VALLEY FORGE, Pa. — PJM and its Independent Market Monitor presented a joint proposal to rework the balancing operating reserve (BOR) credit structure to address a scenario they say can result in generators receiving uplift payments despite not following dispatch orders.

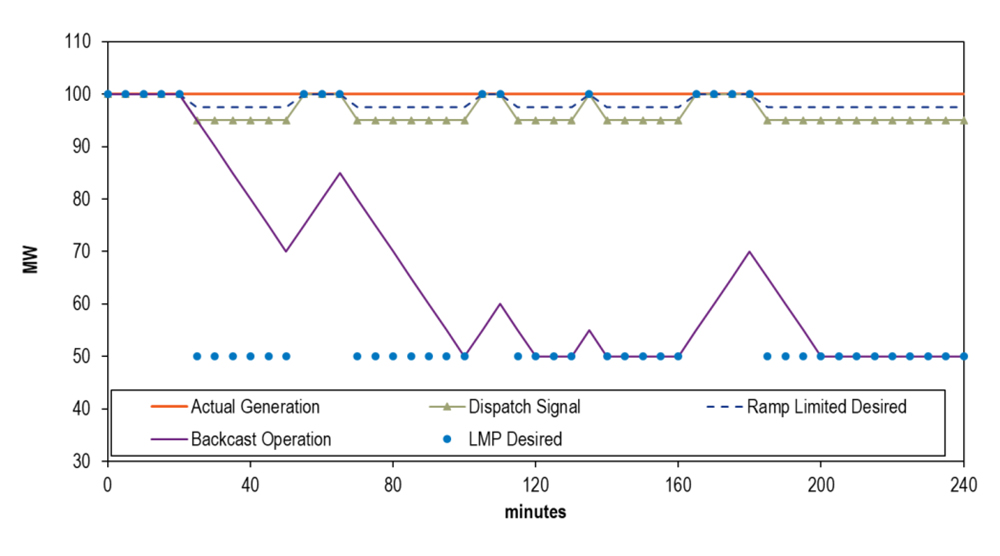

PJM Senior Director of Market Settlements Lisa Morelli said the current metrics determining BOR credits consider only the most recent five-minute interval, looking at what a unit was dispatched to do and how it responded. The proposal would create a new Tracking Ramp Limited Desired (TRLD) metric used to determine uplift and deviation charges based on how a resource conformed to its dispatch signal over time.

Morelli gave an example of a unit operating at 100 MW being dispatched down to 95 MW in accordance with its ramp rate. If that unit ignored the signal and stayed at 100 MW, it would not exceed the 10% margin that defines when a unit is deviating from dispatch. Additionally, since dispatch is limited by ramp rates in the next interval, PJM could only bring it down to 95 MW again.

As the intervals pass by, a widening discrepancy can form between where the unit is and where it would be had it followed instructions from the start, but the difference between the unit output and dispatch signal would remain 5 MW.

Joel Luna, a market analyst with the Monitor, said that between 2018 and 2023, PJM paid $17.9 million in uplift to units that did not operate as requested.

Stakeholder Takes

Several stakeholders requested additional time to review the proposal before the MIC votes on endorsement, which is currently slated for its Feb. 5 meeting.

Erik Heinle, of Vistra, questioned why PJM could not use a unit’s security constrained economic dispatch (SCED) instructions to determine uplift and deviation charges.

“You’ve got SCED telling you one thing, and you’ve got this backcast after-the-fact telling you something else,” he said.

PJM’s Brian Weathers said SCED is optimal for determining uplift only if a unit is responding to the signal, but because it is parameter-limited, it becomes useless if a unit is not following instructions. He said the proposal is not meant to reduce BOR credits, but rather to “right size uplift” to be paid to those who follow dispatch instructions.

Luna said the proposal would not change the dispatch signal, which must continue respecting resource parameters to avoid creating power imbalances.

“We’re not saying the signal is wrong, and that will remain the same. PJM will have to operate the system as given,” he said.

Tom Hyzinski, of the GT Power Group, said if a generator is late to follow a signal to change its output, it could continue to rack up deviation charges while attempting to catch up. If locational marginal prices increase while a unit is ramping down, following the price signal to reverse direction and increase output could move it further from its TRLD, increasing deviation charges.

Weathers said LMP profits would outweigh the deviation charges when prices might be above the tracking limit, meaning generators would maximize their profits by following SCED rather than chasing the tracking metric.

Brock Ondayko, of AEP Energy, questioned how a unit can know if it is following TRLD in real time, adding that there needs to be incremental transparency into how this works.

Since the best financial outcome for the generation owner is to follow SCED rather than trying to maximize uplift that may not be available, PJM doesn’t see the value in having the tracking limit available in real time.

Rory Sweeney, of the Northern Virginia Electric Cooperative, asked if a systemwide analysis has been conducted to evaluate how the change would affect generators. Luna and Morelli said that had not been done, with Luna adding the impact would be positive because it would lead to more accurate market signals. Sweeney said the same belief was held when the status quo rules were implemented in 2022.

The proposal also would add lost opportunity costs (LOCs) to the revenues that offset BOR credits, which Weathers said would avoid possible double payments between the two.

Eligibility for BOR credits would be expanded to begin when PJM commits a unit, even if it was not online at that time, and continue through the end of the resources’ day-ahead commitment or minimum run time. Weathers said this could increase uplift when PJM actions cause a resource to miss its commitments, such as dispatchers holding a unit online longer and causing its minimum downtime to overlap with the start of its day-ahead commitment.

Given the scale of the changes, Morelli said PJM would include simulated settlement results showing how the changes would impact market participants in late 2025, with actual implementation around a year later.

“You’ll have a good long time period to look at the tracking limit time period and become comfortable with it before we start using it,” she said.