission of Texas (PUCT) and ERCOT.”

The processes are still in development, and it will take a few years to determine if they lead to major improvements in Texas transmission planning.