Prices in CAISO’s Western Energy Imbalance Market fell sharply in the third quarter of 2024 compared with a year earlier, as declining gas costs outweighed the impact of increased summer loads, the ISO’s Department of Market Monitoring (DMM) found.

Fifteen-minute market prices across the WEIM averaged about $40/MWh, down 31% from Q3 2023, while the five-minute price average fell by 32%, according to the DMM’s Q3 Report on Market Issues and Performance, which also touched on two issues supporters of SPP’s Markets+ raised late last year in one of a series of “issue alerts” comparing the SPP market to CAISO’s Extended Day-Ahead Market (EDAM).

Day-ahead prices, which currently apply only to CAISO’s balancing authority area, fell by 28% year over year, the DMM found.

“Lower gas prices … brought electricity prices down with them,” Ryan Kurlinski, senior manager in the ISO’s Market and Policy Analysis Group, said during a Jan. 9 call to discuss the DMM report.

Kurlinski noted that Q3 gas prices were down 37 and 58%, respectively, at the PG&E Citygate and SoCal Citygate delivery points in California and fell by 60% at the Sumas hub in the Pacific Northwest.

Northwest hydroelectric output also increased by 15% compared with a year earlier, making the region a net exporter on average during all-in hours for the quarter.

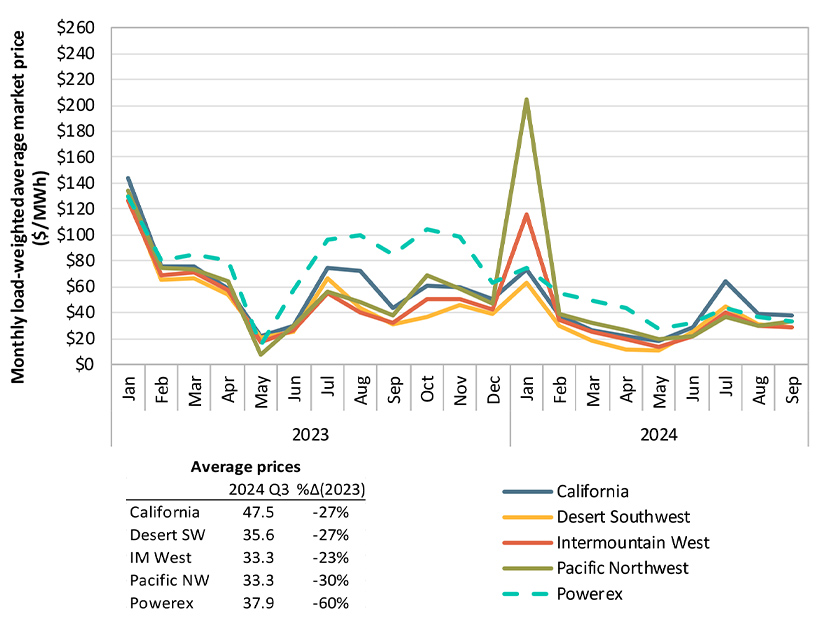

In the WEIM’s 15-minute market, prices averaged $47.50/MWh in California (down 27%), $35.60/MWh in the Desert Southwest (down 27%) and $33.30/MWh in both the Intermountain West and Pacific Northwest (down 23% and 30%, respectively). Powerex average prices declined by 60% to $37.90/MWh.

“The [greenhouse gas] costs in California were the main contributors to elevating prices in California balancing areas relative to other WEIM balancing areas,” Kurlinski said.

He added that “significant congestion” on WEIM transfer constraints into the Powerex and Bonneville Power Administration BAAs led to relatively higher prices there relative to other non-California BAAs.

The DMM also found that WEIM 15-minute market prices in the Northwest and Southwest were “significantly lower” than bilateral market day-ahead prices for power traded on the Intercontinental Exchange for the Mid-Columbia and Palo Verde hubs. In contrast, prices for day-ahead power traded in CAISO’s integrated forward market (delivered in the Pacific Gas and Electric and Southern California Edison areas) tracked more closely with 15-minute prices, reflecting the kind of price convergence that organized markets are designed to achieve.

In Q3, average hourly prices continued an ongoing pattern of following net load, with the highest prices occurring during net peaks accompanying evening ramps and — to a lesser extent — morning peaks.

Loads, Renewable Output up

The DMM found load in the WEIM increased 4% compared with the third quarter of 2023 and had more hours with high system load (over 110 GW) and fewer hours with low system load (below 80 GW).

The Monitor additionally determined that peak load in most WEIM BAAs did not coincide with the market’s overall system peak load of 135 GW occurring July 10, which Kurlinski noted was much lower than the sum of the peak load for each individual BAA: 146 MW.

“This 11-GW difference is one way of describing the benefit of multiple balancing areas [having] peak loads occurring on different days and times and being in one market,” Kurlinski said.

The report showed WEIM hourly transfers averaged about 4,560 MW, down 10% from a year earlier.

“During mid-day solar hours, the majority of regional transfers were from the CAISO area to the Pacific Northwest and non-CAISO California areas. During morning and evening hours, the Desert Southwest was the major exporting region,” the report said.

Average hourly generation from WEIM renewable resources increased by 4,110 MW (11%), with solar accounting for more than 60% of the increase. Meanwhile, average output from coal-fired generators in the Intermountain West fell by 1,220 MW (27%) while gas generation increased by 810 MW (28%).

Batteries played a much greater role in operations compared with a year earlier, as average hourly battery discharge in California and the Desert Southwest increased by 550 MW (87%) and 310 MW (130%), respectively. (See Batteries, Energy Transfers Support ‘Uneventful’ Summer in West.)

Kurlinski pointed out that 10 WEIM entities opted into the market’s assistance energy transfer program for at least one day during Q3, with seven receiving additional transfers after failing the WEIM resource sufficiency evaluation (RSE) ahead of a delivery interval. Public Service Company of New Mexico, which failed the RSE’s upward flexibility test during 1% of intervals, was the largest recipient of assistance transfers.

Special Issues

The DMM report additionally touched on two matters raised by supporters of Markets+ in a November “issue alert” that took aim at CAISO’s dual roles as operator of and participant in the EDAM, which will expand the scope of the WEIM to include day-ahead trading. (See Markets+ ‘Alert’ Covers CAISO’s Dual Roles as Market Operator, BA.)

The first of those matters deals with “load conformance,” a WEIM process that allows a participating BA to adjust its demand forecast in the hour-ahead scheduling process (HASP) and 15-minute market to better position itself for a real-time interval.

In the alert, Markets+ supporters contended that, among WEIM entities, CAISO has a “unique” history of making unusually large upward adjustments to its demand forecasts during morning and evening peaks “to acquire flexible capacity through additional energy imports rather than explicitly purchasing flexible capacity itself.” CAISO has contested the second part of that contention, while pointing out that the adjustments carry a financial price for the ISO.

While the DMM’s Q3 report didn’t wade into that specific controversy, a “special” section within the report notes that “[t]he size and frequency of CAISO balancing area operators’ use of imbalance conformance in the 15-minute market made it an outlier amongst WEIM areas” in the third quarter and resulted in increases in average hourly imbalance conformance adjustments in the hour-ahead and 15-minute markets relative to Q3 2023, especially during evening ramps.

“Imbalance conformance over the evening peak net load hours continued to be significantly larger in the hour-ahead and 15-minute markets than in the five-minute market. This contributes to higher prices in the 15-minute market than in the five-minute market over these hours,” the DMM said.

The second matter in the November issue alert dealt with CAISO’s decision in 2023 to block WEIM transfers into the ISO in the HASP and 15-minute market — but not real-time — during net peak load hours from July to November. The Markets+ supporters pointed out that the DMM itself had determined the practice “created a significant, systematic modeling difference between the 15-minute and five-minute markets,” which negatively “impacted market results in several ways.”

CAISO countered that it imposed the limits after large volumes of WEIM transfers scheduled in the HASP began failing to materialize in real time.

The DMM report noted that CAISO didn’t resume the practice at all last summer.

“California ISO balancing area operators did not implement peak hour dynamic WEIM transfer restrictions into the CAISO area during any hours of the third quarter of 2024,” it said.