To build a reliable, affordable and clean electric power system that can meet the challenges of unprecedented demand growth, the U.S. energy industry and the customers it serves will need to shift their thinking about what a reliable system looks like, according to a new study from nonprofit think tank Energy Innovation Policy & Technology.

“Grid operators, reliability authorities and utilities are ringing reliability alarm bells, and outdated views on grid reliability are colliding with slow-moving institutions,” the report says. New concepts of reliability are needed so that “utilities and grid operators can build new generation faster and more efficiently, while simultaneously deploying strategic demand-side solutions at scale.”

In opposition to President Donald Trump’s call to ensure reliability by building new fossil fuel-fired plants, Energy Innovation argues that “reliability is a characteristic of the whole electric system, to which individual resources contribute. Every source of electricity has different characteristics that should complement each other in a balanced portfolio.”

Examples include the increasing number of grids around the world that provide reliable service with major amounts of solar, wind and storage online, it says.

“For instance, large grids in the Midwest, Texas and California regularly operate using more than 70% renewable energy, and … Iowa and South Dakota generated roughly 60% of all their electricity in 2023 from wind power,” the report says. “In Hawaii, South Australia and Denmark, grids are already operating using 100% renewable power for days at a time.

“Notably, though, these jurisdictions have adjusted their planning and operating practices to integrate higher penetrations of renewable energy and battery storage without compromising reliability.”

The Energy Innovation report is intended to be a primer for U.S. regulators and policymakers to demystify the often-daunting technical details of “grounding reliability discussions in meaningful solutions … while also discussing the challenges in achieving a 100% clean electricity grid.”

Caught between the high speed of data center buildout and the much slower regulatory speed of project permitting and interconnection, the industry is at “an inflection point where the pressures are growing,” Sara Baldwin, Energy Innovation’s senior director of electrification policy and co-author of the report, said in an interview with RTO Insider. “So, the lag that is created in slow decision-making is actually exacerbating the challenges. It’s creating more of an energy emergency. … Excuses are standing in the way.

“We’re actually not confronting technical challenges as much as we’re confronting human challenges,” Baldwin said. “And in some ways, human challenges are harder because human beings want to have full control over all the decision-making that falls underneath their jurisdiction and in their purview.”

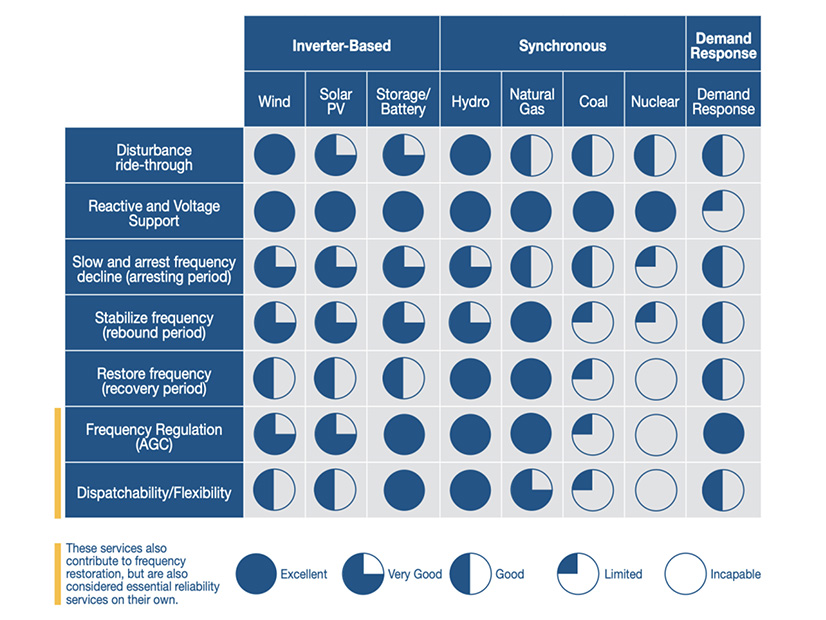

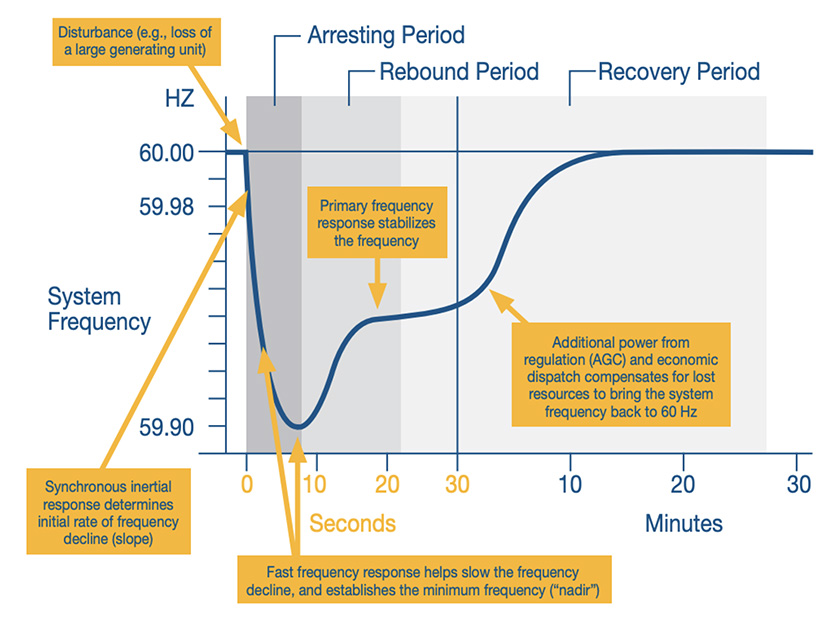

An example is the traditional thinking about the need for system inertia, provided by spinning turbines and typically powered by fossil fuels or hydropower, often cited by industry leaders arguing for more baseload power.

Specifically, they say, inertia can help to keep frequency levels on the grid stable in the event of stress on the system or disturbances caused by extreme weather.

Report co-author Michelle Solomon, Energy Innovation’s manager for electricity policy, countered that “traditional inertia isn’t actually something that you need to run the grid. Traditional inertia is part of this broader frequency response set of services, and actually, in many cases, inverter-based resources can respond faster … and provide what’s called synthetic inertia.”

The report notes that “while inertia slows frequency decline, it is not capable of restoring frequency back to its nominal level. Instead, services like fast frequency response, which can both slow the rate of frequency decline and help restore frequency are needed. …

“Inverter-based resources (IBRs) can ramp up and down much more quickly than a conventional power plant, making them more responsive to changing grid conditions,” the report says. “IBRs can provide nearly instantaneous fast frequency response.”

Can IBRs Deliver?

But the report also acknowledges that a significant gap exists between what IBRs are technically capable of doing and industry confidence in their ability to deliver when needed in real-life situations.

“Developers must be disciplined to program their resources to ride through a voltage event [even] if such a setting should compromise their asset or their operating revenues,” the report says. Similarly, utilities and grid operators need to “quantify and understand how IBRs respond during a grid emergency” and ensure appropriate compensation in cases where they “provide a superior response.”

For Mark Lauby, senior vice president and chief engineer at NERC, such recommendations contain a lot of “ifs” and potential threats to reliability. While he agreed that the future of the U.S. grid lies in a portfolio of diverse resources, including IBRs, “they haven’t been proven. We haven’t got a lot of them on the system.”

New and traditional technologies have “got to work together, not against each other,” Lauby said in an interview with RTO Insider.

“Batteries can move very quickly as long as they are charged … and inverter-based resources can mimic some of the things like inertia on the system, but they have got to be able to run on the battery,” he said. “The battery better be charged, and if you have long-term events, where you’ve kind of exhausted your battery storage, now you don’t have energy and, by the way, you don’t have essential livelihood services.”

Lauby also said that while management of demand-side resources can be effective for shaving peak demand, which can be predicted and prepared for, stress on the grid is now coming at less predictable times and locations.

IBRs could build more uncertainty into electric systems, on top of the essential variability of wind and solar, he said. For example, a dayslong drop in wind could take thousands of megawatts off the grid.

NERC is working on a range of standards intended to build industry confidence in the reliability of IBRs and other new technologies, he said.

Natural Gas Won’t

The Energy Innovation report comes at a pivotal moment in industry and public debates over the most effective short-term strategies for meeting data centers’ ravenous appetite for electricity, which could make up 12% of U.S. energy demand by 2028. (See Berkeley Lab: Data Centers Could Need 12% of US Power by 2028.)

The Trump administration and congressional Republicans are advocating for regulatory changes to allow faster permitting, interconnection and construction of natural gas plants, which they are promoting as baseload power that will keep the lights on and cut consumers’ bills.

For example, in a speech on the House floor Feb. 13, Rep. Julie Fedorchak (R-N.D.) announced her plans to form an AI and Energy Working Group that would target increasing baseload power on the grid.

“The rapid, forced transition to intermittent power sources — paired with the retirement of reliable baseload generators — has left our electric grid increasingly vulnerable to outages,” Fedorchak said.

On Feb. 11, FERC approved PJM’s Reliability Resource Initiative, a one-time measure aimed at adding extra capacity to the RTO’s system by allowing generation that meets certain criteria to essentially jump its notoriously backlogged interconnection queue. (See FERC Approves PJM’s One-time Fast-track Interconnection Process.)

Renewable developers opposed the initiative, saying it is designed to allow large natural gas plants to get online ahead of the approximately 286 GW of projects, mostly wind, solar and storage, that have been waiting for years for PJM to work through its queue backlog.

On the other side, the Solar Energy Industries Association has been attempting to pivot the public dialogue on demand growth to include solar, storage and other renewables as “the fastest technologies to develop and deploy. Not only are they much simpler to engineer, their supply chains are more robust than natural gas (which currently faces a bottleneck in gas turbine blades),” SEIA said in a Feb. 4 blog post. Natural gas plants can also be 2.5 times more expensive to build, it said.

The Energy Innovation report joins a recent study from Duke University in arguing for aggressive deployment of demand-side resources that can open up capacity on the grid versus inherently slow and costly fossil fuel generation. (See US Grid Has Flexible ‘Headroom’ for Data Center Demand Growth.)

“While strategic new generation and transmission solutions are needed to meet growing demand, these large investments will show up on customers’ electric bills for decades to come and could increase emissions without helping affordability or sufficiently improving reliability,” the report says.

“But aggressive investments in demand-side solutions are a cost-effective, least-regrets way to manage growth in the near term, while unlocking their full potential over the long term.” Similarly, getting solar, wind and storage online quickly will buy time for the development of dispatchable, zero-carbon generation that could replace fossil fuels, the report says.

Pointing to the 2,600 GW of mostly renewable projects in RTO and ISO interconnection queues, Solomon said, “Because wind and solar and batteries are already in the process of being built, [they] can come online in a matter of a year and a half. … The gas plants they are looking at building are not coming online until 2030. Natural gas isn’t the solution that’s going to deliver.”