CAISO’s Western Energy Imbalance Market (WEIM) provided participants $374.25 million in benefits during the fourth quarter of 2024, down about 4% from the same period a year earlier, according to an ISO report released Jan. 30.

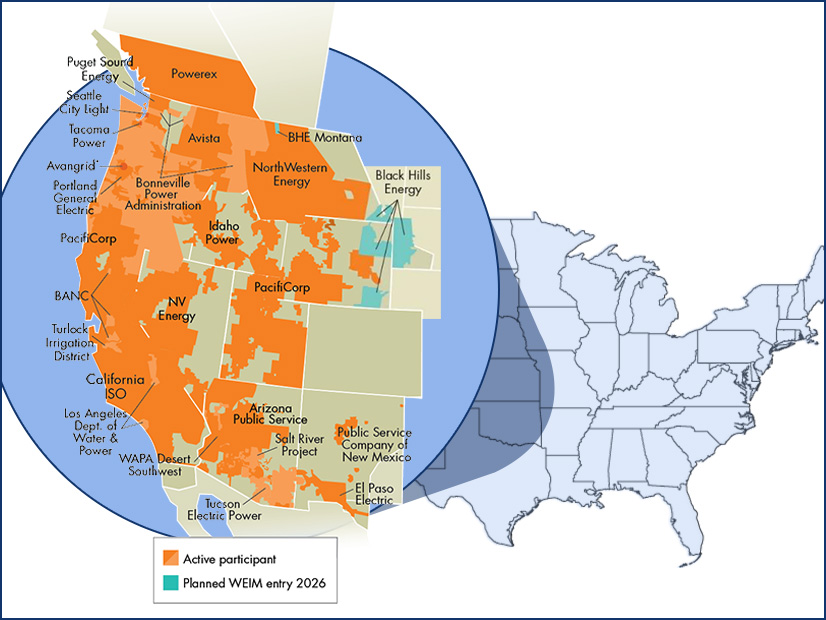

Cumulative benefits since the 2014 launch of the WEIM grew by 31% in 2024, to $6.62 billion. Last year saw no new participants join the market, which includes balancing authority areas accounting for 80% of load in the Western Interconnection.

NV Energy earned the largest share of benefits at $73.08 million, followed by the Balancing Authority of Northern California ($57.99 million), PacifiCorp ($46.58 million) and Los Angeles Department of Water and Power ($34.21 million).

CAISO’s benefits fell by half to $12.65 million, and the ISO was by far the market’s largest exporter (1,060,806 MWh) and importer (877,127 MWh). PacifiCorp came in second in both categories, with its East and West BAAs exporting a combined 839,781 MWh and importing 540,163 MWh.

The ISO also was the location of the largest volume of wheel-throughs (814,970 MWh), followed by the Western Area Power Administration-Desert Southwest region (401,898 MWh) and Arizona Public Service (356,176 MWh). WEIM members gain no financial benefit from facilitating wheel-throughs, with only the sink and source benefiting.

Vancouver, British Columbia-based Powerex earned the smallest share of benefits, at $840,000, down 98% year-over year. The company’s imports fell by 73%, to 336,184 MWh, while its exports rose 25-fold to 16,902 MWh. Powerex will withdraw from the WEIM after confirming last month that it plans to join SPP’s Markets+, although no date for the changeover has been announced. (See Powerex Commits to Funding, Joining SPP’s Markets+.)

The report said WEIM operations prevented curtailment of 30,462 MWh of renewable generation during the fourth quarter, helping to avoid the emission of 13,038 metric tons of CO2. The ISO estimates the market has been responsible for reducing carbon emissions by 1,043,034 MT since tracking began in 2015.

In a press release accompanying the report, CAISO said the benefits “emphasize the value of the ISO’s Extended Day-Ahead Market (EDAM), which promises to further build upon the benefits of WEIM for participants in the day-ahead market, where the vast majority of energy trading occurs.”

The ISO expects to launch the EDAM in 2026 and noted that WEIM members PacifiCorp and Portland General Electric already have begun onboarding activities to participate in that market.

The WEIM currently has 22 participants, including the ISO, but it likely eventually will lose a portion of those to Markets+, which SPP plans to launch in 2027.