Facing proliferating load additions, MISO announced it has begun developing in-house long-term load forecasts after years of relying on outside help to form load outlooks.

Staff made the announcement at a Dec. 19 workshop, where they shared findings from MISO’s inaugural effort to produce a 20-year forecast. MISO previously relied on a combination of a third-party consultant and Purdue University’s State Utility Forecasting Group to prepare long-term load forecasts.

Executive Director of Market and Grid Research DL Oates said “it’s pretty clear” the load growth picture in the footprint is changing rapidly, propelled by a manufacturing revival, transportation electrification and data center growth spurred by rapid AI advances.

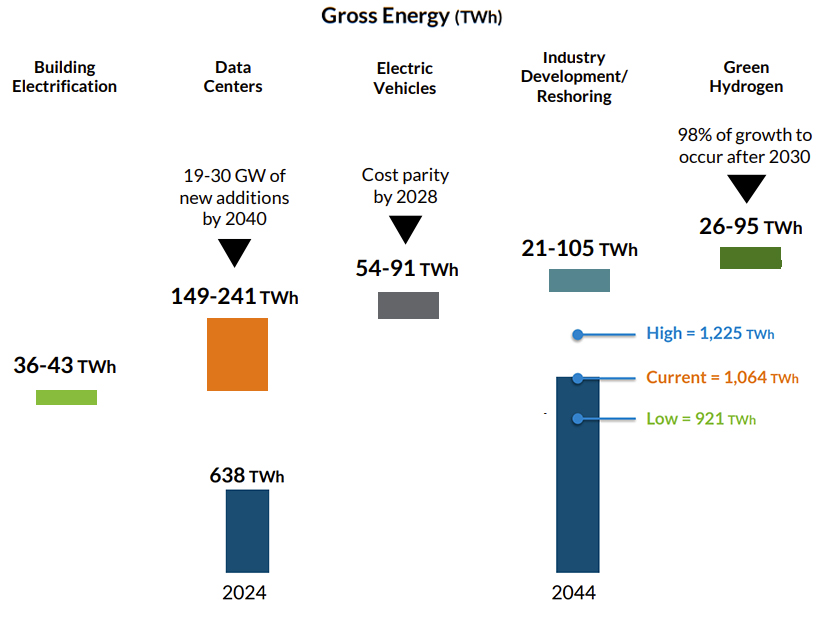

MISO forecasts its 638 TWh of gross energy in 2024 could grow to anywhere between 921 TWh and 1,225 TWh in 20 years, driven by data centers, electric vehicles and a burgeoning green hydrogen industry.

Executive Director of Transmission Planning Laura Rauch said MISO’s load growth forecasting will factor heavily into MISO’s three, 20-year futures scenarios, which are used to inform long-range transmission planning. The grid operator has committed to revising its futures throughout 2025 to account for more load and more clean energy transformation. (See MISO Pauses Long-range Tx Planning in 2025 to go Back to the Futures.)

MISO engineer Brad Decker said MISO and the rest of the country are exiting a roughly 15-year period of stagnant, average 0% load growth. MISO now expects annual load growth of 1 to 2% through 2044.

MISO believes load growth from electrification to be about three times higher than previously projected through long-term forecasts. Decker said the steeper growth rate over the next 20 years is due to the “gold rush” to data centers, He said MISO is gearing up for anywhere from 19 to 30 GW of new data center additions by 2040.

Within MISO, Iowa, Minnesota and Indiana will lead in data center growth, Decker said, due to availability of land, interconnection opportunities and fiber connectivity. He also noted that electric vehicles are expected to reach cost parity with gas vehicles in the next few years.

However, Decker said MISO won’t rule out an economic slowdown that could suppress growth. He said though he thinks much of the load growth will come to pass, there are some “cracks” forming through the U.S., with consumers and companies carrying higher debt. MISO also allowed that most growth in manufacturing and industry will take place post-2030 and is “highly contingent on continued policy support” through federal laws.

Decker said he expects some of the mystique around load growth from data centers to evaporate over the next few years. He said pinning down load growth from electric vehicles a few years back was similarly nebulous.

“Load has been relatively flat, but that paradigm is coming to an end,” MISO Strategic Insights Manager Dominique Davis said. She said MISO will continue researching to better understand future demands and provide “directional insights” to its members. She said MISO will incorporate the latest macroeconomic assumptions and analyses that seek to capture fast-moving industry trends.

Davis added that MISO will look for ways to add machine learning and more automation in its forecasting process, perhaps leading to programmed data exchanges with stakeholders, load-serving entities and other third parties who help shape the forecasts.

Davis also said the RTO has more work to do to understand to what extent distributed energy resources will offset load growth.

MISO is taking stakeholders’ opinions on its internal and more comprehensive load forecasting through Jan. 15.