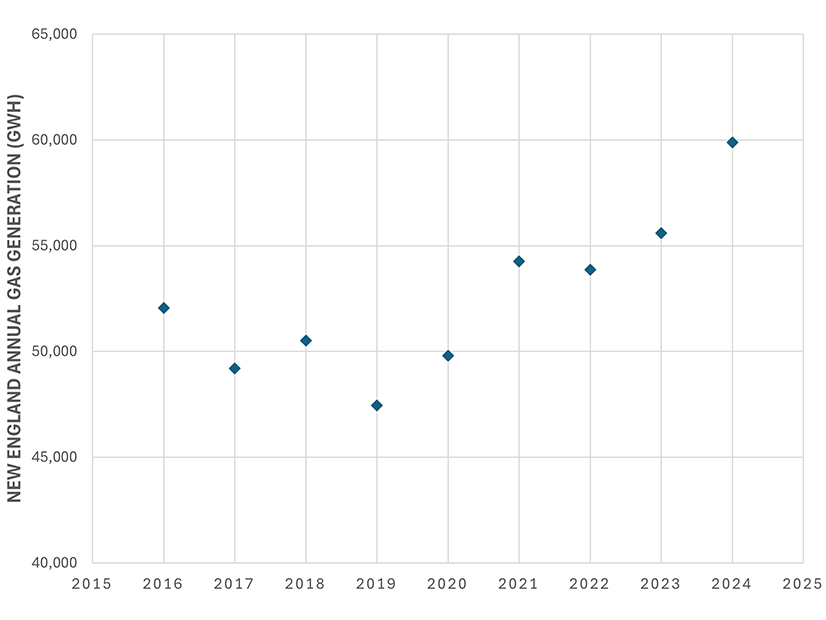

As overall power production ticked up in New England in 2024, natural gas generation reached its highest annual total in the region’s history, accounting for over 55% of all generation and 51% of net energy for load, according to new data from ISO-NE.

Natural gas generation provided 59,883 GWh of power in 2024, up from 55,585 in 2023, which resulted in an increase in annual power sector emissions. Oil generation remained steady year-over-year, while coal generation accounted for 234 GWh, a small increase relative to 2023.

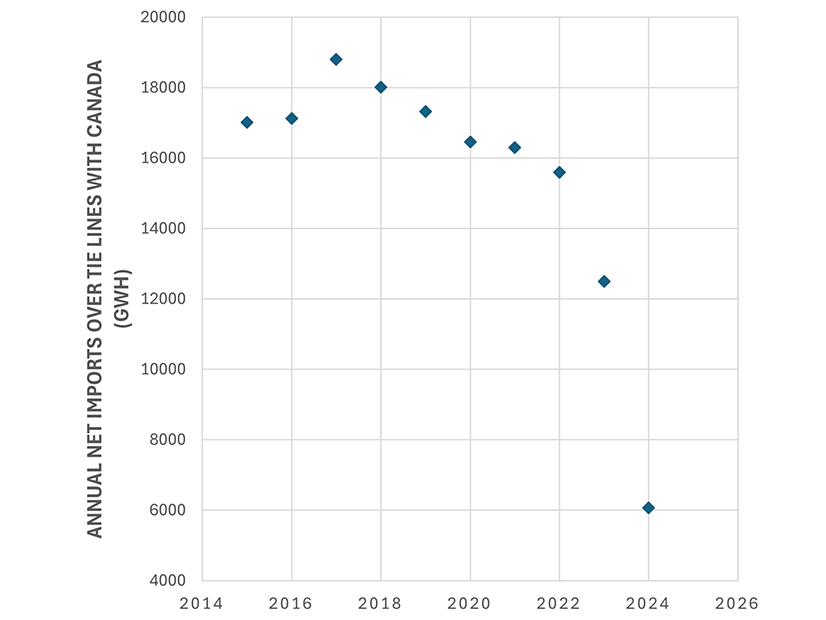

One of the largest year-over-year changes came from a major reduction in power imported from Canada, as a massive drought caused Hydro-Québec to reduce its exports. Net imports from Canada declined for the second straight year, dropping to 6,067 GWh, less than half of the 2023 levels.

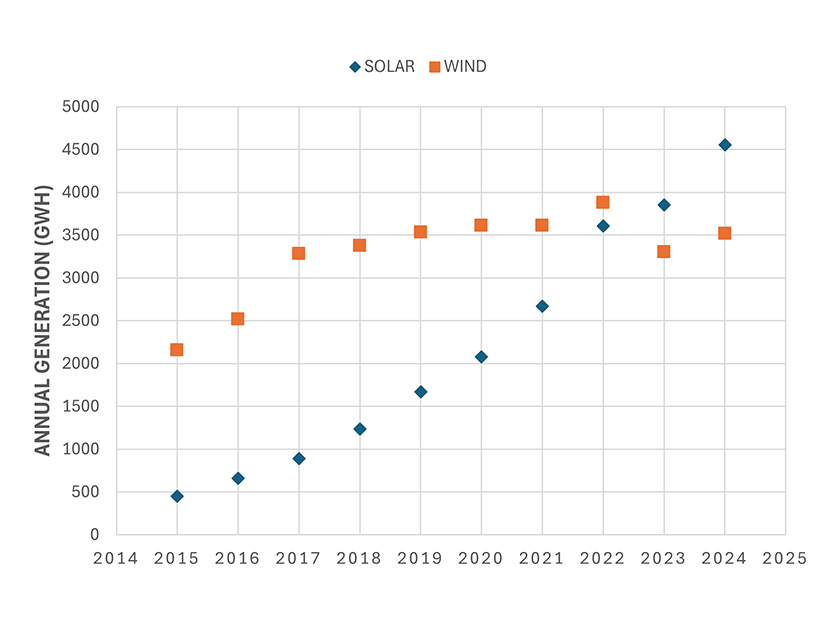

For renewables, solar and wind generation both increased in 2024 compared to 2023, but they remain a relatively small part of the region’s resource mix. Solar increased from 3,852 GWh in 2023 to 4,554 GWh, while wind increased from 3,302 GWh to 3,517 GWh. This does not include power from behind-the-meter solar, which reduced net load by about 4,300 GWh in 2023.

While solar has grown steadily over the past 10 years, wind power production has been largely stagnant since 2017. Despite the year-over-year increase, wind was lower in 2024 compared to 2019-2022. This could change rapidly if Vineyard Wind 1 and Revolution Wind ramp up power production in 2025 and 2026.

Nuclear generation rebounded in 2024 after a significant down year in 2023. It has remained relatively consistent around 26,000 GWh of annual generation after the closure of the Pilgrim Nuclear Power Station in 2019.

The decrease in imports, coupled with the spike in gas generation, contributed to the highest annual generation total in the region since 2013. The peak load in 2024 was 24,871 MW, up 828 MW from 2023 but in line with the region’s average annual peak over the past 10 years.

Both the peak load and total annual generation remain well below the highs reached in the mid-2000s. The region hit its all-time peak in 2006 at 28,130 MW, while total generation peaked at 131,877 GWh in 2005.

In the coming years, ISO-NE’s peak load and overall generation requirements are projected to increase exponentially with heating and transportation electrification. The RTO projects the peak load to increase by about 10% by 2033, coupled with a 17% increase in electricity consumption. (See ISO-NE Predicts 10% Increase in Peak Demand by 2033.)

These increases likely will accelerate in the years prior to 2050. ISO-NE projected in its Economic Planning for the Clean Energy Transition study that the region’s peak load will reach 60.8 GW by 2050. Massachusetts’ 2050 Decarbonization Study projected a more modest 57 GW.

As demand increases, the states will need to find a way to reverse the increase in gas generation to meet their climate goals for 2030 and beyond. ISO-NE has expressed interest in establishing new market mechanisms to support low-carbon resources and dispatchable resources, but the states have been slow to pursue these options.

Beyond emissions concerns, there are physical constraints to how much more gas generation the region could add to meet rising demand, particularly during the winter. Gas utilities reserve much of the pipeline capacity into the region in the winter to meet heating needs, limiting gas generation during these periods.

In 2023, Enbridge proposed a significant pipeline expansion project, intended to help ease some of the region’s gas constraints. The company marketed the project to meet growing demand from generation and local distribution companies. (See Enbridge Announces Project to Increase Northeast Pipeline Capacity.)

It has not filed the project with FERC, and it told a municipal utility in May that it is “looking to get signatures on the precedent agreements, and at that point, we will file with [FERC].”

However, Enbridge and the gas utilities could face a challenging regulatory environment to approve contracts for the project in Massachusetts, where regulators are pushing the utilities to transition away from natural gas in accordance with the state’s decarbonization requirements.