Two energy companies, citing equipment procurement constraints, have withdrawn projects from the Texas Energy Fund’s (TEF) In-ERCOT Load Program. The withdrawals leave 16 projects that have advanced to a due diligence phase (56896).

ENGIE Flexible Generation NA filed Feb. 17 at the PUC to withdraw its Perseus project, a 930-MW peaking facility, from consideration. The company said it has “become evident” supply chain issues would delay the project’s schedule, making it impossible to meet a December 2025 deadline for statutorily mandated initial loan disbursements.

ENGIE also withdrew its Spenser project from further consideration. The project, a 483-MW peaker, did not advance to the due diligence phase.

In January, Howard Energy Partners withdrew its co-generation facility at its Javelina processing plant in Corpus Christi, attributing it to similar “equipment procurement constraints.” The company said the delays would prevent it from meeting the same December timelines as ENGIE.

The Javelina facility, consisting of a 134-MW combined cycle facility and a 192-MW simple cycle unit, would make 271 MW available for dispatch.

PUC spokesperson Ellie Breed said the PUC anticipates proposing an additional project or projects for advancement to due diligence to replace the ENGIE project.

The withdrawals leave at least 16 projects in the TEF portfolio, accounting for about 8.5 GW of capacity. Loan information is confidential.

PUC Approves Non-ERCOT Program

The PUC established another TEF program when it approved a rule during its Feb. 13 open meeting that creates a program for grants to utilities and power generators outside the ERCOT region.

The rule sets up the Outside of ERCOT Grant Program as one of four programs under the TEF, which Texans approved by constitutional amendment in 2023. The grants can be used to finance modernization, weatherization, reliability and resiliency improvements, and vegetation management (57004).

“Every corner of our state faces unique weather threats and challenges,” PUC Chair Thomas Gleeson said in a statement. “The rule approved today will ensure that the TEF improves electric reliability for all Texans, whether inside or outside the ERCOT region.”

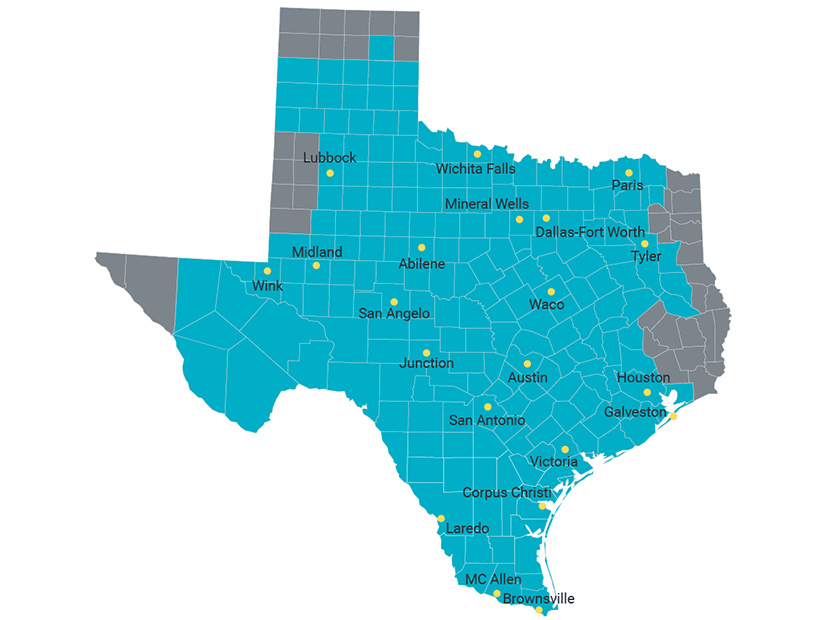

The ERCOT region covers about 75% of Texas, except for portions of East Texas, West Texas and El Paso.

ADER Project Moved to ERCOT

The commission endorsed staff’s recommendation to move the aggregated distributed energy resources (ADER) pilot project into ERCOT’s stakeholder process to determine the best way to move the initiative forward (53911).

The action will dissolve the ADER Task Force, which was created in July 2022. Its work has resulted in three virtual power plants, or ADERs, participating in the wholesale energy market and providing certain ancillary services. The ADERs can provide 25.5 MW of energy, 11 MW of non-spin reserve service, and 8.7 MW of ERCOT contingency reserve service.

“The pilot can only benefit from the larger stakeholder group at ERCOT, and that will facilitate its coordinated growth, along with other projects within the ERCOT market system,” PUC staffer Ramya Ramaswamy told the commission. She also recommended the grid operator file progress reports every six months.