With less than two months until President-elect Donald Trump takes office, the Department of Energy’s Loan Programs Office on Nov. 25 announced three conditional loans totaling more than $11 billion, to be used to build interregional transmission, an electric vehicle factory and virtual power plants.

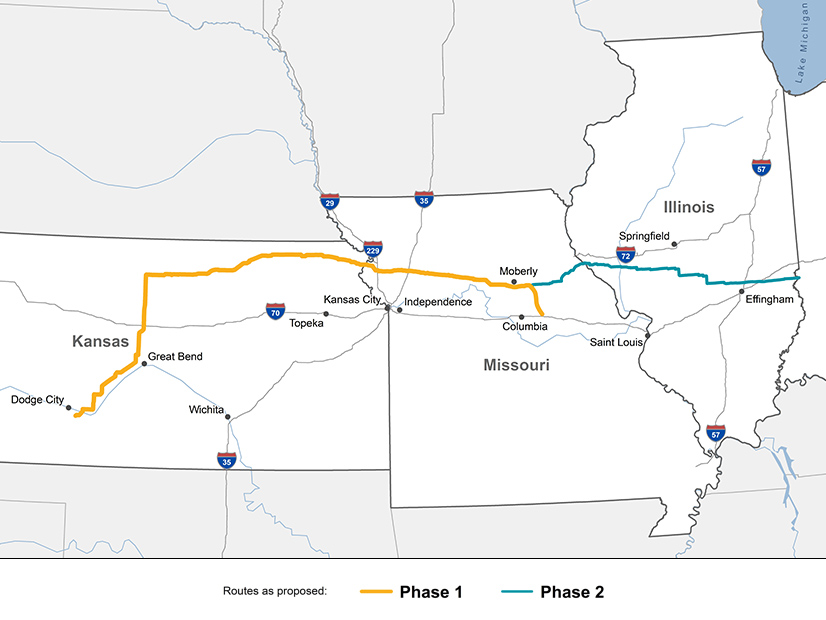

Invenergy’s Grain Belt Express, an interregional high-voltage direct current line, has received a conditional loan of $4.9 billion to help finance Phase 1 of the project, a 578-mile, 2,500-MW line running from Ford County, Kansas, to Callaway County, Missouri, according to the LPO announcement.

The second phase of the project, from Missouri to Illinois, eventually will take the HVDC line to 800 miles and connect SPP, Associated Electric Cooperative, MISO and PJM. The LPO announcement notes that DOE’s National Transmission Needs Study has estimated that interregional transfer capabilities between SPP and MISO might need to increase tenfold by 2035 to meet growing power demand.

EV maker Rivian is slated for up to $6.57 billion for the development and construction of a new plant east of Atlanta. The company plans to build out the facility in two phases, with production of its R2 and R3 SUVs beginning in 2028 and eventually ramping up to 400,000 vehicles per year, according to a Nov. 25 press release.

If finalized, the Rivian loan would be the first made under LPO’s Advanced Technology Vehicles Manufacturing (ATVM) Loan Program to manufacture EVs in the U.S., as opposed to EV components, LPO said.

A third conditional loan, for $289.7 million, will go to Sunwealth, a commercial solar developer, which will use the money to install up to 1,000 solar and storage systems across as many as 27 states. The projects will include installations on commercial and multifamily buildings, as well as community solar facilities.

Partnering with SYSO, a developer of distributed energy resources management systems, Sunwealth intends to aggregate the systems as a virtual power plant. Estimated capacity of the systems could total up to 168 MW of solar and 16.8 MW and 33.6 MWh of battery energy storage, according to LPO.

The announcements of the conditional loans signal the start of contract negotiations between LPO and the potential recipients to finalize the awards. Companies must “satisfy certain technical, legal, environmental and financial conditions before [LPO] enters into definitive financing documents and funds the loan,” the announcements all say.

These negotiations often take months, which could mean uncertainty for the awardees. Prior to his election, Trump pledged to claw back any unspent dollars from the Inflation Reduction Act, which added billions to the funds available to LPO. Some analysts have predicted a Day 1 executive order halting any further distribution of IRA funds.

In response to questions from RTO Insider, an LPO spokesperson did not comment on whether the office would be able to finalize the contracts for these three conditional loans before Trump takes office, focusing instead on the office’s role as a “bridge to bankability” for a broad range of greenhouse gas-reducing technologies.

Since President Joe Biden took office in 2021, LPO has announced 31 deals totaling approximately $47.72 billion in project investment, including 13 projects with finalized contracts for $13.18 billion in federal support. Contracts for 18 projects totaling $34.54 billion are pending, according to the spokesperson.

“Utilizing funding provided by Congress, LPO has accomplished tremendous progress in a short amount of time on bipartisan priorities including advanced nuclear, geothermal, advanced fossil energy and critical minerals,” the spokesperson wrote in an email. “As a result, there is steel in the ground and job openings at new or expanded facilities around the country.

“It would be irresponsible for any government to turn its back on private-sector partners, states and communities that are benefiting from lower energy costs and new economic opportunities spurred by LPO’s investments.”

Navigating Uncertainty

Both Invenergy and Rivian welcomed the LPO announcements, while still navigating ongoing uncertainties about their respective projects.

In an emailed statement, Shashank Sane, executive vice president and head of transmission at Invenergy, said, “We are pleased to see LPO’s evaluation validate the findings of the Kansas and Missouri public utility commissions, both of which have long affirmed our project is key to improving grid affordability and reliability across the Heartland.”

The first phase of the project has earned successive approvals from the Kansas Corporation Commission, originally in 2019 and again in 2023 to increase capacity for power delivery on the line, according to the project website. The Missouri Public Service Commission issued similar approvals in 2019 and 2022.

However, Invenergy has run up against interconnection delays in MISO, which has given the project a 2030 interconnection date, versus the project’s original target of a 2027 in-service date. In February 2024, FERC approved an interconnection agreement with the 2030 date.

Invenergy had asked MISO for a limited operation provision in the agreement to allow the Grain Belt Express to begin partial operations in 2027. (See FERC OKs Grain Belt Express Connection Agreement with MISO; Invenergy Displeased with 2030 Target.)

FERC also gave Invenergy only partial approval to charge negotiated rates on the line once in operation. (See Grain Belt Express Gets Partial Approval for Negotiated Rate Authority from FERC.)

Rivian founder and CEO RJ Scaringe said the LPO’s loan, if finalized, “would enable Rivian to more aggressively scale our U.S. manufacturing footprint. … A robust ecosystem of U.S. companies developing and manufacturing EVs is critical for the U.S. to maintain its long-term leadership in transportation.”

Rivian suspended work on the new plant in Georgia in March, shifting production of its R2 SUV to its plant in Illinois, a decision saving the company $2.25 billion, according to a press release.

The company has not specified when it will resume work on the plant, but according to a spokesperson, “Georgia will provide the volume of production essential for us to enter new markets, including international ones. We expect to start construction to meet our stated goal of start of production in 2028.”