CAISO, California and other parts of the Western Interconnection are moving into 2025 with a heavy load of priorities: implementing a day-ahead market, developing the transmission and other infrastructure needed to meet ambitious climate goals, and moving forward with new and continuing initiatives to address some of the ISO’s biggest challenges.

But the ISO is no stranger to ambitious workloads.

“We’ve been in a heavy lift for several years, and we’ve already been anticipating this, and so we’ve been preparing,” CAISO COO Mark Rothleder said in an interview with RTO Insider.

Key among CAISO’s priorities: continuing the steadfast work required to implement the Extended Day-Ahead Market (EDAM) in time for the 2026 launch date.

“2025 is going to be a major, major focus on implementation of EDAM,” CAISO CEO Elliot Mainzer said at a Dec. 18 joint meeting of the ISO Board of Governors and Western Energy Markets Governing Body.

Several entities have committed formally to joining EDAM over SPP’s Markets+, including PacifiCorp, Portland General Electric, Los Angeles Department of Water and Power, and the Balancing Authority of Northern California. Others have indicated a leaning toward joining in the year ahead, including Idaho Power, NV Energy, Berkshire Hathaway Montana, and Public Service Company of New Mexico.

Others, including the Western Area Power Administration’s Desert Southwest Region, along with Arizona G&T Cooperatives, have indicated strong interest. (See Arizona G&T Cooperatives Announces Pursuit of EDAM Benefits Study.)

PacifiCorp’s “go-live” date is scheduled for the spring of 2026, and PGE’s is slated for that fall.

“We’re going to be doing a lot of work this year to keep both of those entities on track for implementation,” Mainzer said. “I’m very confident that we’re going to continue making progress there.”

But this won’t come without challenges. PacifiCorp, the first Western entity to begin taking steps to join EDAM, already faces scrutiny over its implementation process.

During the Dec. 18 meeting, Carrie Bentley, a consultant representing the Western Power Trading Forum (WPTF), told the ISO board and Governing Body of WPTF’s intent to file a FERC protest in January over PacifiCorp’s proposed tariff changes to implement EDAM.

“WPTF has significant concerns with this filing, specifically that PacifiCorp proposes to allocate virtually all congestion revenues it receives from … CAISO to measured demand,” Bentley said in the Dec. 18 meeting. “At the most basic level, PacifiCorp’s filing goes against a foundational aspect of the EDAM market design — that fundamentally, EDAM is a day-ahead market overlaid on OATT transmission rights, and it’s not a full ISO or RTO that includes congestion management instruments.”

PacifiCorp’s filing, Bentley added, “hands opponents of EDAM a valuable weapon to undermine it, which is completely unwarranted,” and was not part of the EDAM design agreement.

Mainzer validated Bentley’s concerns.

“We are very aware of the nature of your concerns,” Mainzer said. “I think we share your optimism and hopefulness that this matter can be resolved in a mutually acceptable manner, and we will continue to work with PacifiCorp and others to support what they need to bring it to a satisfactory resolution.”

‘In Good Shape’

In 2025, reliability will be — and always is — “job number one,” Mainzer said, emphasizing that the ISO already has begun planning for winter.

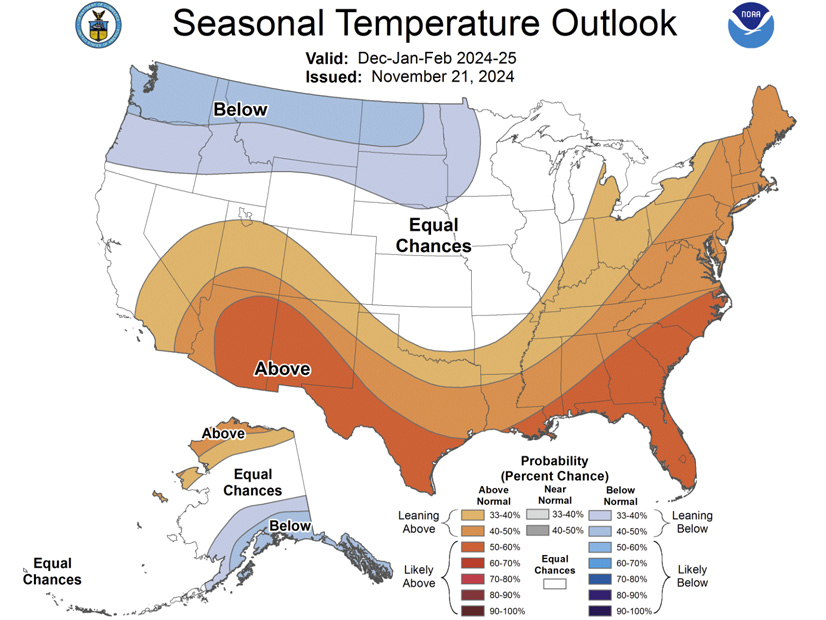

CAISO’s forecast team expects above-normal temperatures across California and in the Desert Southwest from December through February, with the highest likelihood of above normal temperatures in the southern region. In contrast, there’s a greater potential for below-normal temperatures in the Pacific Northwest.

Northern California saw above-normal rainfall through early December, Mainzer noted, which then “dissipated a bit” as the month progressed. Between December and February, there is a projected risk of below-normal precipitation for the Desert Southwest and a higher likelihood of above-normal precipitation in the Pacific Northwest.

Current reservoir conditions across California and the West are at about half-capacity, so the expected precipitation in the Northwest could help the region recover some of its hydro storage, with the Desert Southwest expected to remain at greater risk of low water conditions, Dede Subakti, the ISO’s vice president of system operations, wrote in a Dec. 20 posting on the ISO’s Energy Matters blog.

“We’re going to be keeping a close eye on the forecast, temperature and precipitation,” Mainzer said. “Fortunately, given this outlook, our operations team is reporting that all major transmission paths are expected to be fully available to support transfers across the region, allowing market participants in balancing areas to move energy across the system as needed.”

Resource adequacy is “looking good,” Mainzer added, showing sufficient supply to meet firm demand through the winter.

CAISO has intensified its winter readiness planning, with more time and resources being spent on forecasting, coordination and preparation around cold weather events, Subatki wrote in his post.

That comes partly in response to the January 2024 cold snap that pushed multiple Pacific Northwest balancing authorities to the brink of rolling blackouts and provoked an extended debate about how the ISO managed power flows — and its markets — during the event. (See NW Cold Snap Dispute Reflects Divisions over Western Markets and CAISO Seeks to Dispel CRR ‘Myths’ Around January Cold Snap.)

“The ISO is prepared and has been working hard to make sure all the customers and market entities we serve in California and the broader West are ready for winter,” Subakti wrote. “Mother Nature often has her own plans and weather predictions are never 100% accurate, regardless of what season we’re in. But with all of the work and preparation, we are going into the winter of 2024-2025 in good shape.”

New and Continued Initiatives

CAISO is moving into 2025 with 10 active stakeholder initiatives, and several include sub-working groups dealing with some aspect of EDAM implementation.

In the Greenhouse Gas Coordination Working Group, ISO staff and stakeholders are in the process of developing a process for accounting for GHG emissions in EDAM for states that don’t price carbon but have other policies to reduce emissions. (See Western Market Developers Compare Approaches to GHGs.) The ISO is expected to develop a policy in the first quarter of 2025 and make a decision in the second.

In the Price Formation Enhancements Initiative, staff and stakeholders are, among other things, considering whether to include fast-start pricing in the EDAM design. (See CAISO Considering Fast-start Pricing for Extended Day-Ahead Market.) A straw proposal for this initiative is expected in Q2, with policy development in Q3.

Other efforts, such as the Storage Design and Modeling Initiative, are new, but piggybacking on the work of prior working groups. This effort will continue to tackle an array of challenges related to the market participation of storage resources, including further addressing bid cost recovery issues and developing a default energy bid formula specifically for batteries. (See CAISO Launches New Initiative for Storage Resource Design.)

‘We’ve Got to Push Through’

Rothleder reflected on the past four years, highlighting that since 2020, when the ISO faced challenges meeting demand, the state has stepped up to increase the amount of capacity being brought on, and that pace of development has increased.

Going into 2025, the pace must be sustained, Rothleder emphasized, to maintain reliability and meet the state’s climate goals.

“Taking your foot off the gas pedal is not going to be helpful at this point,” Rothleder said. “We’ve got to push through, continue the development, continue the transmission and continue the collaboration across the region because the lack of not doing so will be both costly and create more operational challenges for not coordinating and collaborating across the greater West.”