Known for his no-nonsense demeanor, ERCOT COO Woody Rickerson was especially candid in December when he appeared before a legislative committee overseeing the state’s grid.

Asked to respond to a lawmaker’s concerns that assessments of Texas’ energy supplies are offering a misleadingly optimistic portrayal of the state’s energy production, Rickerson replied, “I don’t have a positive sense on this at all.”

State Sen. Charles Schwertner (R), the joint committee’s chair and architect of many of the new laws put in place after the disastrous 2021 winter storm, asked Rickerson to clarify.

“I don’t have a positive sense that we have enough generation on the books to serve the load that’s expected,” Rickerson replied.

The Texas grid operator raised eyebrows last April when it said its load-growth forecasts had ballooned by 40 GW over the previous year’s estimates. It said it anticipates about 152 GW of new load by 2030.

The state’s business-friendly environment attracts investors and developers who want to build data centers, mine cryptocurrency and employ artificial intelligence, all massive energy consumers. Industrial electrification, electric vehicles and now hydrogen facilities will only increase the strain on the ERCOT grid. The ISO has about 103 GW of installed capacity for a system that peaks around 85 GW of load in the summer and 78 GW in the winter.

“We’re the best market in the country to react to that kind of growth potential,” ERCOT CEO Pablo Vegas said during the ISO’s April Board of Directors meeting, pointing to the ability to interconnect resources “faster than anyplace else in the country.”

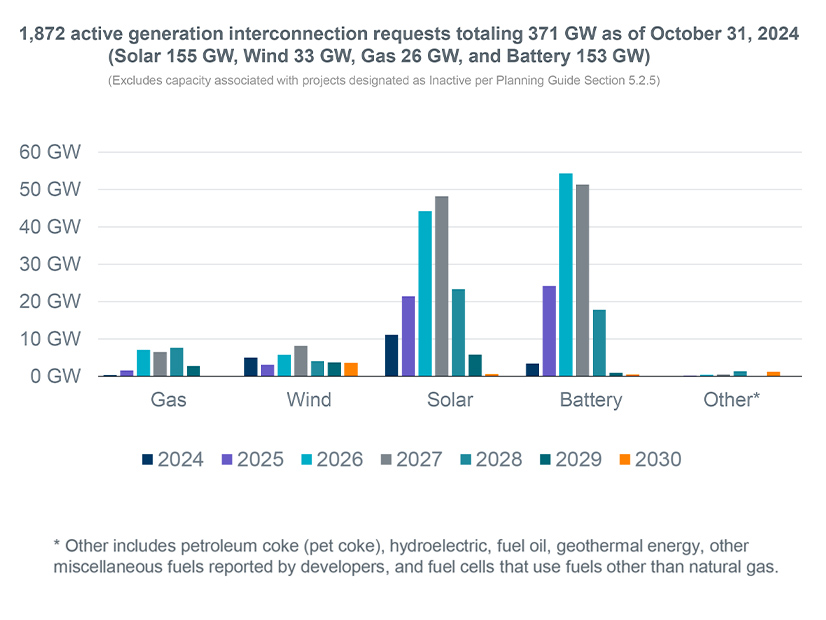

“We continue to add generation at really an incredible rapid pace,” he told his board in December, pointing to an interconnection queue with more than 371 GW of capacity.

Still, ERCOT has decided it had to adapt and take a different approach to meeting future demand that ensures all system-planning processes can “adapt to better serve” the state’s economy. Central to that is a new law requiring the ISO to include prospective load identified by transmission service providers, rather than factoring in unsigned load.

Solar resources (155 GW) and battery storage (141 GW) account for 83% of the 1,775 active interconnection requests. At the same time, Texas is trying to attract more thermal generation with its Texas Energy Fund, established by state law and approved by voters in 2023.

The fund’s In-ERCOT Generation Loan Program offers a low-interest (3%) loan and grant program of up to $7.2 billion for dispatchable generation. It has received 18 applications for 9.72 GW of potential new generation seeking $5.34 billion in loans; the Public Utility Commission will vet the applicants during the year before awarding the grants.

Dealing with Growing Loads

Meanwhile, ERCOT is tracking more than 40 GW of large-load requests that may or may not show up.

“There’s no real cost associated with saying, ‘Hey I’m a load, and I want to come to the grid,’ and there’s no forking over of ‘X’ dollars if you’re a large load, for instance,” Schwertner said during the December joint committee meeting. “We should have a great handle on what that load is, where it’s going to be added.”

Schwertner suggested assessing an upfront fee for those wanting to interconnect their large loads with ERCOT, an issue that likely will be discussed during this year’s legislative session, which runs from Jan. 14 to June 2.

Vegas says the current generation mix is more diverse than ever, can be built faster and is located farther from load centers. While the generation is coming online quickly and load growth increasing faster, it still takes three to six years to energize transmission in ERCOT (about half the time required in other regional grids).

Speaking at an Energy Bar Association symposium in October, ERCOT General Counsel Chad Seely said the ISO often is asked how much its recommended transmission improvements will cost consumers and whether the new buildout will be sufficient “if all that load eventually shows up over the next five, seven years.”

ERCOT staff continues to work with stakeholders to define rules and has completed its Permian Basin Reliability Plan, as directed by the PUC. The plan recommends five 345-kV import paths into the region and, in a first for the state, three 765-kV import paths.

With estimated costs of $13.77 billion for the 765-kV lines and $12.95 billion for the 345-kV imports, the plan exceeds the price tags of previous annual infrastructure portfolios. Seely said the plan is necessary to meet the region’s load growth, which comes not just from oil and gas production but also data centers, crypto facilities and other large industrial users.

“That is the equivalent of taking North Texas [and the DFW Metroplex], from a load standpoint, and putting it out in West Texas,” Seely said. “They want reliable service, so we’ve recommended a lot of transmission infrastructure, both locally and large-scale highway infrastructures.”

Transmission providers are preparing certificates of convenience and necessity applications. The PUC has set May 1 as a date to determine which import paths will be used.

Prompted by a 35.7% increase in projected load growth from the year before, ERCOT’s annual Regional Transmission Plan (RTP) included more than 50 GW of individual loads larger than 75 MW. Released just before the holidays, the plan includes more than 274 transmission projects and about 6,000 miles of line upgrades, rebuilds, conversions and additions to meet the forecasted load growth in the traditional 345-kV plan. In comparison, the grid operator identified a combined 262 projects in its 2023 and 2022 RTPs.

The 2024 plan also considers a 765-kV plan as an alternative to the traditional 345-kV plans. ERCOT will file a 345-vs.-765 comparison with the PUC by late January and will host a workshop on the differences Jan. 27.

RTC with an ERCOT Twist

After the commission shelved the once-favored performance credit mechanism market change, the ISO says its staff and stakeholders will work to complete the real-time co-optimization (RTC) project by the end of the year. Postponed after Winter Storm Uri, RTC will save about $1.6 billion annually in reduced energy costs by procuring energy and ancillary services every five minutes. (See Texas PUC Shelves PCM Design Over Lack of Benefits.)

RTC market trials are scheduled to begin in May. The project has a December targeted go-live date.

Once RTC becomes a part of the ERCOT market, staff will begin adding a new standalone ancillary service, dispatchable reliability reserve service. DRRS will be procured in the day-ahead and real-time markets from eligible generators who must be online within two hours of instruction and run at least four hours at their high-sustained limit. The amount of DRRS procured will reduce reliability unit commitments.

While RTC is common in most regional grids, ERCOT is tacking in a different direction with its reliability standard. As currently proposed, the standard includes the normal one-in-10 days loss-of-load expectation found in other regional grids, but the ISO also will measure duration (no more than 12 hours in any event) and a yet-to-be-determined magnitude. (See ERCOT’s Vegas Touts New Reliability Standard.)

ERCOT says this will result in a comprehensive reliability standard that better characterizes the real risk probabilities of a grid event and its impact on consumers. Staff are finalizing the magnitude element and working on the various parameters and scenario modeling for the new standard.

Speaking to the Texas Reliability Entity in December, Vegas said, “We’re going to now have a yardstick that is going to effectively help us measure how we think the ERCOT market will perform in some period of time.”

ERCOT is also working to improve its reliability must-run and must-run alternative processes, a result of CPS Energy’s attempt to retire three aging gas units this year. Staff has said the units are needed for reliability purposes and are pursuing an RMR contract for the largest resource. (See related story, ERCOT Finds Little Interest in MRAs for San Antonio Units.)

“Some of our thermal fleet is getting quite aged,” Vegas told the board in December. He said about 40% of the ERCOT fleet is over 30 years old and 30% is over 40 years old.

“Over time, as new resources are built and developed and brought onto the grid, you will expect the older, less economic resources to be retiring,” Vegas said. “We want to make sure that we’ve got a robust reliability must-run or must-run alternative process that we can leverage to get the most efficient and effective solutions when we are faced with that circumstance again in the future.”